Last Updated: January 12, 2021

It is essential to recognize the impact COVID-19 (coronavirus) is having on lives around the world. We acknowledge the growing adverse effects the virus is having on human beings—equally important is the immense complexity in combating and stabilizing the spread of this virus.

Today (March 30th) we’re going to be shifting our focus to talk about how rapidly the economic outlook is changing. Beyond the Northern Hemisphere borders, where coronavirus first started, we now see the global pandemic take hold in places that we were hoping would be a bit more sheltered from the virus. Initially, we thought because of their warmer climate or location with a different seasons calendar that these areas would not be as hard hit. However, the pandemic has reached all areas of the globe at this point.

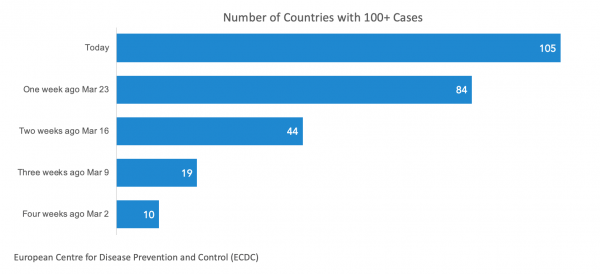

Due to these developments, it is time to expand our thinking about the economic ramifications on an entirely different scale. The rate at which this has turned into a global pandemic has been quite accelerated. To put this in some perspective, just four weeks ago, we would have been discussing ten countries, mostly isolated to Europe and in Asia, that had more than 100 cases of COVID-19. The rate of escalation has been astounding. Today we’re looking at over 100 countries with at least 100 cases of coronavirus.

The “100” threshold has been the kind of tipping point where you start to see the exponential spreading of coronavirus, especially if a country is not fast-acting, particularly in the first few days of crossing that 100 cases threshold. Because the coronavirus spreads so easily and quickly, this puts all countries in danger. As we contemplate the ramifications of this, we first think of countries that have some experience with virus pandemics such as those located within Asia, which has experienced the highest number of responses.

When we consider other countries that have been slower to respond initially, such as parts of Europe and North America, we must recognize that they have more considerable financial resources to help tackle both the health and economic problems. Specifically, these countries have well-developed hospital infrastructure, and although there is still the threat of system overload, least they have the infrastructure in place.

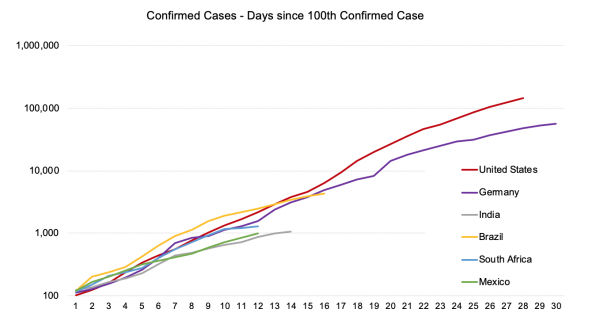

As we talk about this virus spreading to more emerging markets, I think this creates additional concerns for these already fragile economies. How are they going to be able to handle the spread of the virus in their markets? At the time of writing this, the number of cases across the southern hemisphere is minor; we know where they’re headed. We’ve watched China, United States, Germany, Italy, and other countries go through an exponential curve starting at a low number of cases. That’s the trend you can expect for these emerging markets.

For illustrative purposes, let’s consider the United States and Germany as leading indicators of countries that have recently crossed into the threshold of rapidly increasing coronavirus cases. India, Brazil, South Africa, and Mexico, for example, all saw their pandemic start later than the United States did, to the tune of about two or three weeks. These countries are following a similar trajectory when you look at the number of days from the first day that they had more than 100 cases. This means that if they continue to move on that similar trajectory, their economies are going to face the increasing need for social distancing, shutdowns of nonessential businesses, and robust government response to keep their economies from plunging into a downturn.

Unfortunately, these interventions have several challenges in developing nations, which might not have the ready infrastructure or quick responding government needed in a case like this. Many businesses and many of our customers operate on an international scale and had hopes that this economic crisis would be contained in the Northern Hemisphere alone. Even so, the crisis will make for a global recession all on its own regardless of the impact on South American countries or India.

Now that more countries are exposed to the health crisis, not only are there more lives are at stake, but there’s also growing risk to the global economy. The compounding effect makes the severity and magnitude of the downturn challenging to predict for any individual country based on their response to the local health conditions.

In terms of economic risk, there’s an elevated risk in all developing nations. For the most part, we are expecting a global recession that involves most countries seeing a year-over-year decline. They will have their own health crisis on top of the reduction in global trade, further accelerating some of that weakness.

