Last Updated: February 10, 2021

By Andrew Duguay, Chief Economist at Prevedere with special guest commentary from Chris Dieringer, Microsoft National Sales Senior Director.

COVID-19 will no doubt shift consumer sentiment and behaviors. Providing digital technology options as a centerpiece for consumer relationships is a key focus going forward. Pre-pandemic, consumers had already begun a digital age transformation, but this crisis exponentially escalated this transformation and further ingrained technology into their behavior. What started as a pandemic necessity, such as ordering toilet paper from Instacart or having DoorDash deliver dinner, will likely transform into often used conveniences for many.

It is now the responsibility of businesses to ideate on continuing to evolve their product and services to keep up with new demands, behaviors, and expectations of consumers as they plan for the long-term. Everybody is coming up to speed rather quickly when it comes to forecasting and predictive modeling and to the way things are changing compared to pre-crisis. If businesses are not accounting for externalities and external factors in their predictive models, they are potentially leaving supply chains and forecasts to very vulnerable blind spots.

Every forecast and model before the crisis has essentially been rendered inept and discarded. But that doesn’t mean that the process of forecasting and planning is going to be set aside. With the decline of COVID-19 cases, it’s time to prepare for what comes next. It’s already time to ask ourselves what’s going to happen in the second half of the year and into early 2021. How are the vital categories going to change? How are consumer preferences going to be altered? Is there permanence or will we return to pre-crisis normals? What we can be certain of is that there’s much uncertainty. And if we’re not proactively modeling and trying to identify the correct key leading indicators, then we could be leaving our planning efforts exposed to inaccurate assumptions about what business looks like post-COVID.

We’ve been tailoring the conversation with our weekly reports, webinars, and partners like Microsoft, to talk about not only the ongoing health crisis but the continuing economic crisis. And asking what does life look like after the crisis settles down? Of course, the first thing that must happen is that we need the health crisis to subside. At the time that we are writing this copy, we’re still very much in the midst of a challenging health crisis environment with elevated levels of total new cases.

Of course, this epidemic started in Asia, shifted its way over to Europe, and then here to the United States. Now the focus is shifting to concerns about emerging markets as they get started on their journey through the effects of shelter in place. Undoubtedly this is going to have an impact on vulnerable and fragile economies that are trying to stem the health crisis from expanding.

There is Reason to be Optimistic

We can look at Asia and Europe as leading indicators to say that we can flatten the curve. Other models are also optimistic. We have been looking at the IHME model from the University of Washington that is often cited for its rigorous oversight and projections of new cases and whether hospitals and resources are going to be constrained. Lately, that model has been suggesting fewer beds are required and that fewer deaths are estimated in the United States than initially projected. With this, there are positive signs that we are flattening the curve in our actions in the near term. We can now begin shifting our thinking to what life is going to look like after some of these restrictions get lifted and the economy can move back to recovery.

When looking at various scenarios, there are many different opinions out there. Even economists have been going through the alphabet in terms of hypothesizing about the various scenarios. We are hearing everything from the potential of seeing a V-shaped recovery where the economy quickly bounces back to pre-recession levels, to a U-shaped recovery, which means that it takes longer to get back to pre-recession levels.

We’ve even heard new theories, for example, a W-shaped recovery. This is more of a cyclical experience, which could be tied to the virus returning after we lift restrictions. There is also an L-shape recovery or even sideways L-shape. Many of these hypotheticals don’t always do the business world much good in practice considering our need to model and scenario plan for the future.

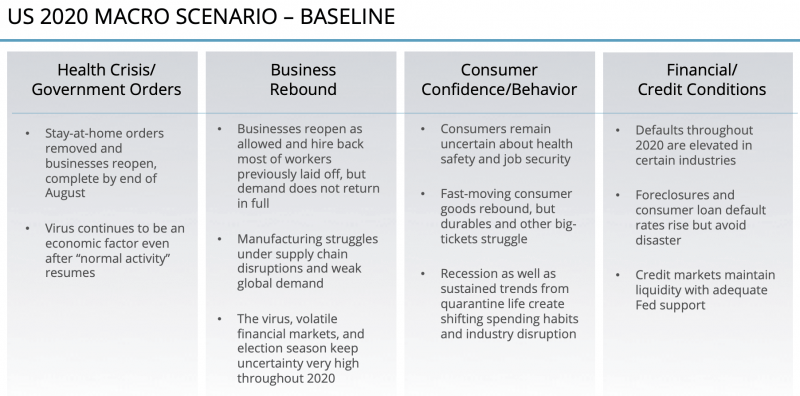

It is crucial to strive for realistic planning with reasonable expectations. This brings us to hard-hitting impact statements in terms of what the baseline scenario looks like when it comes to thinking about planning for the second half of the year. At Prevedere, we’ve been putting together a baseline scenario in consideration of the full range of options. When we talk about the potential impacts, we have prepared highlights of where we feel are a likely baseline scenario to begin planning for the second half of 2020.

