Last Updated: April 9, 2020

It is essential to recognize the impact COVID-19 (coronavirus) is having on lives around the world. We acknowledge the growing adverse effects the virus is having on human beings—equally important is the immense complexity in combating and stabilizing the spread of this virus.

This week saw the rapid escalation of events from stimulus market changes. Prevedere Chief Economist Andrew Duguay discussed the economic signals most impacted by COVID-19 in a conversation today, Thursday, March 26th, 2020, on the latest Economic Outlook Report.

First and foremost, the report for US jobless claims to the week prior came out this morning. As we expected, it set a record. While the media presented numbers in the 3.2 million range, the official numbers are around 2.8 million, not seasonally adjusted. Either way, it was a sharp elevation—about five times the previous record of jobless claims in a single week. The last record was set back in the 2007-2008 financial crisis. What’s different is the nature of this crisis. What we’ve seen in the past is easing into a recession.

COVID-19 has presented us with unprecedented Twin pandemics. Equally weighing down the global population, not only the health pandemic but an economic event, the likes of which we have never seen.

Andrew Duguay – Chief Economist Prevedere, Inc.

As measures to limit the COVID-19 outbreak hit US businesses, the service sector has been especially severely affected, with consumer-facing industries such as restaurants, bars and hotels bearing the brunt of the social distancing measures, while travel and tourism have been all but, decimated. Manufacturing is also reporting a slump in demand, with production falling at a rate not seen since 2009.

There’s always that moment where the stock market collapses, or some major economic event happens, but usually, you have months or quarters of negative headwinds in the economy that precipitate this type of event. This advanced level of insight allows for caution and measures to scale in advance. The COVID-19 crisis is unique because of the speed at which it has escalated. COVID-19 has presented us with unprecedented Twin pandemics. Equally weighing down the global population, not only the health pandemic but an economic event, the likes of which we have never seen. The rapidity is impacting how we analyze the situation, providing another distinction between this recession and our historical past.

Suddenly we find ourselves in a world where the normal pace of data releases is not fast enough for us to measure how severe the effects are going to be, so we need to look at alternative data sources. Fortunately, in a world of big data, there are numerous alternative sources of information to utilize.

The strength of the US government to recognize a rapid exponential loss of jobs and step in with a stimulus package this week shows a resilience that shows promise for the months ahead. Although expected, the fact that they locked down a deal to the tune of around 2 trillion dollars will undoubtedly help cushion some of the blow of economic the ramifications of shelter in place, as mandated.

The Package includes stimulus checks for many Americans and business loans for small- to medium-sized businesses and even larger corporations. Welcome news as US private sector firms indicated a marked contraction in March with the spread of virus cases. To further try to soften the blow, unemployment benefits are being boosted and lengthened. Even so, this does not necessarily change the economic outlook for the remainder of 2020 and into 2021. The US economy is in a recession and will probably continue to slump after the Health crisis subsides for some time, due to the significance of the unparalleled health and economic landscape.

With a significant ramp-up in unemployment, businesses are going to be challenged to stay afloat, and we’re going to see some real near-term pain.

Andrew Duguay – Chief Economist Prevedere, Inc.

Consumer Sentiment

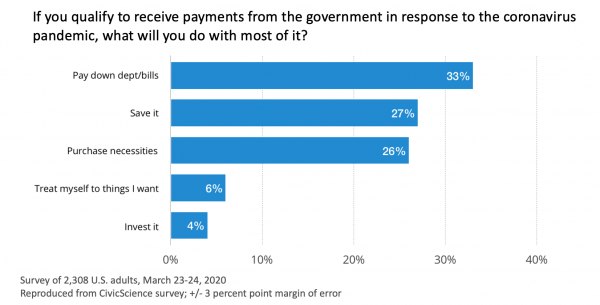

With the added assistance from the federal government stepping in and trying to cushion the blow will undoubtedly positively impact people’s lives. A recent survey provided some anecdotal information to put in context the positive and timely impact of the stimulus.

It found that 33% of recipients would actually use the money to pay bills. What we can take from this is that the government can help try to get people down to a conservative basic standard of living. We don’t want people losing their homes or left out in the cold due to job disruption.

