Last Updated: December 14, 2022

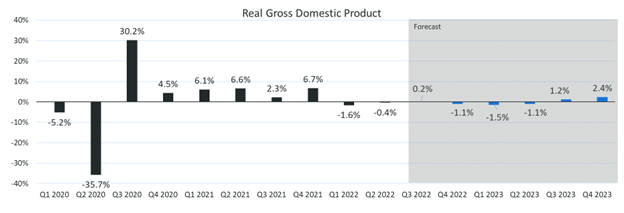

Recent data from Prevedere, along with aggressive monetary policies from the Fed, signal a recession likely in Q4 2022.

Key Takeaways:

● Despite cooling inflation numbers, Prevedere does not anticipate prices to return to pre-pandemic levels

● Aggressive monetary policies, tightening financial conditions, and a cooling labor market lead Prevedere to predict that a recession is likely, as soon as Q4 2022

● Prevedere predicts reduced consumer spending and increased risk in fixed investment and inventory levels

As we start Q4 2022, inflation seems to be losing its bite. Despite energy shocks, extreme weather events, and persistent strains on global supply chains causing volatility and global uncertainty, the U.S. economy shows signs that cyclical drivers of inflation are beginning to cool.

While continued COVID restrictions in China, the threat of port strikes across the globe, and the war in Ukraine continue, we have seen evidence that supply chain stress is easing. This, in turn, makes goods more accessible and affordable—especially given the U.S. dollar’s strength to drive import costs down.

Despite somewhat good news on the inflationary front, Prevedere anticipates a possible recession in Q4. That said, a lot is up in the air right now. As such, businesses should be prepared for a number of market scenarios when making their late-2022 and early-2023 strategic plans.

Economic signals of cooling inflation

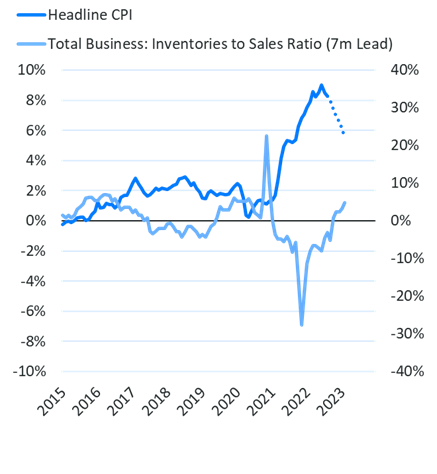

Leading signals indicate that inflation is beginning to cool. Several leading factors of this phenomenon include swelling inventories and cooling labor shortages. However, it is unlikely that prices will return to pre-pandemic levels , especially in key spending categories.

Additionally, normalization in trade and logistics has led to improving mobility of goods, which means manufacturers and retailers no longer struggle to maintain enough material on hand to meet end-use demand. Additionally, higher consumer prices are suppressing demand. Together, these factors have led to swelling inventories.

Excess inventories, of course, are both a blessing and a curse. On the one hand, manufacturers and retailers no longer have to guess whether they will be able to fulfill orders. On the other hand, excess inventory creates additional pressure to clear out supply, which can be especially challenging with high prices and reduced demand.

For the broader market, however, excess inventories are a positive signal that the price pressures stemming from supply constraints are neutralizing.

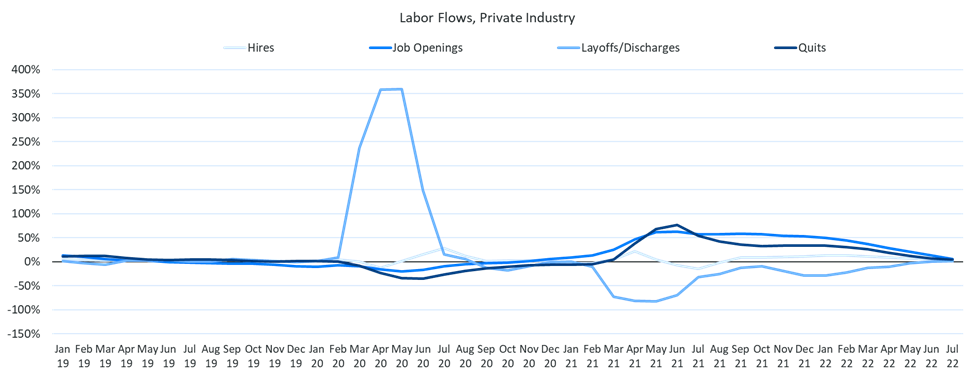

Another sign of cooling inflationary pressures is the softening of labor shortages, due mostly to improved worker mobility and slowing demand for labor. The best evidence of this is that wage growth appears to have peaked—in many industries, employment has either returned to or surpassed pre-pandemic levels.

