Last Updated: February 10, 2021

Our Economic Outlook Report focuses on economic indicators most impacted by COVID-19, presentation by Prevedere’s Chief Economist Andrew Duguay.

Oil is long held as the crown-jewel of commodities. Around the globe, oil is considered the prima economic barometer to monitor. Investors, governments, and executives are vested in the changes in oil prices. Even slight changes in oil prices have ramifications on global economies. Understandably, oil’s recent descent is a relevant topic currently.

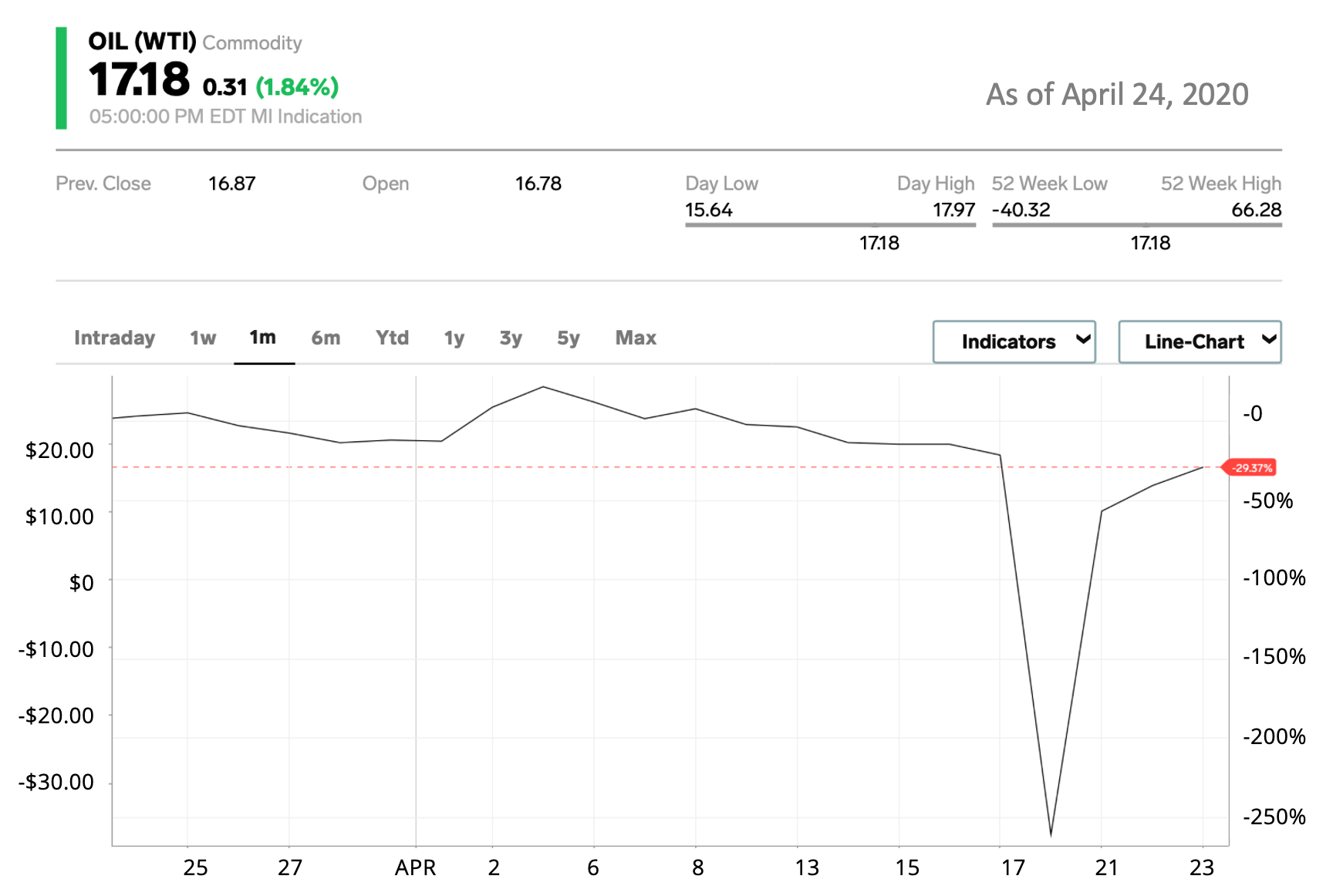

Oil prices have seen some unprecedented changes of recent; throughout modern history, we have never seen a movement as we see now. Crude oil prices have dipped into the negative. These events qualify as a fascinating phenomenon, but it really has been a long time coming in the oil market.

