Last Updated: February 10, 2021

By Andrew Duguay, Chief Economist at Prevedere with special guest commentary from Chris Dieringer, Microsoft National Sales Senior Director.

It is indeed difficult to put into words the impact COVID-19 has had on the global economy. The ramifications are vast and ongoing, and we likely won’t know the total impact for years to come. Microsoft is one of many businesses leading in the effort to guide companies through the pandemic’s economic effects. Prevedere recently had the opportunity to speak to Microsoft leadership about their perspective on the current financial land and what it may look like heading into the future.

Chris Dieringer, Microsoft National Sales Senior Director – US Retail & CPG Industry, recently joined Prevedere to share perspective on the current economic situation and how it may evolve as we head into the future. He identified key areas as jumping-off points to navigate this uncertain time, including strategies to shape the new normal facing us all post-crisis.

The New Normal

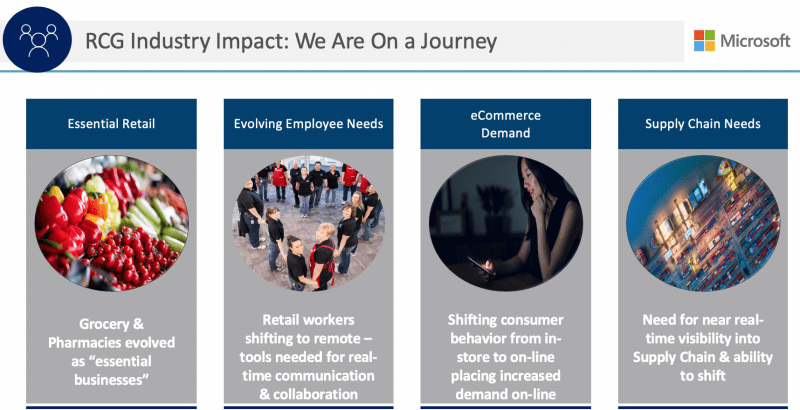

Organizations are creating thoughtful environments that protect the safety of both customers and workers. Many are tried-and-true measures that businesses are rolling out on a larger scale. A scale that none of us thought we would ever experience due to a health crisis. One example, curbside pickup, has gained much favor over the last couple of years. But now, during this COVID-19 pandemic, curbside pickup is deemed an “essential” retailer service (grocery, pharmacy, big-box). Additionally, many states are only allowing restaurant patronage through pickup. In effect, this service will continue to get much broader attention across not only traditional pickup destinations but also quick-service restaurants and casual dining.

Next in consideration is ship-to-home businesses that leverage partner relationships, as seen with Instacart, GrubHub, and UberEats. These services were previously deemed a “luxury” for those not wanting to venture out but are now turning into a necessity for those not leaving their homes due to social distancing measures.

The use of audio and video conferencing has also increased exponentially. As an example, Microsoft shifted its retail stores to entirely online, holding mass numbers of virtual meetings regularly. Approximately 900 million minutes is being logged daily through Microsoft Teams. That’s an impressive rapid shift in conference communications technology.

It’s stirring to see how businesses have responded to the nuances of this pandemic by providing safe ways to provide products and services to their customers and effectively helping to “flatten the curve”.

Common Trends Across Retail and Consumer Goods

Microsoft reports these assumptions in terms of common trends across 500 retail and consumer goods enterprise clients. Initially, there have been many requests around Cloud economics. Moving on-premise solutions into the cloud, VPN and networking environments, and building the chatbot with the CDC. And Microsoft has other examples of consumer goods companies and retailers who are evolving and changing with policies in state and local government, including the federal government. The initial response when navigating the moment has been around how companies and retailers can leverage cost savings opportunities to help enable their workforce and drive consumers.

As the pandemic curve in the United States begins turning the corner, Microsoft clients are shifting to examine how consumer sentiment and consumer behaviors are changing. It is assumed that this event has had some defining and lasting effects the likes of which are too early to decipher.