While the labor market remains tight by historical measures, job openings last month have demonstrated their sharpest decline in nearly two and a half years. This suggests that labor shortages are softening, as fear of a wage-price spiral (comparable to the Volcker era) is overblown. This is another positive signal that inflationary pressures are easing.

Additionally, recent data suggest that supply of and demand for workers is reaching a more balanced state, likely due to tightening of economic conditions disrupting labor market strength—brought about by risk of rising unemployment and subsequent income loss.

For now, it appears that excess worker supply is concentrated in select industries—notably the tech sector. But as recessionary trends continue and companies tighten their belts, we can expect that more workers will return to the labor force, only to find fewer jobs available.

Like inventory excess, softening labor shortages are also a blessing and a curse. Access to affordable labor will certainly be a boon to businesses. At the same time, it is a signal of a potential recession, which causes a host of other problems.

Although inflationary pressures are likely to cool, it is unlikely that prices will return to pre-pandemic levels. As some cyclical drivers of inflation begin to cool, others are heating up. This imbalance means that price growth (or inflation) will remain a risk despite cooling pressures.

Federal Reserve action signals high likelihood of recession

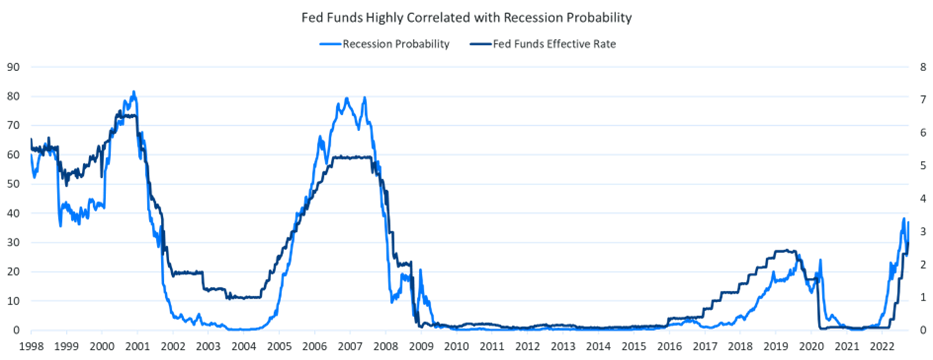

Recent action from the Fed signals their priority lies with curbing inflation, rather than preventing a recession. They have embarked on one of the most aggressive courses of quantitative tightening that we have seen in decades. Negative economic signs will not deter them —they are committed to seeing it through.

In other words, the Fed is willing to accept the risk of a recession, so long as they can bring inflation under control. Thus, it is reasonable to expect that they will keep to their current policy regime until inflation is back within target range.

The chart below demonstrates the directly proportional relationship between Fed action and the probability of a recession—and that the odds of a recession are the highest since the 2008 collapse.

In fact, there are already signs that a recession is currently underway. Financial conditions are tightening, making credit less available and more expensive—both for consumers and businesses.

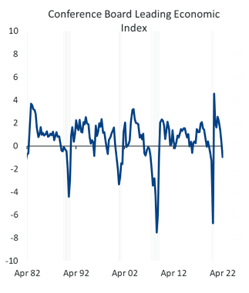

As a result, sentiment remains weak, and both consumers and business leaders are taking steps to reduce unnecessary spending in anticipation of an economic downturn. The danger with negative sentiment is that it often creates a self-fulfilling prophecy. That risk is evident in the figures below, with the Conference Board’s Leading Economic Index suggesting a recession could be upon us within the next 3 to 6 months.

The Fed appears to be banking on the underlying strength in the labor market to mitigate a significant, deep downturn resulting from declining incomes. The wager appears to be: if they can manage to tame inflation fast enough to avoid a major labor market disruption, we can avoid the worst effects of a recession. Since the Fed was late to the game in fighting inflation in the first place, it remains unclear whether they can actually achieve this.

Our forecast at Prevedere anticipates a broader slowdown in economic activity in Q4, likely to extend through the first half of next year. As consumer finances deteriorate, we expect a more meaningful pull back in spending, as well as considerable risk in fixed investment and inventory levels.

That said, there is no way to predict exactly what will happen. Much of the outcome depends entirely on the Fed’s resolve, and enterprises should be prepared for a variety of scenarios. This is why predictive macroeconomic models are a critical investment for businesses in today’s volatile market.

For More Information

Suggested actions:

Is your strategy considering the macroeconomic factors that impact your business?