The Oil Crisis and the State of The Economy

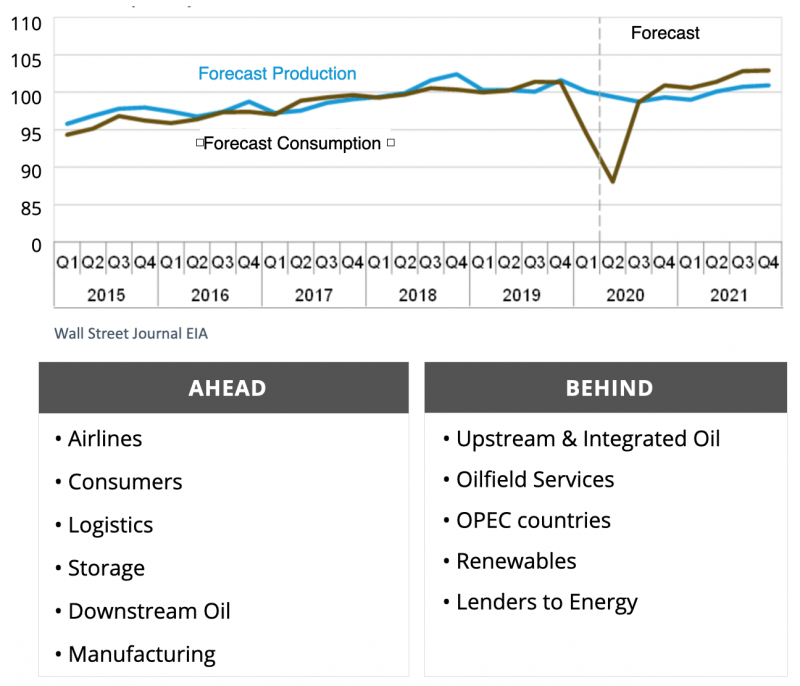

It began as a decrease in world consumption as a consequence of the shelter in place order that started in Asia and then quickly expanded to Europe and North America. Following this, the world’s oil consumption fell dramatically. Normally producers would react quite swiftly to this but instead, we had that historic spat between Russia and Saudi Arabia, which delayed some of the promised oil cuts. Since then, the countries have somewhat mended their terms and have committed to decreasing oil by around 10 million barrels per day. However, that’s too little too late. And what we’re left with is so much oil that there’s nowhere to store it.

Storage costs are rising. We are in a phenomenon that is called super contango. per-contango is a state in which a forward price of a commodity is higher than the spot price to a greater extent than can be explained by the interest and storage costs that explain the usual state of contango. This led to prices dipping into the negative.

Navigating Through the Oil Crisis

Ahead Through the Crisis

Moving on from the history lesson. Let’s talk about the winners and losers and how this impacts the US economy in multiple ways. Some of the winners are going to be hard-hit industries that will see some relief from this. Airlines, for example, have fuel costs that, in any given month, account for around 30% of their total expenditures. Seeing fuel costs decrease will help the airlines. Airlines are beleaguered for several other reasons, but at least they come out a winner in this situation.

Another winner is the consumer through lower gas prices, fuel costs, and energy costs. This is a must needed net positive for US consumers who still rely relatively heavily on oil. Additionally, low oil prices and fuel costs are certainly good for lowering inflationary expectations. This will also work toward keeping a few extra coins in the American consumer’s pockets, which is sorely needed right now with unemployment rising rapidly, and jobless claims increased by the millions every week.

