Last Updated: August 25, 2023

EWS = Early Warning System

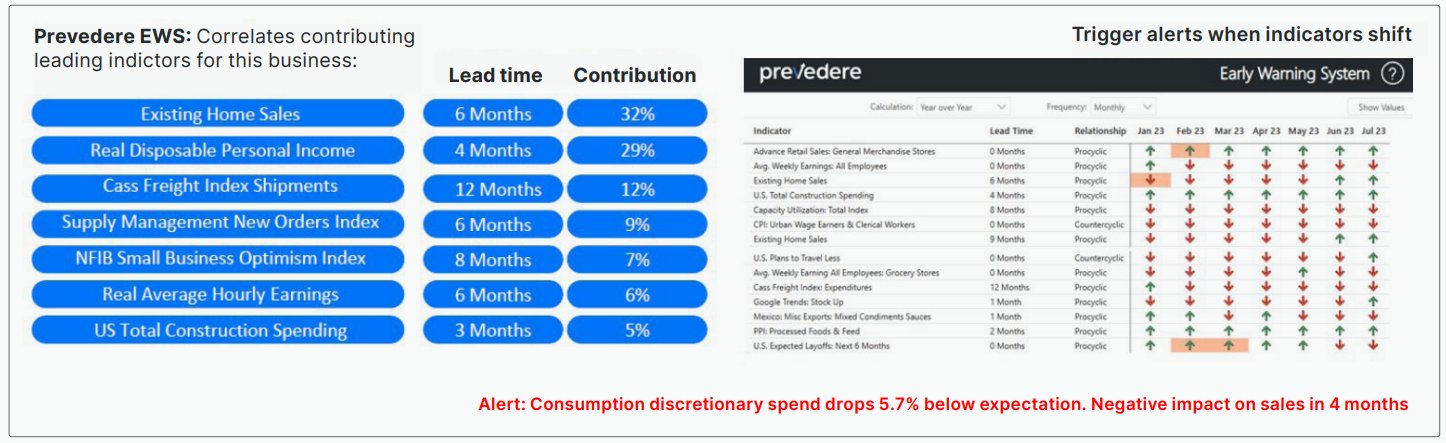

Prevedere EWS is a new target market monitoring and alerting system, combining leading indicators and economic modeling to provide truly unique foresight for business leadership.

The question is, would it be possible to automatically monitor the unique external drivers of your business and alert business owners when unexpected change is projected?

Well that is the goal and modus operandi for EWS. It automates the monitoring of business drivers and future outcomes, alerts for upcoming shifts, and enables the proactive adjustment of plans and resources. The result is more agile and smarter business.

Background and Planning Questions

Most companies plan based on what they know from the inside out. However given the significance of macroeconomic factors and other external forces, many companies are realizing they need a broader perspective when planning.

The planning questions to consider are whether your business can:

- Identify which external factors impact your business – whether it is for your total business, or each brand, or division, or category, or a territory, or a combination?

- Quantify the impact of these business drivers in the form of risks and opportunities – whether it’s the US consumer price index, or the cost of oil, or Canadian unemployment … understanding the potential impact is critical.

- If you can incorporate these dynamics into your plans and forecasts, you’re well positioned to create consensus forecasts, and to conduct “what if” analysis – empowering you to assess how these forces will impact your business. This is of real value whether for the board, CFO, FP&A, or the many operational planning teams in your organization.

- Monitor these market forces and know ahead of your competition when shifts require new actions. A loss of prediction can be caused by future market shifts and anomalies that you may not have planned for, but you likely need to pivot plans and strategies to effectively manage risk and maximize the opportunity

EWS Origins

One of our large cargo and logistics customers had a significant quarterly forecast miss a couple of years ago, ended up oversupplying and it cost them hundreds of millions. It resulted in their CEO asking several tough questions as to why, e.g. “What are the actual external drivers of our key businesses”, and “How can we monitor them to be more proactive when markets start shifting?”.

So this was the origin of EWS, with a mission to identify the unique drivers of any line or layer of a customer’s business, determine the lead time, and to monitor them for change. If a customer has created Prevedere prediction models, additional insight can be generated about any alerts or warnings triggered. This includes the contribution of any shifting indicators to the line of business in question, e.g. Residential Architectural Billings Index contributes 43.2% of a prediction model, or the ISM Manufacturing PMI contributes 22.8% to a forecast. In this way, customers can determine how significantly a shifting indicator impacts the business.

Prevedere already leverages unique leading indicators in order to build econometric prediction models, so adding monitoring and alerting has been a logical extension. The logistics customer now automatically monitors their leading contributing indicators and model forecasts daily, alerts on upcoming new headwinds or tailwinds, and shifts resources as needed. This has fundamentally changed their operating model, from a quarterly planning and resourcing operation to daily adjustments as and when needed.

EWS Breadth of Applicability

Prevedere EWS can be applied to any layer or line of business, whether top line, or for a category, channel, region, brand or combination. In addition to demand, EWS can also monitor cost KPIs (e.g. freight cost, wages, raw materials). If the trajectory of a leading indicator shifts out of expectation, or the forecast for (e.g.) sales in Q3, or material costs for 2024 shift out of plan or norm, as above, alerts are triggered, with identification of the root cause indicators.

Prevedere’s Early Warning System really is unique in its ability to quantify external market dynamics to help businesses manage risk, maximize opportunity and benefit from competitive foresight.

Thank you very much for your time today.

For More Information

Suggestion:

Is your strategy considering the macroeconomic factors that impact your business?