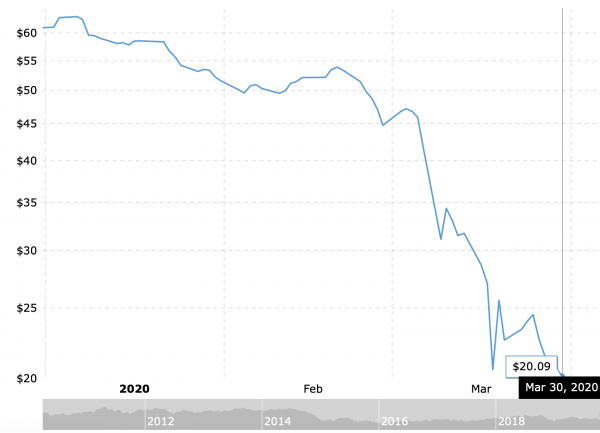

When we look back to the origins of the pandemic, it began to spin off as a severe financial crisis when the price of oil started to plunge, going from $60 trading at the beginning of the year down to around $20 that it is trading at today. The plunging oil price has already impacted numerous countries around the world who depend on oil and natural gas and commodities to fund their government. And when you see oil crash as it has, there are severe negative economic ramifications for many countries, particularly many Emerging Markets who depend on those natural resources for a large share of their economic growth.

Not only have we seen the negative ramifications from the inability to drill and export, but the production of substitute goods such as Brazil’s corn crops for ethanol is now less attractive given the lower prices of oil.

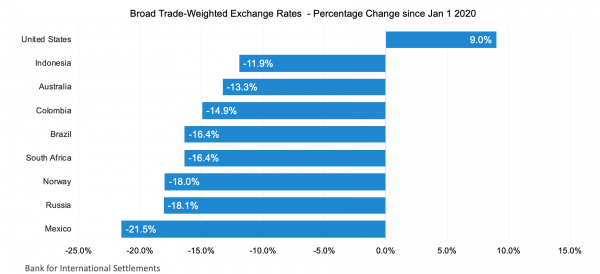

What we also expect during any global recession is the traditional flight to safety through normal traded currencies shifting towards the most significant traded currencies around the world. This brings the focus to the US dollar as well as the Japanese yen and the euro. What we’ve seen is that many countries have faced an enormous financial crisis in terms of their exchange rates. This is apparent from the change in broad trade-weighted exchange rates for different countries from January 1st until today.

When you look at the United States currency compared to a basket of currencies around the world, it has improved 9%, which helps mitigate inflationary pressures. Further, this helps stabilize trade in the United States and keep its economy buoyant. However, there are ramifications on the other end for these currencies that have shown severe weakness, not only against the dollar but also against the euro and other trading partners in their currencies. We can see that many countries are facing crisis-type levels with double-digit declines in their currency since the beginning of the year.

What we’re really facing is that many economies are going to struggle on multiple complex levels from a jobs and economic opportunity standpoint, with a weakened currency, lower commodity prices, and enervated trading partners to the extent that they rely on manufacturing exports to keep their current account balances in check.

On top of this, there’s the health crisis as these countries move through that phase where the virus was somebody else’s problem to being their problem. They are forced to make hard decisions. Do we shut down businesses? Do we shut down schools? How do we reduce normal economic and social activity so that people don’t get sick?

Acting on the realization of the health crisis exacerbates an already fragile economic situation with consideration to declines in currency valuations as well as commodity prices. The nature of this outlook as a whole is truly global. It’s a potential global recession, that will present challenging circumstances for many countries as we look to the months ahead.

***

In the wake of the COVID-19 pandemic, it is now more important than ever to have access to trusted data and expert economic analysis to help guide strategic decision making and business planning.

In the wake of the COVID-19 pandemic, it is now more important than ever to have access to trusted data and expert economic analysis to help guide strategic decision making and business planning.

To meet this need, Prevedere is unveiling its Economic Outlook Weekly report, with a complimentary package focused on COVID-19. There is no charge for access to leading indicators as they matter updated weekly.

Complimentary COVID-19 Economic Outlook Weekly includes:

- Macro view of COVID-19 global economic impact

- Key leading indicators to watch

- Regular economist presentations offered as information becomes available

- Weekly updates sent to your inbox

Click here to learn more.

***

About Andrew Duguay – Chief Economist Prevedere, Inc.

Mr. Duguay is a Chief Economist for Prevedere, a predictive analytics company that helps provides business leaders a real-time insight into their company’s future performance. Prior to his role at Prevedere, Andrew was a Senior Economist at ITR Economics. Andrew’s commentary and expertise have been featured in NPR, Reuters, and other publications. Andrew has an MBA and a degree in Economics. He has received a Certificate in Professional Forecasting from the Institute for Business Forecasting and Certificates in Economic Measurement, Applied Econometrics, and Time-Series Analysis and Forecasting from the National Association for Business Economics.

Mr. Duguay is a Chief Economist for Prevedere, a predictive analytics company that helps provides business leaders a real-time insight into their company’s future performance. Prior to his role at Prevedere, Andrew was a Senior Economist at ITR Economics. Andrew’s commentary and expertise have been featured in NPR, Reuters, and other publications. Andrew has an MBA and a degree in Economics. He has received a Certificate in Professional Forecasting from the Institute for Business Forecasting and Certificates in Economic Measurement, Applied Econometrics, and Time-Series Analysis and Forecasting from the National Association for Business Economics.