Last Updated: February 10, 2021

By Danielle Marceau, Senior Economist

Data updated 9/8/2020

COVID-19. While that is good news, the decline is occurring at a prolonged pace. The longer it takes for the pandemic to subside, the deeper this recession is likely to be. And the more businesses are likely to struggle under the weight of the decreased demand and government intervention in efforts to keep COVID-19 at bay.

Labor Market in Flux

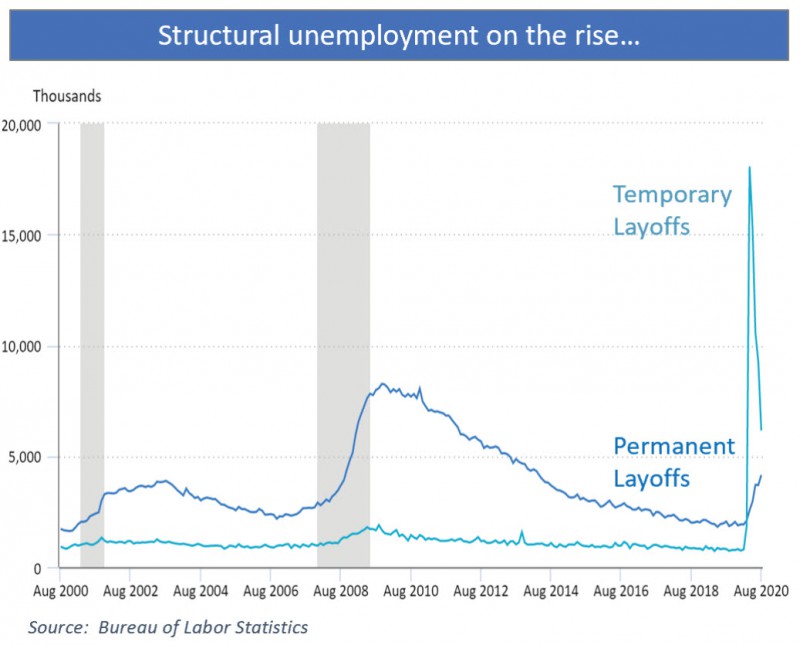

The following chart illustrates the total number of people that were laid off temporarily during this pandemic. Temporary unemployment is declining, and the number of people returning to work is increasing. Still, the concern is the number of layoffs that are converting from temporary to permanent, indicating a shift in structural unemployment.

The increase in the number of permanent layoff s accelerated in August, partly attributed to some of the paycheck protection program funds’ expiration. With those funds running out, businesses that may have been able to keep people employed may now have to lay them off or shut their doors altogether.

We expect to see permanent layoff s continue to increase over the next couple of job reports. There have been many headlines recently where major corporations continue to layoff employees, and many temporary furloughs are turning into permanent job losses. Some especially hard-hit industries, such as the airline industry, received substantial government funding early in the pandemic. Along with that assistance came stipulations such as keeping people employed or not permanently laid off through the end of September. There’s already been talk amongst the airline industry of major layoff s to come in October, contributing to permanent layoffs. Other big corporations such as Coca Cola, Salesforce, and Boeing, are discussing the potential of significant layoff s to cut costs as this economic recession persists.

