Last Updated: February 10, 2021

By Andrew Duguay, Chief Economist

Data updated: July 8, 2020

COVID-19 cases continue to surge across the U.S. with the caseload increasing daily. Initially, many thought that after a spike in infections, the curve would flatten, and then there would be a second wave threat in the fall. However, unfolding is a second wave as businesses across the United States have opened up, perhaps prematurely.

The conversation is beginning to change from how restarting America will impact the economy to what is holding back reopening. Several states have already reversed their reopening plans to a certain degree. They have either fully closed bars and restaurants again or are reducing them back to a limited capacity.

Economic Ramifications of Increased COVID Cases

Economic ramifications are quite complicated due to stimulus and many people being able to work from home. Because of the increased infection rate, additional federal and fiscal policies are likely to be enacted. But the very fact that there are increased cases means that people are likely going to have to limit and restrict movement in some way to flatten the curve again. The grand goal of having things reopen and get back to normal seems very distant now.

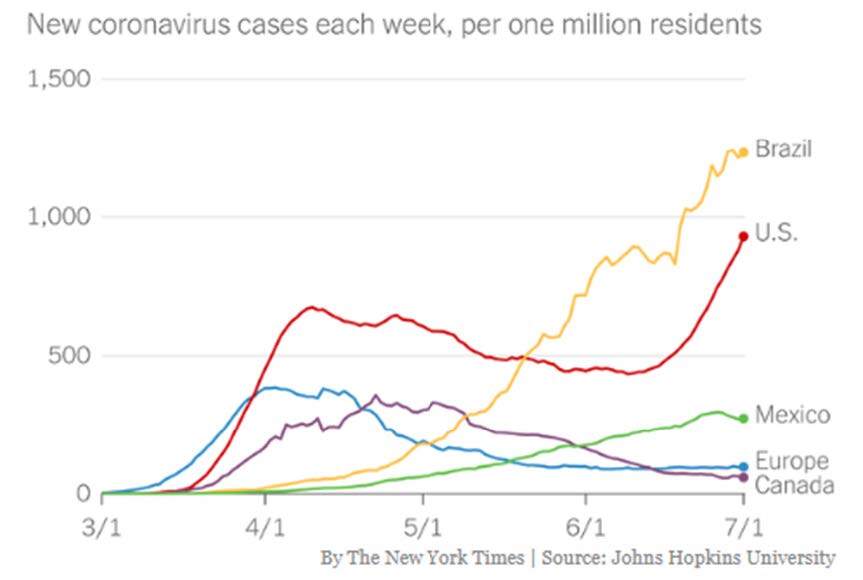

Volatility is part of the uncertainty in every economic outlook, and in this situation, it’s about whether we can control the number of cases. In contrast, that gentle curve occurring in places like Europe and Canada has not necessarily followed the same trend in the U.S.

The U.S. tends to mirror Brazil, which is struggling with COVID-19 right now. America is at a very elevated level of new coronavirus cases each week per 1 million residents, only to be outpaced by Brazil.

As of July 8, 2020

In looking at locations in Europe and through Asia, there is a curve with a slope downwards without a sizeable second wave. The U.S. situation may be related to timings of actions and reactions by people and their attitudes towards social distancing.

No matter how you look at it, it is not a good situation for the U.S. economy. Summer will endure economic disruption; however, there is still an opportunity for change. Additional stimulus or extended benefits are things to watch for this summer. The U.S. could face a lot of economic shocks if the government doesn’t step in and try to prop up the economy as they have in the past months. If there aren’t similar policy reactions to those enacted in the last several months, there could be a real fallout among industries that have yet to have felt the full result. The economic downside risk remains elevated.

To achieve the U-shape recovery that many economists are referencing, a reduction in infection rate needs to occur to allow for safe reopening. However, current trends indicate a W-shape improvement—up and down like a seesaw.

Micro-Recessions

The U.S. is beginning to experience micro-recessions, in which an industry experiences an immediate downturn followed by recovery, followed by another decline. These events tend to be stimulus-related, or even driven by the uncertainty that consumers themselves have over their future expectations. One week might bring good news on the stock market, enabling consumers to want to spend. Then the next week could bring increased cases and restrictions, dampening consumer spending intentions.