Logistics companies are also going to benefit because of lower transportation costs. This relates to trucking companies and their cost of fuel, and storage companies, both onshore and offshore storage. We have seen demand rise for any sort of storage that can hold oil—barrels of oil, tankers of oil—due to this glut. The storage companies are winning. And so is the oil sector, specifically downstream channels of oil. Particularly the refining companies and many of the chemical companies are going to benefit from lower input costs. They get their margin by taking that input and then refining it and turning it into something else and moving it downstream. Downstream oil companies will benefit from this situation, which is fortunate because, due to the global recession, demand is going to be weak. With the lower volume that chemical companies are facing, at least they can be facing it with potentially higher margins due to the lower oil prices. Any sort of high-energy impact manufacturing will also be winners.

Behind the Crisis

On the other hand, the losers are very clear-cut in this, and they include upstream companies in the oil industry, those who drill and pipe that oil, and even the integrated oil giants who tend to benefit from both drilling and refining.

Any exposure to the upstream where they’re drilling for oil—which costs money—will be impacted by this. This was evident with strong negative numbers. And even as these numbers have turned positive at around $9, $10 a barrel, it’s not enough to make money, because those numbers are still below the cost of production.

Next to consider are the periphery industries. These effect areas of the country or the world that are heavily oil-dependent for revenues, the extra services in the oil field, or even just servicing those people who work in the oil field. Retailers, banks, and others are going to be negatively impacted by this. The consequences will be pockets of recession-like conditions that are more severe in the United States for areas that are oil-centric. Looking globally, those countries that depend heavily on oil are naturally going to be taking a significant hit.

We also have renewables to consider. This pandemic situation is a setback for renewables when the cost of your main competition—oil and gas—is in a virtual free fall. This forms a natural impediment for competing prices. Economic policy and environmental policy could certainly help stem some of the losses that renewables will experience.

In terms of sheer market supply and demand, renewables currently look less valuable given the fact that oil is no longer at its customary $80 – $100 a barrel.

