Last Updated: April 9, 2020

Before we delve into the week’s economic update, it is essential to recognize the impact that COVID-19 (coronavirus) is having as a health crisis on lives around the world. We want to ensure that as a company, we acknowledge the growing adverse effects the coronavirus is having on human beings—equally important is the immense complexity in combating and stabilizing the spread of this virus.

Our most recent Economic Outlook Report (March 14th, 2020), is an examination of the latest economic signals impacted by the global effect felt by the coronavirus. Prevedere provides economic-based predictive analytics solutions that power intelligent forecasting. Our mission remains focused on helping businesses understand the financial landscape to make informed decisions during this challenging and unprecedented time.

Last week witnessed several major global and domestic events that affect future global and domestic economic performance, including additional travel bans, news of expanding coronavirus cases throughout Europe and the United States, and coronavirus officially declared a pandemic by the World Health Organization. We have seen aggressive responses from the Federal Reserve to drop interest rates to 0% on Sunday, essentially doing what they can to prevent the health crisis from spreading to a financial crisis.

All these recent actions take consideration into how they will impact the direction of the US economy going forward and business performance. While we can’t predict the course of the virus, we can interpret incoming data combined with historical data to discuss findings and future economic outlook.

A more in-depth look into the PMI

While the US was in a position of economic strength going into 2020, the rapid rise in coronavirus cases increases the likelihood of an economic downturn. It’s become evident that consumption in the US will decelerate in the first quarter from normal levels.

We are seeing some stock up in consumer segments at the grocery store at the moment, but when we take that into broader consumption consideration, we expect overall consumer spending to be a net negative from this event. The possibility of a quick rebound in the second quarter due to pent-up demand, as many were initially hoping when this crisis started to take hold, looks to be optimistic at this point.

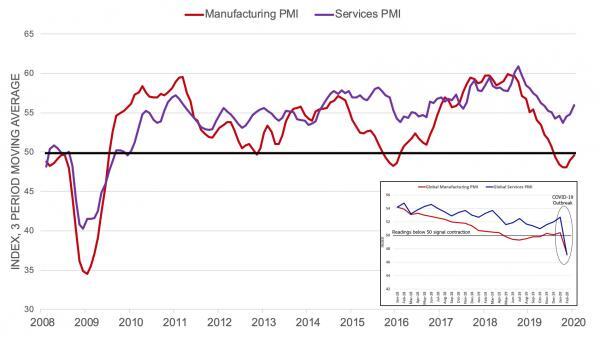

As we look for measures of the health in the US economy, one of the indicators we like to look at is the US Purchasing Managers’ Index (PMI), shown in the graph above. We have an overall economic growth through February. The exception, previously noted, is that manufacturing was seeing a declining growth trend and possibly signaling some weakness. What was lifting the US economy was the services sector and consumer spending, as represented in the purple line on the graph. The context of the indicators shown is trending quite negative at the moment.

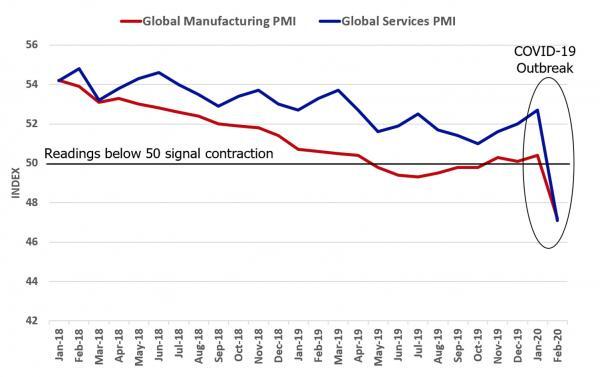

When we look at China’s Purchasing Managers’ Index as well as global Purchasing Managers’ Indexes, what we see is that once the pandemic takes hold, there are noticeable disruptions to supply chain, manufacturing, and logistics represented in the red line. The added indicator to note is the escalated downturn in the services sector, highlighted by the purple line.

Turning back to the US, this poses a unique threat to the near-term economy and the rate of economic growth as we expected some weakness in manufacturing in 2020 before the pandemic. At the same time, all indicators were pointing to a strong consumer showing that would continue to stabilize the US economy, and now that appears to be under increasing threat.