Is there a way to build forecasting scenarios that look at a conservative, moderate, and potentially harsh economic model planning? Yes. Our team of economists have considered all scenarios from the extreme Great Depression to a minor recession. However, we know that we’re probably going to be somewhere in between. With our customers, we have been employing “scenario planning” and providing “baseline scenarios” that include optimistic, median, and pessimistic scenarios. It’s vital to forecast with a broader range of expectations, particularly in times where there’s an elevated uncertainty. With infinite possibilities, using three scenarios with a baseline that is thoroughly understood is a recommended standard practice.

Referring to our general baseline, included in the graph above, you will see elements of recovery in the second half of the year. Businesses will rebound, an obvious example is when stores open again and people go out shopping. However, the likelihood is that it’s not going to be a V-shaped recovery.

We don’t go through a crisis like this and, psychologically or financially, come out of it on the other end just the same. We’ve had a ten-year run between recessions. And during those ten years, as is natural during times of economic expansion, businesses and consumers started to leverage more and increase their debt levels. Having government stimulus packages and Federal Reserve backstops for businesses certainly helps cushion the blow like the one the world has just absorbed. One thing we can guarantee is that we won’t come out of this crisis with any sort of lower debt levels. If anything, we’ll be fortunate if we’re in as strong financial shape as we were going into this crisis.

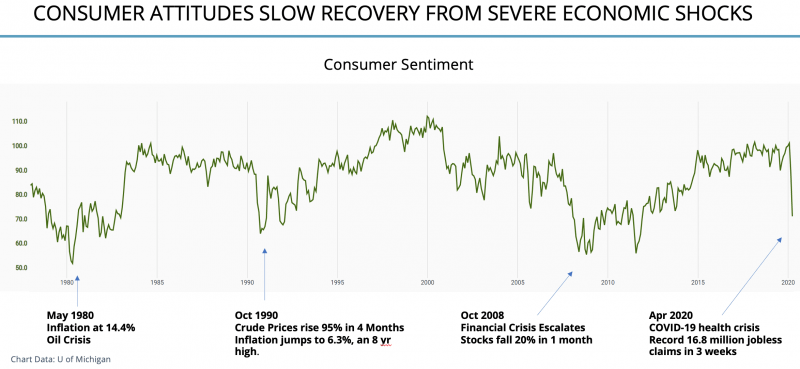

The combined effects from this unprecedented period in our history leave us in a vulnerable place as we consider the second half of the year. Is it a realistic expectation that consumers will be just as confident as they were before the crisis happened? Consider that pre-COVID consumer sentiment was at consistently high levels compared to historical averages. In the post-economic turmoil, it’s highly plausible that more conservative consumer behavior will impact discretionary spending.

When you think about what businesses are going through, are they going to be experiencing the same levels of hiring and investment as was widespread before the pandemic? We entered this crisis with a historically dynamic job market in terms of near-record low levels of unemployment, with more jobs available than unemployed people to fill those jobs. That scenario dematerializes when you look at surveys from the National Association of Business Economists.

Even though economists are predicting a return to GDP growth in the third quarter of 2020, the average forecasted unemployment is 10% by the end of the year and 6% by the end of 2021. Before the pandemic crisis, the country was at a low of 3% unemployment. With the pandemic, unemployment is escalating to 13% and higher in a matter of a few weeks. Even with the projected employment rebound, the labor market is not going to look the same. Many of the jobs that were lost during this crisis won’t be coming back. And with consumers facing a more challenging job market, spending could be impacted in multiple ways.

Chris Derringer from Microsoft reports these assumptions in terms of common trends across 500 retail and consumer goods enterprise clients. Initially, there have been many requests around Cloud economics. Moving on-premise solutions into the cloud, VPN and networking environments, and building the chatbot with the CDC. And Microsoft has other examples of consumer goods companies and retailers who are evolving and changing with policies in state and local government, including the federal government. The initial response when navigating the moment has been around how companies and retailers can leverage cost savings opportunities to help enable their workforce and drive consumers.

As the pandemic curve in the United States begins turning the corner, Microsoft clients are shifting to examine how consumer sentiment and consumer behaviors are changing. It is assumed that this event has had some defining and lasting effects the likes of which are too early to decipher.