Economic Ramifications on Industries

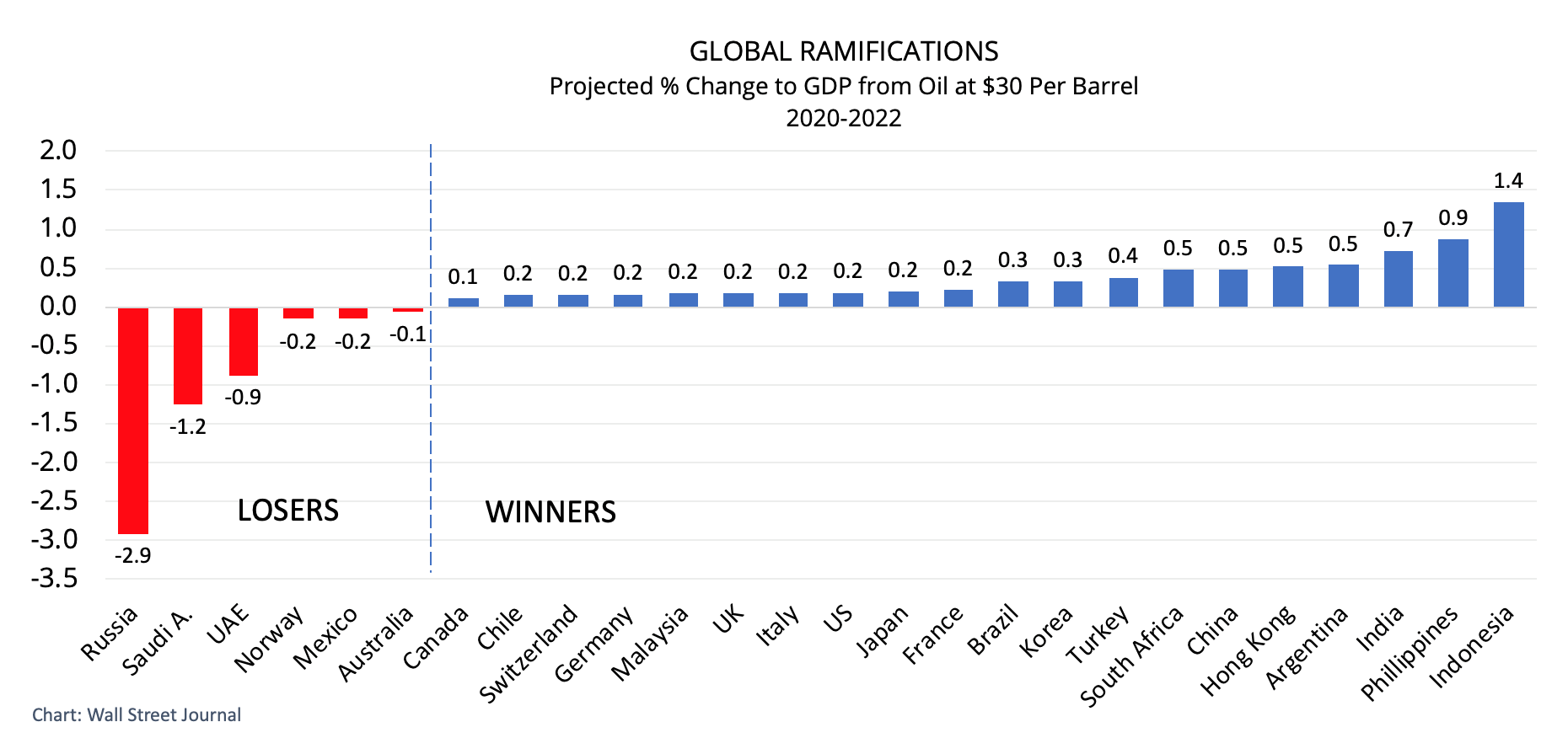

We certainly have troubling times in the energy industry—let’s examine where prices need to be. As stated, nobody is making money at negative barrel rates, so where do prices need to be? – It’s highly dependent on the country we are referencing, so let’s introduce two different views.

First are the countries that are heavily dependent on oil for government revenue (right side of the chart). Here oil drilling is largely a government activity or heavily subsidized by the government to reap the productions and the taxes from it. These are the traditional OPEC countries. Venezuela and other countries can be included as well in that category.

We need to ask, where do they need to be in order to balance their budgets? This price point isn’t necessarily where they make a profit, but where they need to be to make enough to cover all the expenditures that the government has promised its people. As you can see, prices need to be anywhere from $60 to $80 a barrel or more for these governments to have a balanced budget. And that’s where levels sat for the last five years, in the comfortable $60 to $80 a barrel range. That’s when OPEC is functioning well, and they remain in control of supply to meet global demand. However, when OPEC fell apart with recent Saudi Arabia and Russian dispute, we saw the glut take off. The timing was critical here, considering the shelter-in-place orders and the resulting oil prices are much lower than what their target is.

Fortunately, the US government isn’t as dependent on oil as a primary source of income to subsidize different industries or fuel costs. It’s reliant on a natural supply and demand metrics for oil drillers themselves. Because of this, here is a look at what it costs to open up new wells, about $40 to $60 a barrel. Costs for existing wells are lower than drilling new wells. However, to keep operating existing wells on a break-even basis, it’s still anywhere from $24 per barrel in the Permian to upwards of $38 in offshore and other non-shale areas. This equates to no one in the US is making money at these prices either.

Historically, shale has benefited from fluctuating oil prices and has turned the United States into the largest oil producer in the world as a low-cost provider. However, this oil environment is not healthy for the US oil industry whatsoever, which I think will force the US to work with OPEC and others, and it’s in everyone’s best interest to try to control this phenomenon and get oil prices back up.

When we talk about scenario planning for companies, we want to factor in oil prices that are likely to rise in the future once we get through this global pandemic, and through this supply glut. Both the US and its international oil-producing partners are likely going to have to work closely together to make sure that this does not repeat itself.

When we conduct scenario planning at Prevedere, frequently we include scenarios for oil prices in our medium, high, and low side scenarios. This may equate to everything from a retailer who is selling in the Texas, Oklahoma region, where they know that oil prices are going to dictate a certain portion of discretionary income for consumer spending. Or it could be the down-channel companies that benefit from low oil prices and want to know whether oil is going to stay this low, or rise again to historical averages of $60 to $80 a barrel. We build out a few of those scenarios and what-if analysis to locate where revenues might fall over a given period of time.

