Last Updated: February 10, 2021

Data updated 11/11/2020

Results from the U.S. elections have significant implications for the economy in the future. As the 2020 election season has come to a close, it’s interesting to look at how the results may impact consumers and the future economy. This blog looks at how an election may affect consumer confidence, minimum wage, and stimulus policy, and in turn the U.S. economy as a whole.

Consumer Sentiment

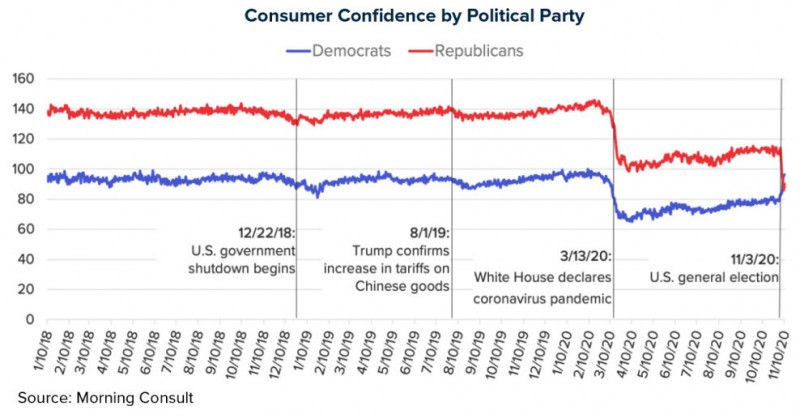

The consumer confidence partisan gap has widened noticeably over the last two decades and has continued to widen following the presidential election in 2016.

Historically, consumer confidence shifts after an election. This election was no different, and of no real surprise, Republican consumer confidence went down, and Democratic consumer confidence went up after the election results. Overall, this has resulted in consumer confidence moving slightly down because the negative impact on the Republican consumer confidence was stronger than the positive effect on the Democrat consumer confidence.

However, we are not sure of how much this alone will translate into weaker Retail Sales. Sentiment and Spending have been moving in unrelated directions all year long, as COVID-19 has caused panic-induced stock ups (sentiment down and spending up), and created large shifts in the ways consumers spend in a socially distanced environment (some retail up and some down regardless of sentiment). In any normal year, you might conclude that Retail is going to swing on the whim of election-related Sentiment shifts, but this is no normal year and we have seen larger shifts this year due to the pandemic, and fully expect that locally administered government-mandated restrictions and general virus-related fear, or optimism over a vaccine, will continue to be much bigger influences on shopping habits than people’s satisfaction or perceived economic future given the election results.

Policy Changes

From a business impact standpoint, by far the most important thing to come out of elections are policy changes.

Minimum Wage

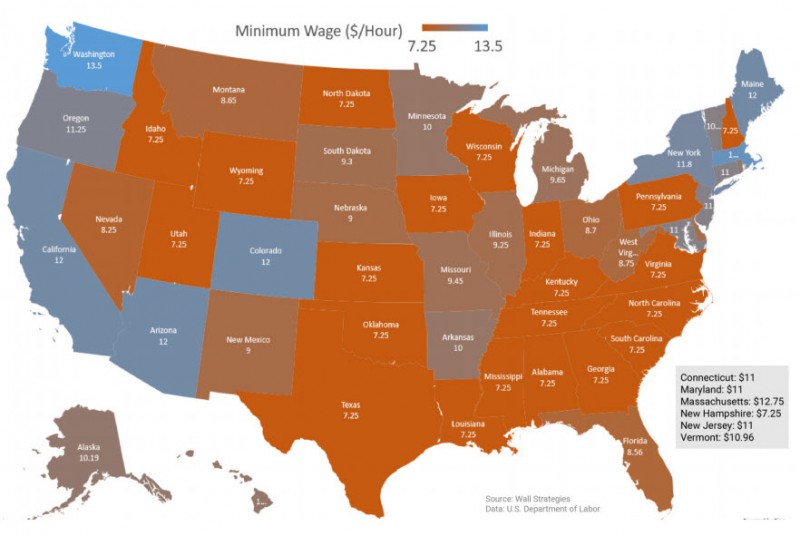

A national minimum wage has been in the news for a while and is a policy proposal of increasing importance over the last few years. Moving forward, a split government at the federal level between the executive branch and the legislative branch likely takes a $15 per hour minimum wage off the table, at least in the very near term.

However, there are few places, especially weighted by the U.S. population, that rely on the federal minimum wage anymore. There is a large portion of the population where state laws are above the federal minimum and others with cities or counties where the minimum is higher. This map is a good reminder of where the federal minimum is enforced, which is represented by the orange states. The brightest of blues are the states where the state minimum wages are the highest.

The effects of minimum wage increase

From an economic standpoint, discussing a minimum wage is not that big of a deal from a macroeconomic perspective because very few people actually earn the federal minimum wage. Only 2% of all hours worked in America is paid at the federal minimum wage. However, whenever you’re talking about raising a significant amount, that can also mean increases for those not making the minimum—for instance, take Florida as an example. Results from this past election day include a constitutional amendment that now sets the state minimum wage to $15 an hour. It will increase gradually to reach that point. Currently, it’s at $8.56 an hour and it will grow around a dollar per year to reach $15 an hour by 2026.