What have learned from China and others

In looking to China and global indicators in the Purchasing Managers Index, we see that February data was already negative for the economies that felt earlier impacts of the coronavirus pandemic. What becomes immediately visible are sharp declines both in manufacturing and services sectors with prominent supply chain disruption. We are also observing the adverse effects of cumulative travel bans and social distancing, which are impacting consumer spending and the services sector. We should expect similar declining trends in the US in March data releases as we are starting to escalate our response to the spread of the virus by implementing many of the same measures that other countries are forced to perform.

The magnitude of the coronavirus has caused implications for global and the US economy in ways that no one could have foreseen merely a few weeks ago. But given the gravity of the situation and how it’s spreading into the US as it has in other countries, the profound social changes are on the side of the health crisis. And while this will cause near-term economic pain, it appears necessary for the ultimate path of economic recovery.

Lessons from watching economic indicators

The cumulative learnings and economic consequences we can glean from following the rapid changes in global indicators, especially in countries that have seen the escalation of coronavirus cases sooner than the US have been profound.

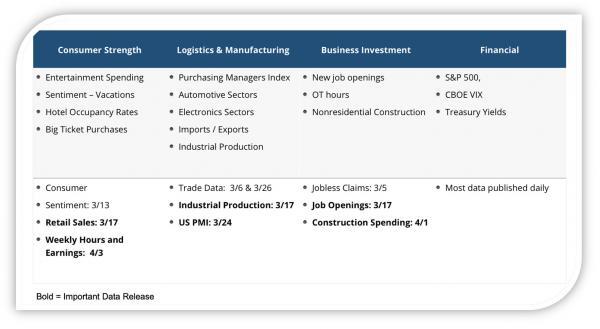

When it comes to the indicators to watch, the PMI is a good one. But as we advise our customers and Prevedere subscribers, we are focusing on four key areas for tells on broad economic implications. Advanced of watching indicators, businesses need to measure the impacts against their internal data to look for potential leading signals of a downturn.

When we think about areas of the economy that are going to be affected, there are four key areas to monitor. One is consumer strength. So this can be a measure of travel and tourism which we know has been strongly impacted as conferences, concerts and business travel has mostly been put on hold for the foreseeable future.

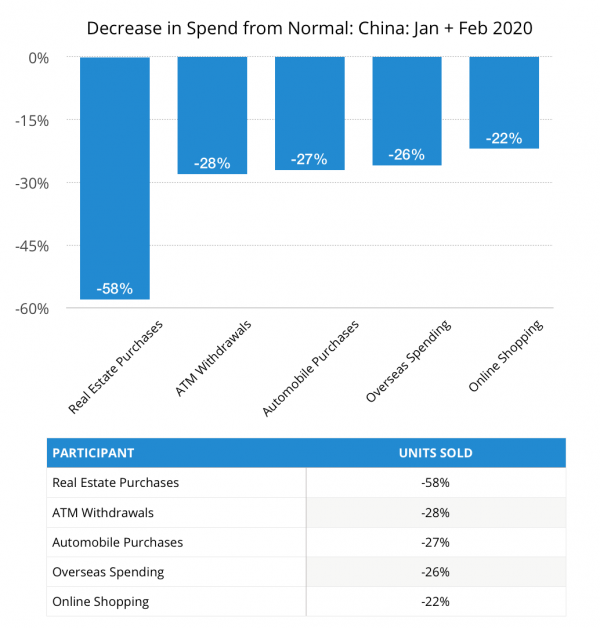

But we can also look at the consumer for other measures. During times of heightened uncertainty, we might see temporary increases in sales at grocery stores. However, we should be looking and paying attention to big-ticket purchase items such as automotive and home-buying. When we appraised the same data for China last week, we saw significant declines from the Chinese consumer.

We should expect to see signals of similar negativity in the US. We will also be anticipating the data releases from retail sales. We’ve already had some early releases on consumer sentiment. And we’d seen that attitudes had shifted from near record highs as the US consumer was in a particularly happy place before the pandemic event happened and transpired, to a much more conservative consumer.

We are looking forward to the Census Bureau’s retail sales release coming out on March 17th. For our Prevedere customers; you know that your workbenches are set up with some of these leading indicators. As data is released, models and indicators will update as well. We can not underscore enough the importance of monitoring the indicators as they refresh.

Logistics and manufacturing is a crucial area to watch that was showing signs of slowed growth trends in 2020. The latest evidence shows the threat of contraction is becoming more serious. We’ve seen and talked about how the fall in oil prices is going to have a significant impact on oil, petroleum, distribution, and refining areas of the US economy.