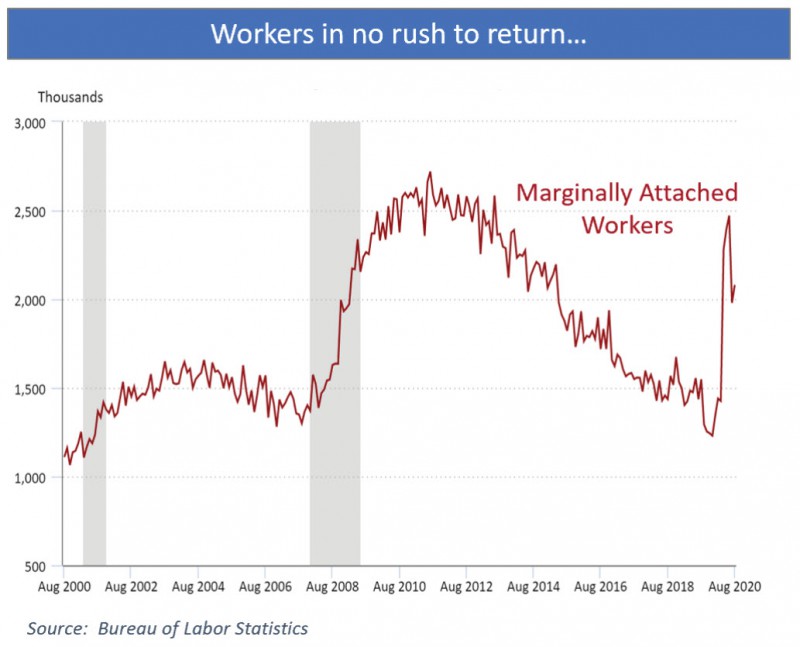

The headline unemployment rate of 8.4% in the August release was better than anticipated, from many economists’ consensus. But one factor that is likely contributing to a lower unemployment rate is marginally attached workers, which are those not in the labor force. Those are workers who want a job, are of working age, and able to work but did not search for a position within the last four weeks.

This trend is concerning because the higher this percentage is, the more likely unemployment numbers will be understated.

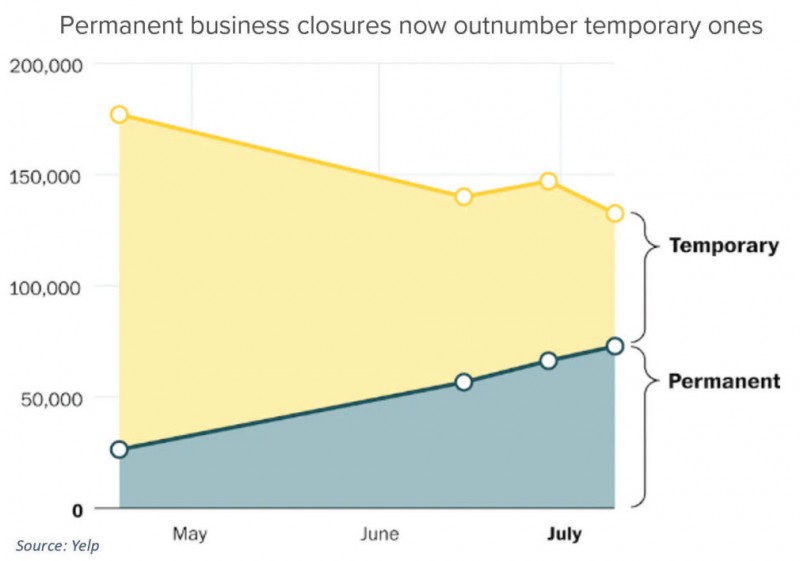

The Fall of Disappointment

In looking at business closures in the United States early on in the crisis, the number of permanent closures was relatively small. People expected that the closure was going to be brief and that they would open up once again. But now there is a dynamic shift, and there’s a larger percentage of permanently closed businesses than temporarily closed.

According to the University of Chicago, 77% of employees who lost their job due to the pandemic expect to get it back. 42% of job losses, however, are likely to be permanent. What’s interesting is that it means about one out of every five people who lost their job will be surprised not to get it back.

Permanently unemployed numbers are going to increase, and there is a significant percentage of marginally attached workers. So the question becomes, why are so many of these macroeconomic numbers, such as retail sales, actually seeing more optimistic results? The reason is that there is a really interesting dynamic happening when it comes to how much money the American consumer has in their pocket.

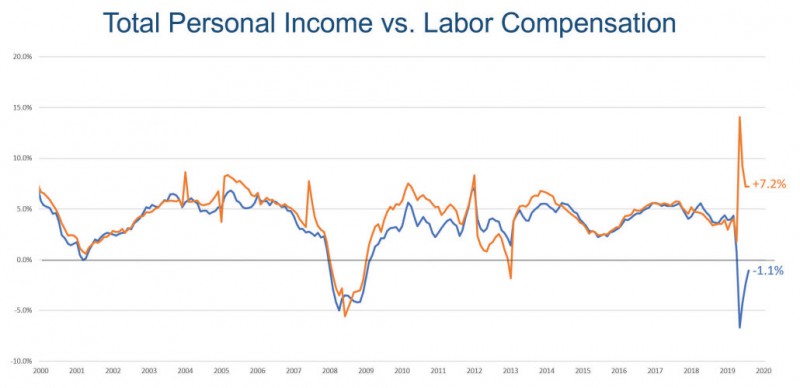

In the following chart, the orange line illustrates the year over year percent change or growth on a monthly basis for total personal income in the United States. It represents the total dollars that American consumers have to spend. The blue line is the year over year monthly percentage change in labor compensation, which is income from labor and wages only.

