Last Updated: December 28, 2020

By Andrew Duguay, Chief Economist

Data updated 12/2/2020

Overall, the economy is still tracking in a soft recovery as expected. There have been no significant changes over the last few weeks to our overall GDP forecast here at Prevedere, and we still expect the recovery to continue into 2021. Of course, that depends on the pandemic. But, from a total GDP standpoint, many of our key macroeconomic indicators are tracking in line with our recovery expectations.

Mixed Signals on Consumer Spending

One of the surprises of this recession is how fast of a rebound retail sales have experienced. When you look at media headlines indicating that they are back above year-ago levels, it’s like the recession never happened. Total retail sales from the Census Bureau suggest that sales are growing at a 4 to 5% clip. That’s pretty much where they were before the pandemic. So what’s going on? Is the U.S. in a recession or not? Are consumers cutting back or not?

The broader perspective is that total retail sales don’t cut it from fully measuring this pandemic’s impact. Why? Because total retail sales aren’t total. It is a measurement of actual stores and retailers. However, this isn’t just the only thing that people spend on. It is heavily biased towards retailers of goods, both online and in-store. What this doesn’t cover are things like going to a lawyer or hiring a babysitter.

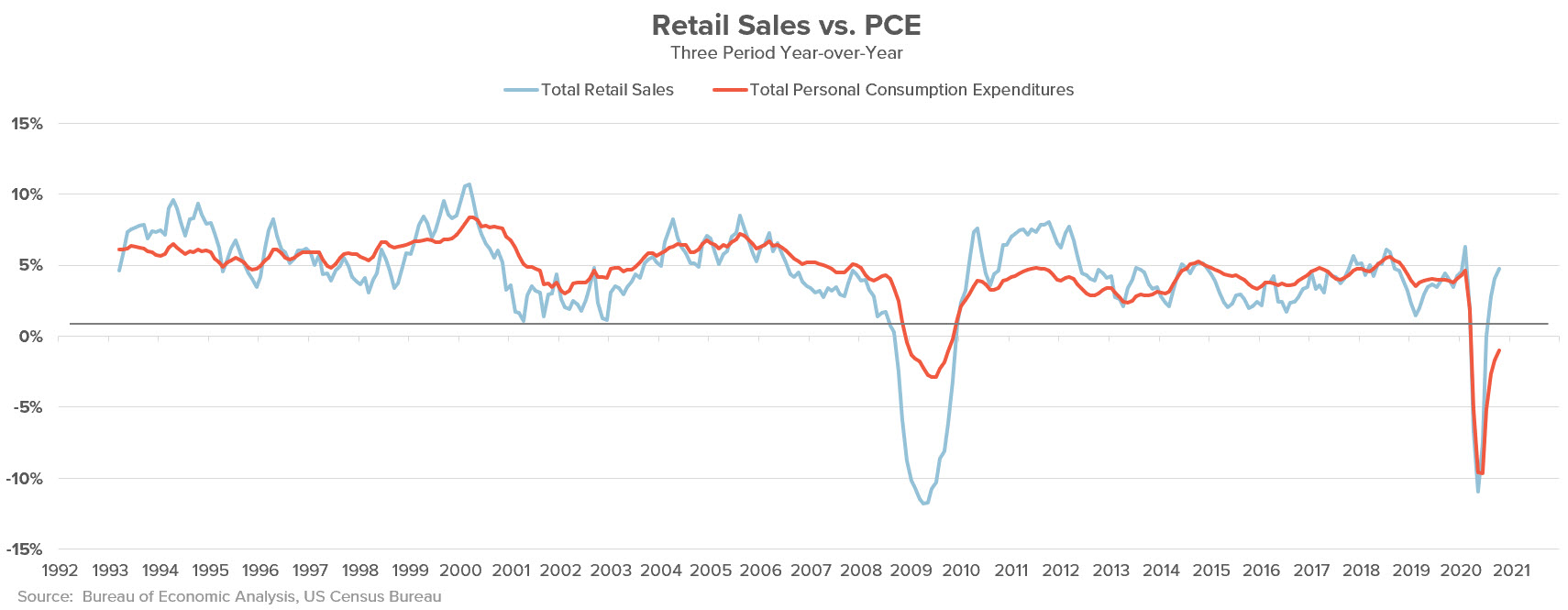

Total personal consumption expenditures from the Bureau of Economic Analysis include things that do not require actual retail transactions. That data indicates that the recovery doesn’t look as V-shaped and not back to pre-recession levels on a year-over-year basis. In fact, it’s still down about 1% on a year-over-year basis. If you look historically, these two data sets tell very different stories about the nature of the economic cycle this time around.

In looking at total retail sales, it dipped down as much as the Great Recession back in 2009, but the recovery has been swifter and now back to year-over-year growth. In past recessions, such as 2000 and 2001, total retail sales didn’t even go into contraction, and that’s normal if you look back through a 100-year history. Often, recessions are not bad enough for consumers to pull back their spending. They merely slow it down.

However, total personal consumption expenditures, both spending at physical retail stores and online and services, went much lower than in 2009, especially in 2001, but the recovery is not entirely there. This makes sense as this pandemic has specifically hit services.