The public tends to naturally retreat to a more conservative position in times like these. There isn’t going to be a boost to the stock market using stimulus funding, people aren’t going to invest, and they’re not going to spend on discretionary items. We’re going to see an entirely different consumer over the next six months than we saw in the previous six months, where consumer sentiment remained elevated, and post-tax spending applied to discretionary items versus essential goods. Any cash stimulus is going to help people pay the bills, and weather the storm.

We entered this health crisis with record low unemployment and near record-high consumer sentiment. Consumers, on average, were happier than they had been before, according to most surveys. And unemployment was lower than it had been in decades. And we’d been running about 10 years since the previous recession and overall in a somewhat economically healthy place here in the United States.

But now as we look at the consequences of COVID-19, we hope first and foremost that the health crisis is contained as soon as possible. Even if we do bend our curve of new confirmed cases to reflect more like China, and a little less like Italy, that would be a great thing for humanity, and obviously for the health of the citizens in the United States.

Looking at the business ramifications of this, we need to realize that as the health crisis subsides, the economic crisis is going to linger on a bit longer. There’s going to be debts that need to be repaid. Businesses are going to take a while to recover considering the hit they’re already seeing.

The United States won’t be the only country affected. With the spread of COVID-19 from Asia to Europe to North America, we’re really witnessing a global economic recession. Even if countries in the southern hemisphere, Brazil and Australia, for example, don’t experience devastating illness, they will be faced with especially weak economies over the next couple of quarters as the rest of the world’s economies weaken.

Looking out at the second half of the year, our hope and our best case are that the pandemic will be contained. And as a society, we will start to get back to “normal activity”. However, when it comes to business activity, it is likely still going to be weak. Conditions won’t be as bad as the first half of the year, but things will still be very slow. This week’s boost from the federal stimulus was much needed, but they are not going to be a cure-all for the second half of the year.

As we think about the extent of this recession, we should be planning on about four quarters of relatively weak activity with the hopes of leaning more towards the recovery side in the second half of the year. The purpose of this update is to put things in a broader context compared to what we’re seeing today.

Compared to two weeks ago, the world has changed, and our economic outlooks have had to pivot. Initially, there was more hope of V-shaped recovery. There was more hope that we could control the pandemic and that the economic consequences of the actions necessary to stay healthy would not be as severe as they are.

What we’re experiencing now is that the reaction to the health crisis is necessarily severe, and necessarily puts the global economy in a contraction. Later, it will be about businesses and individuals persevering to get to the other side and come out of this together. With that said we’re continuing to monitor data on a daily basis.

Back to Business

One of the more significant issues is how businesses treat this recession. We’re looking at considerable risk to the second half of the year. The overall decline was the steepest recorded since 2009 and reflected falls in activity across the many sectors. When we look beyond the immediate months of shelter-in-place, we need to consider how businesses are going to be able to handle this? Companies are expressing concerns regarding the longevity of shutdowns and the ongoing impact of the coronavirus outbreak. This brings us to the junction where the health crisis and the economic crisis are closely tied together because there’s going to be a massive difference in the impact between shelter-in-place policy for three weeks or three months.

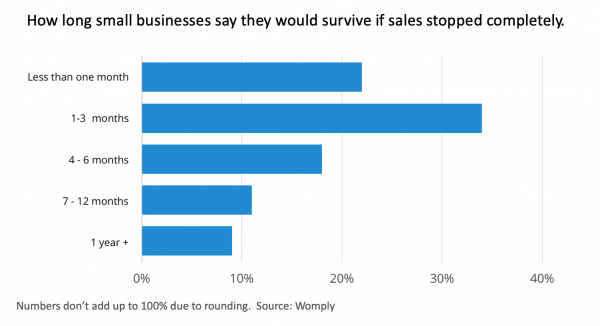

Another survey illustrates one-month to one-year outlooks of how small businesses could technically survive if sales stopped completely. It is worrisome and worth the attention that well over 50% of small businesses cannot last three months of closure.

Imagine the economic ramifications of that. Not much better, another near 20% say that they couldn’t last more than four to six months of closure. The clock is ticking to get control of the twin pandemics and to resume some sense of normalcy across US business.