Leading up to the crisis, 2% to 3% of the grocery industry market sales comprised online sales. In a matter of weeks, grocers saw a marked increase in curbside, online, and e-commerce orders. What we are seeing is the significant influence of the rapidity of changes in consumer behaviors trickle down to logistics, supply chain, shipping, sales, and even how company employees react.

Customers also see a more connected workforce among the employee pool. “The number one comment we hear from our clients is that mobilizing their workforce is one of the most challenging but essential undertakings they have taken on,” says Chris Deringer. “This pandemic will continue to deepen how organizations operate, from a consumer lens, and an employment perspective.”

Interestingly, through the massive disruption in consumer habits, businesses across industries and employees have had to change their practices daily to manage this event. The resulting outcome could reshape and open up new market opportunities in ways that businesses may have been struggling to get involved in or might have previously only played a smaller role.

Forecasting the New Normal

COVID-19 will no doubt shift consumer sentiment and behaviors. Providing digital technology options as a centerpiece for consumer relationships is a key focus going forward. Pre-pandemic, consumers had already begun a digital age transformation, but this crisis exponentially escalated this transformation and further ingrained technology into their behavior. What started as a pandemic necessity, such as ordering toilet paper from Instacart or having DoorDash deliver dinner, will likely transform into often used conveniences for many.

It is now the responsibility of businesses to ideate on continuing to evolve their product and services to keep up with new demands, behaviors, and expectations of consumers as they plan for the long-term. Everybody is coming up to speed rather quickly when it comes to forecasting and predictive modeling and to the way things are changing compared to pre-crisis. If businesses are not accounting for externalities and external factors in their predictive models, they are potentially leaving supply chains and forecasts to very vulnerable blind spots.

***

About Andrew Duguay

Mr. Duguay is a Chief Economist for Prevedere, a predictive analytics company that helps provides business leaders a real-time insight into their company’s future performance. Prior to his role at Prevedere, Mr. Duguay was a Senior Economist at ITR Economics. Andrew’s commentary and expertise have been featured in NPR, Reuters, and other publications. Andrew has an MBA and a degree in Economics. He has received a Certificate in Professional Forecasting from the Institute for Business Forecasting and Certificates in Economic Measurement, Applied Econometrics, and Time-Series Analysis and Forecasting from the National Association for Business Economics.

Mr. Duguay is a Chief Economist for Prevedere, a predictive analytics company that helps provides business leaders a real-time insight into their company’s future performance. Prior to his role at Prevedere, Mr. Duguay was a Senior Economist at ITR Economics. Andrew’s commentary and expertise have been featured in NPR, Reuters, and other publications. Andrew has an MBA and a degree in Economics. He has received a Certificate in Professional Forecasting from the Institute for Business Forecasting and Certificates in Economic Measurement, Applied Econometrics, and Time-Series Analysis and Forecasting from the National Association for Business Economics.

About Chris Dieringer

Mr. Dieringer is currently leading the US Retail and CPG practice focused on following current and future trends in the industry and helping customers realize those within their digital transformation. He has experienced time with sub-segments including Consumer Electronics, Grocery, Home Improvement, Fashion / Apparel, Department Store and CPG companies. Functions include Marketing, HR, Tax, Supply Chain, Finance, Merchandising, Operations, Strategic Planning with technologies in business intelligence, data warehouse, application development, ERP deployments, CRM installations, and cognitive services delivery.

Mr. Dieringer is currently leading the US Retail and CPG practice focused on following current and future trends in the industry and helping customers realize those within their digital transformation. He has experienced time with sub-segments including Consumer Electronics, Grocery, Home Improvement, Fashion / Apparel, Department Store and CPG companies. Functions include Marketing, HR, Tax, Supply Chain, Finance, Merchandising, Operations, Strategic Planning with technologies in business intelligence, data warehouse, application development, ERP deployments, CRM installations, and cognitive services delivery.