Last Updated: April 9, 2020

Data updated: March 9, 2020

The following blog is part two of a two-part blog series, The US Quarterly Outlook in the Midst of the Coronavirus, based on the US Quarterly Outlook report webinar by Prevedere economists. (Listen to the updated addendum here.) The goal of this two-part series is to help executives make informed planning decisions in the wake of a complex economic landscape, based on quality economic data using the expertise of Chief Economist, Andrew Duguay.

***

I think we all understand the timeliness of this quarter’s US economic update. As we’re facing many new and escalating challenges on the global economic front, particularly from Covid-19 (coronavirus), it is essential first to recognize the impact that this health crisis is having on lives around the world. We want to ensure that as a company, we acknowledge the effects that the coronavirus has on human beings, as well as the immense complexity in combating and stabilizing the spread of the virus.

At a high-level, the coronavirus epidemic is shifting rapidly from what initially looked like a temporary supply chain interruption coming out of China, which in itself is big news. However, the scope is broadening to encompass a wider global net with far-reaching market disruption. Those market disruptions are crossing more and more industry sectors.

As the coronavirus extends out, the expected recovery time will be delayed. We can expect market implications for the months ahead rather than a temporary disruption.

Oil Prices

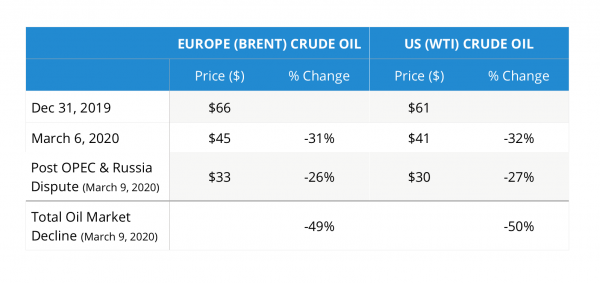

Other interesting market developments greeted us on Monday, March 9th, 2020. There was a disruption in the oil markets as Saudi Arabia and Russia struggled to come up with supply agreements. Unfortunately, the results have been a severe decline in oil prices globally. It is important to note that oil prices were already falling coming into last week’s negotiations, likely a strong contributor to the atmospheric agreement reluctance.

Oil prices had fallen around 30% since the beginning of the year up until last week, which is a rather significant decline. However, since the supply disagreement last week, this has been followed by another 20% drop in prices, at least as of today.

We are looking back at oil prices in late 2019, prices hovered around $60-$65 a barrel, depending on whether looking at US crude or European Brent. Today prices are in the low $30 range across the globe. That is a significant decline. Oil prices are a weighty economic indicator, as they function as a key economic barometer of overall economic health.

The impact of the decline in pricing will spread across many industries, including in the US, where we are a rather large oil and petroleum producer, refiner, and supplier. This will assuredly have negative impacts on many industries within the US and globally. Today’s markets experienced a sharp negative backlash against the news. What is particularly concerning is that the developments facing the oil markets are an increasingly disparate issue than anything directly related to the economic developments from the coronavirus. The virus fears may have started to temper some global demand for oil but are not directly the cause of the now-frontline supply issues. We are facing economic headwinds on multiple fronts in March, and the business and investment community is duly concerned.

With many different data points getting released every day, it is imperative to know and identify the most relevant economic leading signals unique to businesses, markets, and industries before making reactionary adjustments to planning. Understanding developing trends and how the data is impacting internal predictive models requires discipline and perhaps at times, antacids.

The Latest from China

On the consumer side, we have our focus on how these combined developments are going to impact household spending.

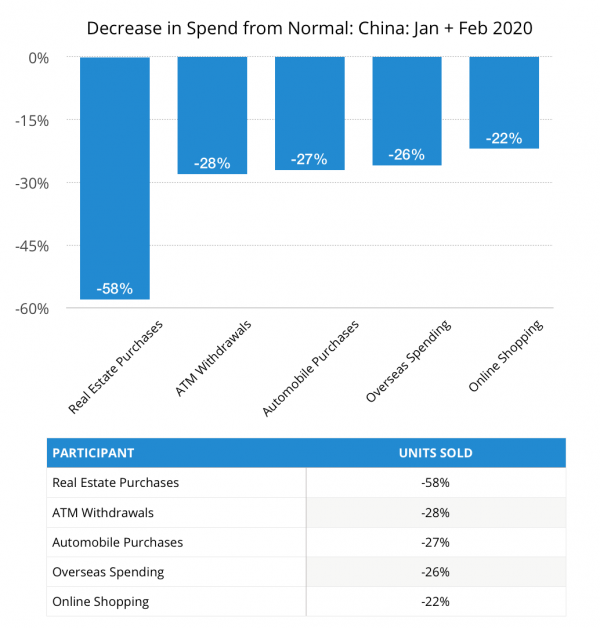

Consumer spending is, of course, a linchpin for most economies, including China. Prevedere has been eagerly tracking how the coronavirus is impacting those countries where this crisis is most pervasive and particularly the Chinese consumer. To do this, we are looking beyond ordinary Chinese government data releases, to data partnerships we have in China that directly measure changing consumer attitudes, spending intention, and direct purchase transactions.