Historically, total personal income flows very closely with compensation. The current landscape is the first time that there has been such a significant divergence. Despite the labor market dynamics in earnings from actual wages being down 1%, consumers have had more money to spend than they have ever had before, and many of them were spending it. The stimulus and the extended unemployment benefits have more than made up for lost wages throughout the summer. Despite what has been going on in the labor market, consumers have had money to spend because they were getting it unconventionally.

When will the U.S. feel the pain?

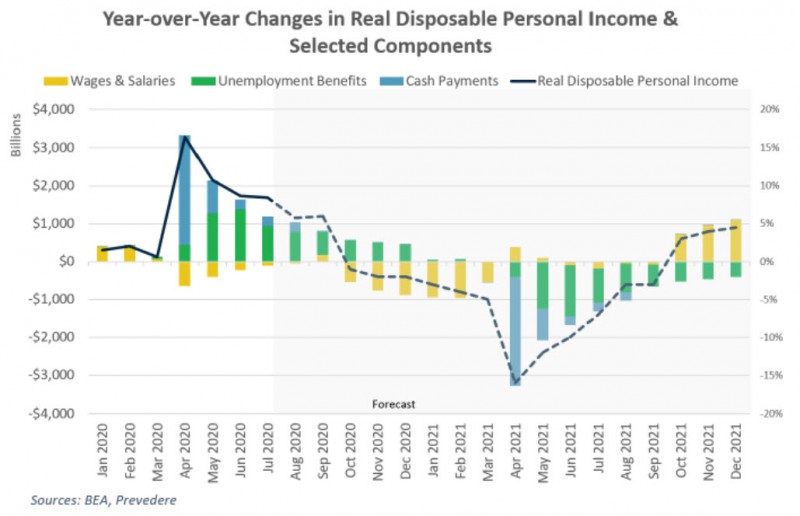

When the stimulus and the extended unemployment benefits run out entirely, there will be an income cliff. The following chart shows future estimates of when to expect that to happen.

During the pandemic, year over year disposable personal income is positive, above the $0 line. In looking at total income in consumers’ pockets, it has been higher than the prior year. But that’s been bolstered by government intervention, as indicated in the bars. Extended unemployment benefits and the one-time cash payment offset declines in the earnings from labor. From now on, that is going to be a shifting and changing dynamic. In the fourth quarter of this year, disposable personal income will drop below where it was last year. It’s going to become a significant headwind without an additional round of stimulus. A drop in labor compensation will translate to a real decline in consumer income, affecting their ability to spend.

This will be a major headwind that’s likely to prolong this economic recession. The depths of the decline in consumer spending is expected to take hold going into 2021, although it’s not likely to be as big of a pullback as earlier this year. We don’t expect a return directly to pre-COVID levels when it comes to the amount that the U.S. consumer is spending. This is one of the key things that Prevedere economists are keeping our eyes on. As stimulus subsides, we’re going to be focusing on the labor market, the structural shift to permanent layoff s, and what that ultimately is does to consumer income. That’s very important to monitor when it comes to assessing the health of the U.S. economy.

Navigate What’s Next with Economic Scenario Planning

The COVID-19 crisis has given rise to a world of economic uncertainty, with uneven effects across regions and industries. As we head into the 2021 planning cycle, every business wants to know How will the pandemic impact next year’s numbers? Prevedere’s Economic Scenario Planning solution helps companies navigate these tumultuous times. The solution projects future business outcomes for three plausible macroeconomic scenarios under COVID-19. Companies can use these insights to sharpen 2021 forecasts and plans, improve shareholder guidance, and stay on top of the pandemic’s evolving impact.