Last Updated: April 3, 2019

2018 was a banner year for the restaurant industry. With unemployment low and wages higher, consumers spent on dining out at a record rate. Sit down dining grew at the fastest pace since 1997, peaking at above 10% annual growth last summer.

While growth in the industry is still trending upward, 2019 may not be as strong of a year. In a recent webinar, Andrew Duguay, Chief Economist at Prevedere shared his forecast of 5.7% growth for full-service restaurants. He, along with John Sydnor, EVP of Sales and COO at Prosper Insights & Analytics, highlighted potential challenges and trends, as well as demographic and purchase intent data that influences consumers’ dining choices.

Why is restaurant dining growing so quickly right now?

Unemployment is low, under 4%, and wages are climbing, with a 2-3% growth in real disposable income. This increases consumer confidence and allows for more discretionary spending on eating food away from home. The sentiment is highest for those earning more.

While 2018 was a year of organic momentum due to a tax overhaul and stimulus, this created a high level of growth which is unsustainable. As the stock market cools, consumer sentiment is also cooling.

Challenges Ahead for the Restaurant Industry

As industry growth generally doesn’t continue at this rate for more than a month or two without slowing down, look for it to slow in 2019. Food and labor costs are also rising, and restaurants must pass costs through to consumers to maintain their margins.

Another challenge involves consumers eating at home, which is always a threat to the restaurant industry. With competition from the grocery side, which pushes prices down, restaurants must be wary of consumers choosing to dine in. Prevedere’s Food Service Spread, which measures the gap between the price to eat out versus that of eating at home, is at a record high. If the economy softens, consumers will be more price conscious, resulting in a legitimate threat to the industry.

Trends in Consumer Behavior that Impact Dining Out

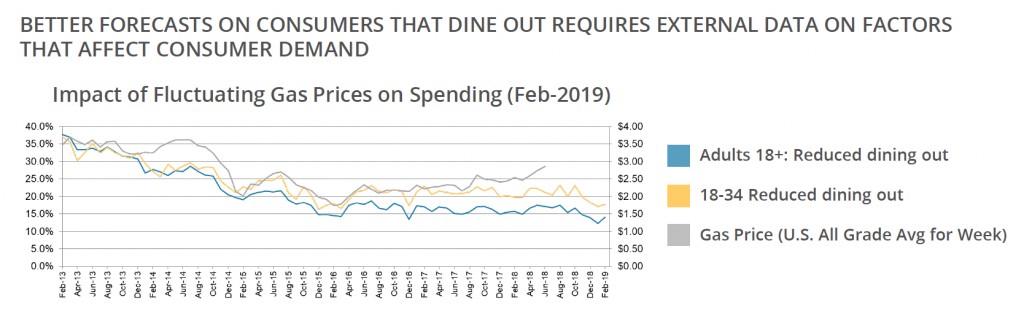

As consumers feel good about their “personal economy,” they tend to spend more in a number of areas, but few are as impacted significantly as the restaurant industry. Fully understanding the fast food category requires delving into consumers’ behavior and lifestyles to complement internal data with external data.

Consumers have choices and vote daily with their wallets. For example, if diners are choosing more organic options or eating foods with lower fat or carbohydrate content, that informs what restaurants should offer on their menus.

One example that illustrates this is the data that shows males are more likely to visit fast food restaurants than females. Males are also more apt to be “frequent” fast food consumers. Having this type of basic profile allows restaurants to begin to create a narrative that serves consumer targeting more efficiently. Variables can then be introduced, such as income, ethnicity and dietary restrictions. On top of that, psychographic data like impulsiveness or shyness can be added. This can help determine which “target profiles” are most likely to support choices in the fast food sector.

Key Takeaways for the Restaurant Industry

As growth continues this year but is slower than last year, the restaurant industry should anticipate making shifts accordingly. Full-service and fast food restaurants should expect a healthy year, while value-based restaurant chains may face challenges.

The full-service restaurant outlook for 2019 is 5.7%, which is slower than the 2018 breakneck pace of more than 8%. Prevedere’s restaurant leading indicator, among others, suggests that current levels of activity aren’t sustainable. Most indicators are falling from peak cycle growth and signaling slower growth ahead.

The full-service restaurant outlook for 2019 is 5.7%, which is slower than the 2018 breakneck pace of more than 8%. Prevedere’s restaurant leading indicator, among others, suggests that current levels of activity aren’t sustainable. Most indicators are falling from peak cycle growth and signaling slower growth ahead.

If the economy softens, eating at home will be a legitimate threat to the industry. To keep up with the challenges they face, restaurants should understand how to target key customers and use external data to enhance their internal first-party data. Messaging to their likely customers should be at the forefront of marketing efforts.

Using the Prevedere Prevedere Predictive Analytics Cloud and Macroeconomic Data to Guide Future Performance in the Restaurant Industry

Every business has a unique set of leading drivers that give signals as to future potential industry headwinds and tailwinds. For example, a slowdown in construction today could impact wages and employment tomorrow, which could eventually affect consumer habits like dining out months later.

By using cloud computing and the latest technology, like Prevedere’s Prevedere Predictive Analytics Cloud, algorithms and patterns match and detect leading predictive drivers of business and industry segments. A combination of the right set of leading indicators can contribute to a highly accurate predictive model that ebbs and flows with the economic data and gives off positive and negative signals as to what’s ahead.