One thing is certain; oil prices are not likely to remain where they are. It seems there’s no incentive for anyone. But oil is a commodity, and as such, it needs to be physically stored, and that’s part of the reason why oil prices are doing what they are. Also important to note; those that have the most to gain from oil prices rising are the ones that caused oil prices to fall to record lows in the first place. Considering the added pressures from a global pandemic, this too will change, and when considered together, prices will eventually rise.

On the supply side, we have Russia and Saudi Arabia disagreements, which are essentially trying to break apart their traditional agreements to curb supply during economic downturns. They have the most to lose as countries on the whole. A significant modifier when considering the crisis as a whole: looking at projected percent changes of GDP over the course of the next two to three years with oil at $30 a barrel, it’s only at a third of that currently.

Comparatively, the rest of the world, including the US, tends to be a net gain from low oil prices with the list of winners that include broad segments like transportation and general consumers and manufacturing. Despite the US being the largest oil producer in the world, as well as being a significant refinery and manufacturer, it’s still a net positive when we look at the oil in the US. Crashing oil prices have to be taken in context with how much an economy is dependent on oil versus other parts of a diverse global marketplace. Those countries that are heavily reliant on oil for government revenue are going to be losers in this. Therefore, those countries have the incentive to try to curb production and get prices back up.

Post-Pandemic Forecasting and Planning

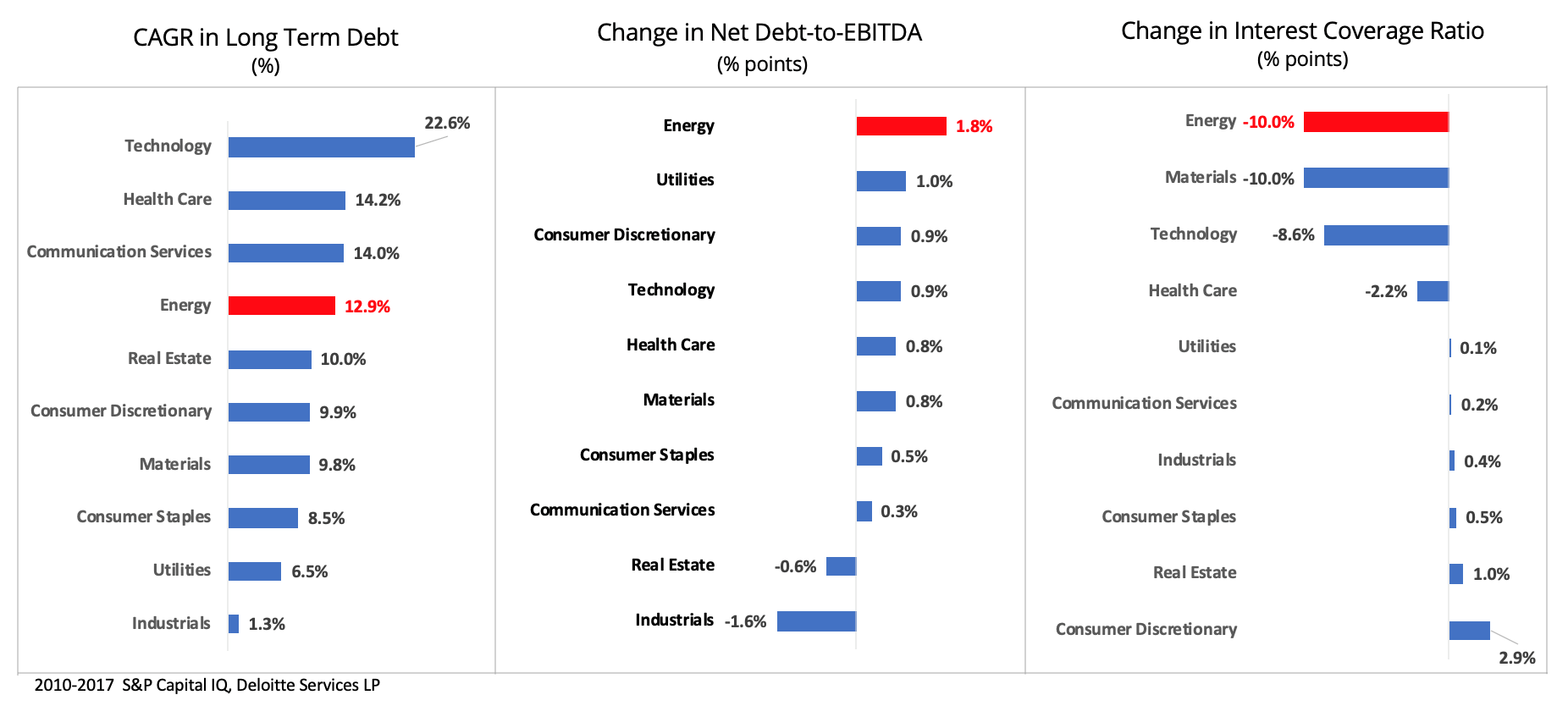

In terms of the United States, we’ve done some analysis that pulled from S&P Capital, Deloitte, and others that focuses on areas of concern within our energy industry. We looked particularly at all the different industry segments in the United States and how they have ramped up their corporate debt since the last recession. The Energy sector stands out as one of the more vulnerable industries at risk right now from a corporate debt standpoint. Add in the fact that oil prices are now at a price so low that the majority, over 80%, of producers right now are not at their break-even cost. What we are left with is a highly leveraged energy sector at a vulnerable time when oil prices are much lower than where they need to be. This could set up long-term damage in the US energy sector in terms of new investment, bankruptcies, or just lack of capitalization looking forward. The question is whether this is a temporary situation with a quick lift, or is it going to be some long-term damage?