The latest data received shows that Chinese consumers are cutting back pretty severely on their spending on a year-over-year basis. Our analysis shows that amongst a profusion of broad categories in consumer spending, the January and February year-over-year period compared to a ‘normal seasonal trend,’ as if this coronavirus never happened, we see about a 25% decrease in most categories versus trend. We attribute most of the consumer hesitancy from the coronavirus associated travel restrictions and the like.

Further delving into the data, it is clear that the lack of consumer health is not confined to brick-and-mortar businesses alone. We are seeing declining overseas spending, less travel, and even online retail transactions are down. Combined, the consumer and manufacturing side data feeds from China suggest the country is in a year-over-year decline. Technically a recession equates to two quarters, but for all purposes, the first quarter in China is going to be felt like a recession in all areas of China.

The latest data on the US economy

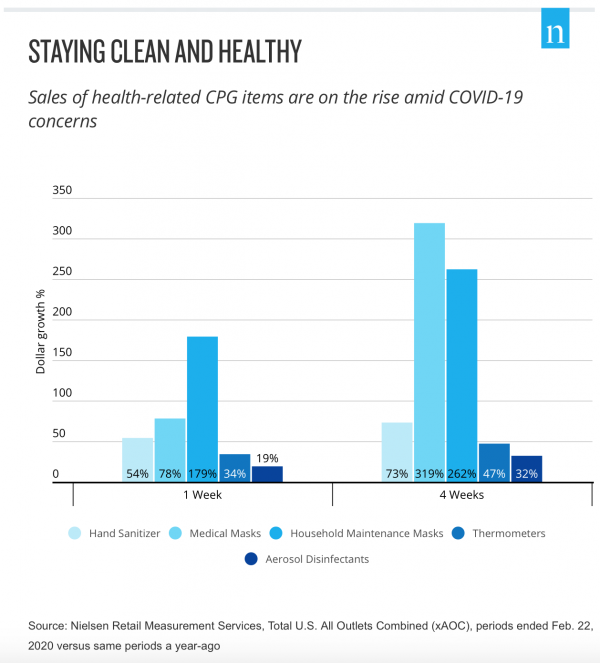

When we look to leading economic signals closer to home, the US consumer is shifting the market. To understand this, let’s look at some real-world examples. For instance, people might be spending more on hand sanitizer and less on fresh fruits and vegetables as they might be worried about the number of trips to the stores. Nielsen calls this the “Pandemic Pantry”. Consumers may feel the need to stockpile on frozen foods instead of fresh.

Historically, as we mentioned in our US Quarter Outlook with Special Coronavirus Report webinar last week, what is typically seen from similar rare crises events is that if they are contained timely, there is only a temporary supply and demand disruption. Consumers tend to reduce their spending on some things to buy more others, however, GDP and consumer spending as a whole will continue forward at a normal pace with minimal impact overall. With every passing week, the likelihood of the long-run, little-to-no impact scenario dwindles. We will grow more concerned if things continue to devolve in the US with more severed virus trends than expected or perhaps longer-lasting travel restrictions.

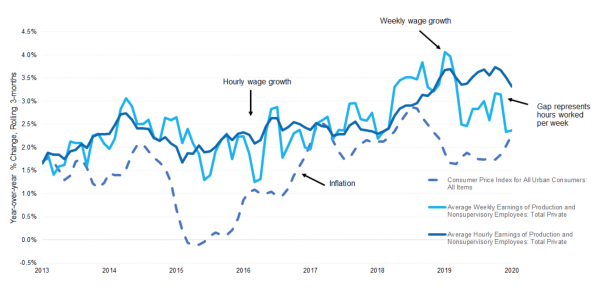

When looking at consumer strength, we do need to keep in mind the context of the US economic cycle; the US consumer is in a relatively stable and healthy condition with low unemployment rates and relatively high wage growth. We would have to see extended periods of impact from this coronavirus before we started to get into recessionary territory.

Watch the full US Quarterly Outlook with a Special Coronavirus Report webinar by Prevedere economists