Spending Patterns Have Shifted

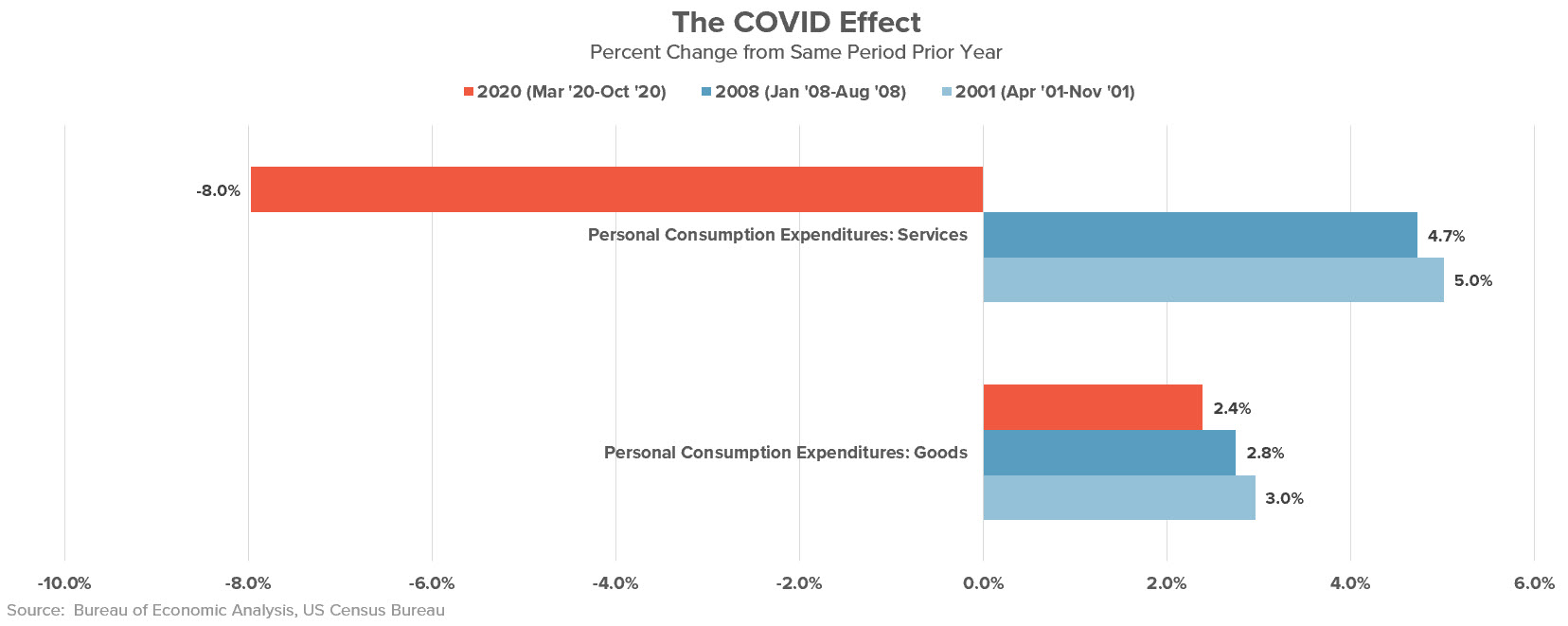

The chart above illustrates the difference in the COVID effect or how it is different from other recessions. In looking at personal consumption expenditures, which was the red line in the previous chart, this chart breaks it out into its two components: whether consumers are spending dollars on goods or spending dollars on services.

In this chart, the red is measuring the COVID-19 recession and comparing that to the recessions of 2008 and 2001. This shows some comparison to other times where the economy was in recession and what the consumer was doing. Consumers were always spending on goods in past recessions. They are still spending on goods in this recession, but spending is slightly weaker than the previous two recessions.

A significant difference that we are currently seeing from consumers is that they are pulling back spending on services. Their spending levels in previous recessions have been much higher. This is the big gap, an 8% reduction in spending on services year-over-year versus ongoing growth, even during recessionary conditions, on services in the past two recessions.

There are some key takeaways to be gathered from this. The first is that the Bureau of Economic Analysis total personal consumption expenditures illustrates that we are in a recession, and there is a contraction in consumer spending. However, this data is somewhat overshadowed by heavily reported retail sales numbers that do not capture the whole picture.

From a business standpoint, a key takeaway is that many businesses that have not been forced to shut down are getting some boost in 2020 from share of wallet gains. This COVID recession has created winners and losers. Either you are going out of business, or perhaps because consumers have nowhere else to spend their money, they are spending it in your industry. The wallet is shrinking overall for consumers, but because so many services are unreachable right now for consumers, they are paying relatively more on other things like groceries, home improvement, and online sales.

Conclusion