Even two weeks into this contraction, and it is clear that businesses are going to come out of this a bit damaged. They will have to take a more conservative approach to investments that they were planning in 2020. No doubt, more conservative practices will follow to try to build back up the balance sheet and try to resume business as usual.

For many businesses, it’s about survival. How do they best take care of their employees? How do they retain their employees? How do they keep the lights on, and how do they stay in business through a crisis like this? These perspectives outline where a stimulus helps. The fact federal funds are aimed at small businesses and business loans is a positive approach. On another positive note, direct cash payments are considered more of an effective economic measure than tax rebates or payroll tax cuts.

COVID-19 (coronavirus) has likely changed the economic landscape as we know it. Perhaps one of the biggest learnings is the necessity to monitor external signals and new data for upcoming changes to business performance. It is no longer possible for companies to rely on systems and processes that seek to determine forecasts based on what was a few weeks ago. It has become paramount to incorporate external data, such as consumer, economic, industry-centric activity, and fresh signals into careful planning and forecasting strategy.

The government was able to read the cues and make positive steps forward this week with a powerful stimulus package. At the same time, we need to keep this in context. The U-shaped recession that we have been talking about remains the likely outlook. As well all indication is toward a slow recovery in the second half of the year. The stimulus helps to avoid the conversation about potentially spiraling into a great depression, or worse. That’s when you didn’t have a government that had the policies that they do now. We’ve learned a lot since the 1930s, and we’ve changed our federal and fiscal policies a lot.

Government action, in the near-term, helps stimulate the economy and cushion the blow. However, this does not eliminate the business cycle. We are still experiencing an unprecedented event in many ways. As fast as the COVID-19 pandemic arose, we are facing unexpected cacophonous consequences. And this is going to have some economic ramifications in the second half of the year.

This concludes our summary for the week ending March 27th, 2020, listen to the full recording here. We’re going to continue to keep you up to date weekly as new events unfold.

In the United States, there’s not a lot of near-term economic data from monthly government bureaus because of data lags. That is reflecting just how dire is the situation is. To compensate, we’re looking at alternative sources and diagnosing that the US economy is in a difficult spot, along with Europe and Asia. We, therefore, should expect a global recession with a rather slow recovery in the second half of the year.

Andrew Duguay – Chief Economist Prevedere, Inc.

In the wake of the COVID-19 pandemic, it is now more important than ever to have access to trusted data and expert economic analysis to help guide strategic decision making and business planning. To meet this need, Prevedere is unveiling its Economic Outlook Weekly report, with a complimentary package focused on COVID-19. There is no charge for access to leading indicators as they matter updated weekly.

Complimentary COVID-19 Economic Outlook Weekly includes:

- Macro view of COVID-19 global economic impact

- Key leading indicators to watch

- Regular economist presentations offered as information becomes available

- Weekly updates sent to your inbox

Click here to learn more.

***

About Andrew Duguay – Chief Economist Prevedere, Inc.

Mr. Duguay is a Chief Economist for Prevedere, a predictive analytics company that helps provides business leaders a real-time insight into their company’s future performance. Prior to his role at Prevedere, Andrew was a Senior Economist at ITR Economics. Andrew’s commentary and expertise have been featured in NPR, Reuters, and other publications. Andrew has an MBA and a degree in Economics. He has received a Certificate in Professional Forecasting from the Institute for Business Forecasting and Certificates in Economic Measurement, Applied Econometrics, and Time-Series Analysis and Forecasting from the National Association for Business Economics.

Mr. Duguay is a Chief Economist for Prevedere, a predictive analytics company that helps provides business leaders a real-time insight into their company’s future performance. Prior to his role at Prevedere, Andrew was a Senior Economist at ITR Economics. Andrew’s commentary and expertise have been featured in NPR, Reuters, and other publications. Andrew has an MBA and a degree in Economics. He has received a Certificate in Professional Forecasting from the Institute for Business Forecasting and Certificates in Economic Measurement, Applied Econometrics, and Time-Series Analysis and Forecasting from the National Association for Business Economics.