Leading up to the crisis, 2% to 3% of the grocery industry market sales comprised online sales. In a matter of weeks, grocers saw a marked increase in curbside, online, and e-commerce orders. What we are seeing is the significant influence of the rapidity of changes in consumer behaviors trickle down to logistics, supply chain, shipping, sales, and even how company employees react.

Customers also see a more connected workforce among the employee pool. “The number one comment we hear from our clients is that mobilizing their workforce is one of the most challenging but essential undertakings they have taken on,” says Chris Deringer. “This pandemic will continue to deepen how organizations operate, from a consumer lens, and an employment perspective.”

Interestingly, through the massive disruption in consumer habits, businesses across industries and employees have had to change their practices daily to manage this event. The resulting outcome could reshape and open up new market opportunities in ways that businesses may have been struggling to get involved in or might have previously only played a smaller role.

“What’s always been interesting for Microsoft is recognizing and understanding. We call this the personalization effect of a consumer or customer. We challenge ourselves to ask, how can I identify a customer, understand their behavior and patterns, both online and off, and then how can I provide relevant content and services to them?”

– Chris Dieringer, Microsoft National Sales Senior Director US Retail & CPG Industry,

From Crisis Arises Opportunity

The pandemic has offered us all an opportunity. We can see that there has already been a shifted mindset and subsequent opportunity to accelerate many changes businesses thought might be ten or even 12 years off, which are now maybe one to two years away. As we move through the second half of the year and look forward to 2021, this crisis will also shape opportunities in so many different ways. While we might not be in a position like we were pre-crisis, where unemployment hovered at record lows and wage growth was accelerating. We’ll still come out of this with many opportunities to connect with the consumer and each other in new ways as we innovate new efficiencies to create opportunities. That’s what a lot of these challenging economic times tend to present—new ways of doing business going forward.

Conclusion

It’s no longer an option to forecast or not. Being able to take advantage of cloud computing, machine learning, and the millions of global datasets correlated to business trends is quite possibly the key to business survival post-pandemic. To identify exact key indicators to help model and predict where sales are going to go is increasingly important. Harnessing the advancements in technology today can make those modeling goals attainable. While the challenges to forecasting struggle in this unpredictable health pandemic are notable, the business community has opportunities to discover new indicators and build better models for predicting trends in the future.

***

About Andrew Duguay

Mr. Duguay is a Chief Economist for Prevedere, a predictive analytics company that helps provides business leaders a real-time insight into their company’s future performance. Prior to his role at Prevedere, Mr. Duguay was a Senior Economist at ITR Economics. Andrew’s commentary and expertise have been featured in NPR, Reuters, and other publications. Andrew has an MBA and a degree in Economics. He has received a Certificate in Professional Forecasting from the Institute for Business Forecasting and Certificates in Economic Measurement, Applied Econometrics, and Time-Series Analysis and Forecasting from the National Association for Business Economics.

Mr. Duguay is a Chief Economist for Prevedere, a predictive analytics company that helps provides business leaders a real-time insight into their company’s future performance. Prior to his role at Prevedere, Mr. Duguay was a Senior Economist at ITR Economics. Andrew’s commentary and expertise have been featured in NPR, Reuters, and other publications. Andrew has an MBA and a degree in Economics. He has received a Certificate in Professional Forecasting from the Institute for Business Forecasting and Certificates in Economic Measurement, Applied Econometrics, and Time-Series Analysis and Forecasting from the National Association for Business Economics.

About Chris Dieringer

Mr. Dieringer is currently leading the US Retail and CPG practice focused on following current and future trends in the industry and helping customers realize those within their digital transformation. He has experienced time with sub-segments including Consumer Electronics, Grocery, Home Improvement, Fashion / Apparel, Department Store and CPG companies. Functions include Marketing, HR, Tax, Supply Chain, Finance, Merchandising, Operations, Strategic Planning with technologies in business intelligence, data warehouse, application development, ERP deployments, CRM installations, and cognitive services delivery.

Mr. Dieringer is currently leading the US Retail and CPG practice focused on following current and future trends in the industry and helping customers realize those within their digital transformation. He has experienced time with sub-segments including Consumer Electronics, Grocery, Home Improvement, Fashion / Apparel, Department Store and CPG companies. Functions include Marketing, HR, Tax, Supply Chain, Finance, Merchandising, Operations, Strategic Planning with technologies in business intelligence, data warehouse, application development, ERP deployments, CRM installations, and cognitive services delivery.