Our advice about 2021 is to watch out for the post-covid whipsaw. Suppose any significant portion of consumer spending reverts to the old distribution of services and goods that have been neglected for the past nine months. In that case, many retailers and businesses that are on a high from the share of wallet gains in 2020 could see their recession in 2021 as consumer spending moves back to more traditional ways and proportions. However, consumers have less to spend overall.

While we are in a recession and consumers are spending less, your business or your industry might not be feeling the effect of it, or on the flip side, you might be massively feeling the impact. Either way, watch out for the whipsaw effect in 2021 because that will likely happen as we start to move back to some normalcy.

Of course, this is in anticipation of a vaccine and COVID-19 not being the headline story for the entire year of 2021.

Navigate What’s Next with Economic Scenario Planning

The COVID-19 crisis has given rise to a world of economic uncertainty, with uneven effects across regions and industries. As we head into the 2021 planning cycle, every business wants to know how the pandemic will impact next year’s numbers.

Prevedere’s Economic Scenario Planning solution helps companies navigate these tumultuous times. The solution projects future business outcomes for three plausible macroeconomic scenarios under COVID-19. Companies can use these insights to sharpen 2021 forecasts and plans, improve shareholder guidance, and stay on top of the pandemic’s evolving impact.

Click here to learn more about Economic Scenario Planning. >>

***

About Andrew Duguay

Mr. Duguay is a Chief Economist for Prevedere, a predictive analytics company that helps provides business leaders a real-time insight into their company’s future performance. Prior to his role at Prevedere, Andrew was a Senior Economist at ITR Economics. Andrew’s commentary and expertise have been featured in NPR, Reuters, and other publications. Andrew has an MBA and a degree in Economics. He has received a Certificate in Professional Forecasting from the Institute for Business Forecasting and Certificates in Economic Measurement, Applied Econometrics, and Time-Series Analysis and Forecasting from the National Association for Business Economics.