Economic indicators are no longer consistent across industries. As an example, the purchasing managers’ index for the services sector came out last week very high, above 50, indicating a return to growth. It looked like a V-shape, very similar to some other indicators that came out of China. However, other signs give a more sobering look, which is shaking up many industries.

Uncertainty has increased, meaning that there are going to be more misses in the future. But what is a reliable grounding indicator?

Economic Indicator to Watch: Weekly Economic Index

There are some indicators that, no matter how you look at them, provide false signals depending on interpretation. However, one indicator that our economist team is using frequently is the Weekly Economic Index, which is a rather new data set released by the New York Federal Reserve.

The Weekly Economic Index is a proxy for GDP growth rate using only high-frequency data such as weekly unemployment claims, steel production, railroad traffic, electricity consumption, and same-store retail sales. It’s a composite that indexes very well to GDP. Essentially, they are trying to replicate quarterly GDP on a weekly basis.

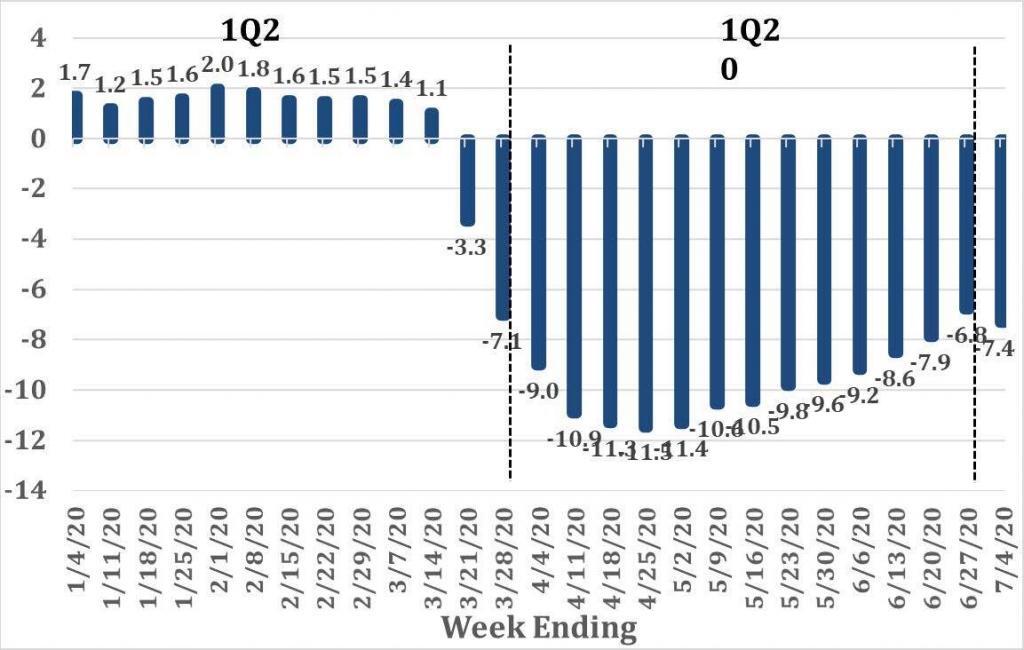

Weekly Economic Index: Real-Time GDP Growth Measure

Source: NY Fed

As indicated in the chart above, the activity in recent weeks isn’t linear, tied to increased cases and more restrictions and leading to weaker economic activity (-6.8% to -7.4%). This provides a sobering view that is in contrast to other, more positive indicators recently released, such as the jobs report or retail sales.

Some leading signals may indicate recovery; however, on the grand scale, when you consider composites such as the Weekly Economic Index, the U.S. still has a long way to go in terms of economic recovery.

3 Key Recession Recovery Takeaways

Reflecting on the events that happened in the first half of 2020, there are three critical takeaways for demand planning for the second half of the year.