Other areas of manufacturing are going to be impacted by global supply chain disruptions. Even as China goes back online, we are seeing disruptions coming out of Europe. Behind Europe, the US is expected to experience increased interruptions domestically as work from home policies and different factors play into our production capacity.

We’ll be looking for additional releases for more refined data, including that important ISM Purchasing Managers’ Index coming up later this month on March 24th, 2020. Business investment is one of those areas where we have to look at what is going to happen to jobs. And this is a big question mark for the US economy.

Jobs security

If social distancing and limited public gatherings continue for too long, we could be talking about a significant gap in temporary job displacement. This could potentially cause a substantial change in the structure of the US economy. The US has enjoyed a period of exceptional high employment. With both unemployment or under-employment possible, we need to pay attention to essential releases around job claims, lost jobs, new job openings, or even measure hours or overtime hours worked to get a good sense of what businesses are going to do to react to this crisis.

Overall, indications are that employers will be taking the long-approach where possible, view this crisis as temporary, and therefore make efforts to retain talent. It is also possible that as the coronavirus escalates to a more severe level, there will be structural adjustments where people will be permanently displaced from their jobs. If the latter happens, there would be a higher likelihood that a more significant economic crisis could stretch farther and deeper beyond the peak amount of virus containment in the future.

The most reasonable assumption is that stimulus, Monetary or Fiscal, will help but not completely heal the economic issues. For the Federal Government, they will need to address with “stimulus” much differently than a typical downturn. From the services sector side, we are entering this crisis from the point of strength, with historically low unemployment rates and stable labor force participation. Any direct cuts to payroll taxes will likely miss the mark, as impactful social-distancing means fewer opportunities for discretionary spending, regardless of the paycheck, so savings rates will most likely go up, but not overall spending. And, more significantly, it’s going to be the workers in those hardest-hit industries that are going to lose hours or temporarily lose their employment, most impacted. Payroll tax reduction will be less impactful than other potential measures of temporary work displacement assistance.

Fiscal stimulus will also face challenges to the typical recipe of market-relief. It is not really a bubble-burst or high-interest rate issue at heart, which is what Monetary policy is best equipped to help. They can help stabilize some of the fear and shore up support for bank loans, but the economy will still cool if people are not going out and doing the things they usually do.

Closing Remarks

This is a health crisis, and sometimes what is best for our health is not best for the economy in the near term, and unfortunately, this is primarily the case with COVID-19. More aggressive closures of public events and encouraging of social distancing is what this country needs, the economic ramifications now indicate a period of economic contraction that will more than likely meet the definition of a recession. Businesses should plan on Q1 and Q2 contraction. It may be relatively shallow and short, but the impact is and will continue to be felt.

The recovery still has a likelihood of being swift if containment times meet early examples from China and potentially Korea. Corporate debt levels are one area of concern, as businesses have seen elevated levels of borrowing for the past decade based on historically low-interest rates. The risk of this being a prolonged recession after the virus is contained will hinge on financial market stability and the high debt levels of businesses not tipping into massive defaults. That is one area of elevated concern for the second half of the year.

Watch the full US Quarterly Outlook Updated with Prevedere Chief Economist, Andrew Duguay

***

About Andrew Duguay – Chief Economist Prevedere, Inc.

Mr. Duguay is a Chief Economist for Prevedere, a predictive analytics company that helps provides business leaders a real-time insight into their company’s future performance. Prior to his role at Prevedere, Andrew was a Senior Economist at ITR Economics. Andrew’s commentary and expertise have been featured in NPR, Reuters, and other publications. Andrew has an MBA and a degree in Economics. He has received a Certificate in Professional Forecasting from the Institute for Business Forecasting and Certificates in Economic Measurement, Applied Econometrics, and Time-Series Analysis and Forecasting from the National Association for Business Economics.

Mr. Duguay is a Chief Economist for Prevedere, a predictive analytics company that helps provides business leaders a real-time insight into their company’s future performance. Prior to his role at Prevedere, Andrew was a Senior Economist at ITR Economics. Andrew’s commentary and expertise have been featured in NPR, Reuters, and other publications. Andrew has an MBA and a degree in Economics. He has received a Certificate in Professional Forecasting from the Institute for Business Forecasting and Certificates in Economic Measurement, Applied Econometrics, and Time-Series Analysis and Forecasting from the National Association for Business Economics.