There is the possibility of real long-term risk and exposure in the US energy sector. We use different measures of how leveraged essentially each industry segment is in the United States and the common themes, whether it be the compound annual growth rate and long-term debts or just changes in debt to income ratios.

Findings show that the energy sector expanded rapidly from the period of 2010 forward and increased their debt levels relative to their income. Even when considering lower interest rates, their interest coverage ratios have been falling. Therefore, the energy sector has made big bets on the abundance of oil in the shale areas of the United States. They also bet that high energy costs were going to make it well worth the extra borrowing and leverage to tap those resources. But now that those resources are virtually worthless, with meager cost compared to what they originally were, the energy sector is very vulnerable in terms of industry segments compared to others.

Comparatively, other highly leveraged sectors, such as technology, healthcare, utilities, and communication services, are a more likely net benefit, amidst the overall crisis. People are spending more time on the phone, using remote services, using technology to communicate. Healthcare should have some benefit with efforts in trying to come up with a cure and making sure everyone stays healthy. This leaves the energy sector as the only industry that has increased its leverage significantly over the past ten years that will most likely see very strong negative economic ramifications from this business cycle.

As you can see, it’s one thing to point out that energy prices are low, it’s another thing to say that many of the companies in the energy sector have borrowed a lot to get where they are. We’re going to likely see substantial defaults, cuts in dividends, and possibly some mergers and acquisitions of vulnerable companies to stay alive. The tangled web doesn’t necessarily point to the end of oil and gas in the United States. But it’s certainly going to continue to evolve into a very interesting economic time over the next couple years to observe how the energy sector is going to retrench from this and get their borrowing costs under control.

When we talk about the energy sector or any other sector, we do want to point out that there is considerable uncertainty given the current pandemic crisis and the unknowns economically as we are still dealing with the crisis. As such, Prevedere is working diligently with its clients to create accurate, consistent scenarios for planning purposes. When we build out our predictive models, we factor in realistic expectations of where oil can go from its shallow point, as well as expectations of GDP, retail, and other topics.

If you want to learn more about Prevedere’s methodology for how we are forecasting planning for the second half of the year and 2021, please reach out to us.