1. Blend Soft Data with Hard Data

The first key takeaway is that a proper analysis of the marketplace needs to blend soft data with hard data because data is uncertain right now, and attitudes diverge from standard economic data sets.

As a refresher, soft data refers to things like opinions, attitudes, and expectations, which are extremely important in a time of crisis. Economic recovery is tied directly to consumer confidence in their safety and ability to spend. An example of soft data is Google Trends, as people are signaling their intentions through their search terms. It’s not necessarily if they are doing anything; it’s that they are thinking of doing something. There is tremendous value in looking at consumer sentiment metrics and consumer expectation metrics because everything has changed with COVID-19.

Some consumers are bullish, and others are pulling way back, as evidenced in how they are spending or thinking of spending—from recipes for cooking at home or researching which restaurants are open. Soft data is going to capture some of that intent compared to hard data, which is usually more heavily relied on because it provides facts. How much income do people have? How many jobs are there? Those are the core principles of what drives an economy, and those are still very important.

But in this time of psychological crisis driven by a pandemic, effective models are going to need to blend people’s attitudes about the economy alongside their real economic situation to get a complete picture.

2. The Value of “Real-Time” Indicators

The second key takeaway is the value of real-time indicators. It’s no longer good enough to just rely on one or two signals that come out on a monthly or quarterly basis.

Obviously, with times changing so fast, the value of real-time data, or higher frequency data, becomes much more valuable. Data sets with a lag of a month or two are only going to show what happened yesterday and are not indicative of what’s going to happen tomorrow. In the second half of the year, it’s imperative to hone in on what those key indicators are that are of a higher frequency that drives your business.

3. Do Not Linearly Extrapolate the Recovery

The third finding is not to linearly extrapolate the recovery. When things started to worsen, people planned for the worst, which is a logical thing to do. But if you would have linearly extrapolated the trend that began in March and April, you would have missed some of the high side or mini recoveries that happened in May and June.

In early July, there was record stimulus and expectations that things would get back to normal. However, don’t over-rely on the fact that the recovery to date has felt pretty strong. There will be challenges to face this summer, especially moving into August and September, as some of the provisions expire, such as the extended unemployment benefits from the federal government, that expire at the end of July. There are going to be some real roadblocks for the U.S. economy, especially at the rate of new coronavirus cases.

Even if the government extends provisions, millions of people remain dependent on unemployment for an extended time, impacting the productivity of the overall economy and more businesses hoping to survive a month or two. Extended provisions will lead to job losses outweighing job gains. Right now, businesses are hiring back a portion of temporarily laid-off employees, and that’s leading to positive jobs reports. Still, companies will need to create millions of jobs to gain back those that are lost.

There will be much oscillation in the future with economic indicators with businesses. It’s going to be necessary not just to extrapolate linearly but also to consider the ebbs and flows of different signals that matter to your business.

Conclusion

It’s not going to be a smooth transition through the summer months for the U.S. economy. There’s going to be varied and fast-changing environments for many businesses. Prevedere has been advising customers to think about planning in terms of scenarios.

It’s not good enough to do a point forecast anymore, and companies need to consider both potential high sides and low sides. They need to determine a baseline scenario driven by real-time indicators with a blend of soft and hard data.

The best approach is for companies to recognize that they don’t know what’s going to happen in the future because there is so much uncertainty related to the health pandemic. They should be looking at the right data sets and considering a range of outcomes, focusing on the most likely and making sure they can quickly adapt when circumstances change.

That is the best chance of executing successfully on a plan in the second half of the year.

Economic Scenario Planning in a COVID-19 World

Planning and forecasting based on historical performance is no longer valid in today’s economic climate. As you look ahead beyond the immediate crisis and consider your business plans, having visibility to external economic factors and being able to consider how your company will fare in the “new normal” economy are paramount. This is what we call Intelligent Forecasting.

Prevedere helps companies answer, “what’s next?”, using global data and AI technology.

Whether it is a black swan event like the COVID-19 pandemic, less severe shocks like falling oil prices, or the regular contraction-expansion business cycles, Prevedere provides executives with insights on global forces impacting their business.