This is very similar to what the Democratic plan proposed and passed a bill last year by the House at the federal level. It gives us another case that we can study to see what happens and what the effects are. The economic profession is very unsettled here for a couple of reasons. Number one is because it’s challenging to track the dynamic impact of a minimum wage increase. Clearly, if you are a minimum wage worker and the wage rises, this would benefit you. However, we know that when businesses are forced to pay more for labor, they will actually find other ways to conserve spending, such as reduced hiring or raises.

Therefore, you have to look at job cuts and employment cuts as well. We have seen from research in places where these minimum wage increases have happened before that it is not

easy to measure the effects. It’s also challenging to understand what would happen with such a massive increase.

Some businesses can shift workers and store locations across borders and it’s challenging to measure whether job losses or other changes resulted from the minimum wage or other

factors going on. Furthermore, as businesses increase costs, minimum wage workers with increased income may have to pay high prices. It’s a complex policy to study, and unfortunately, the economic profession is very unsettled on what the net effect is to overall consumers in this regard.

There is an impact on businesses with a higher minimum wage, as costs will increase. Businesses will likely look to other cost savings initiatives, such as labor replacing technology. If there is a large increase in the minimum wage, some manufacturers will be better positioned to utilize new labor-saving technologies. The service sector, however, might find this more difficult, and may instead have to rely on increasing prices or slashing services. Similar to a company’s ability to raise prices to compensate for cost increases, there are other

factors that make a difference in the policy’s universality. So, if the increased minimum wage policy goes into effect at the federal level, there’s nowhere to run and hide from it. Companies are not going to be able to shift things across city lines or state borders. At that point, everybody will be paying the same, so it’s going to be a different ball game.

The minimum wage is a hot topic now and it will continue to be one moving forward, even if a $15 national minimum wage does not happen right away.

Stimulus Package

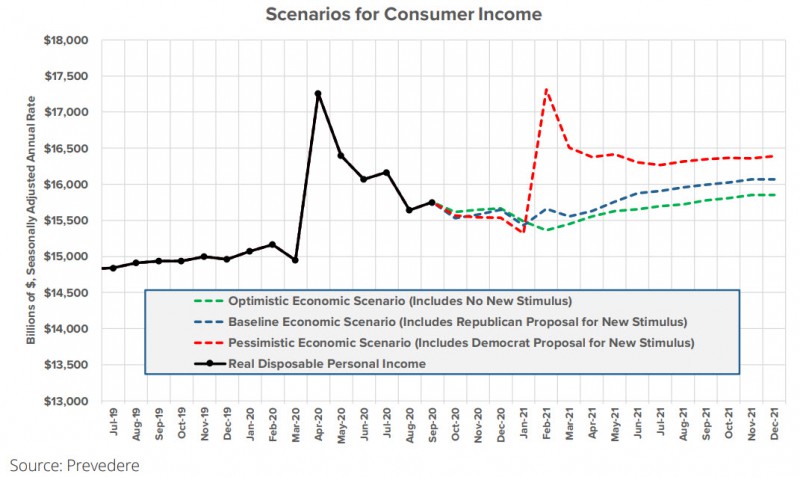

One of the most urgent implications of this election is going to be what happens with the federal stimulus and any new stimulus type. This was already under negotiation this year before the election and ultimately didn’t come to pass. Heading into 2021, what happens with consumer stimulus is going to be important. We saw this drive consumer health way higher than expected during this time in 2020.

In late 2019 during a typical expansion, real disposable personal income, which is income that consumers have after taxes and price changes, was rising very slowly and steadily. Then, all of a sudden, you can see the dynamic changes happening in March 2020. It starts to wobble, and then suddenly, in April, the stimulus pays out in the form of checks straight to consumers, and then beyond that enhanced unemployment benefits.

This has been one of the significant stories of 2020. This is unlike the magnitude of anything seen over the last number of recessions–that impact from the stimulus would outweigh losses in wages and salaries from employment. What happens to this moving forward is crucial, particularly to businesses and industries that are consumer-facing, but really to everyone.

The chart above illustrates three different ways that this can play out. At Prevedere, we look at this from an optimistic, baseline, and a pessimistic economic scenario.

The green line represents the most optimistic of economic scenarios, but it also represents no new stimulus coming from the federal government straight to consumers (the scenario plays out that if the economy is in a solid recovery, there is no perceived need for new stimulus checks to be doled out). This means that as the effects of this stimulus wear off heading into the next year, but the income from wages and salaries would be there to pick this up and continue growing at a slow and steady pace.

The baseline scenario (blue line) means that employment, wages, and salaries would be a little bit lower than an optimistic scenario, but there would be another round of stimulus that would begin paying out in February of next year. Of course, we don’t know exactly when; that’s just an educated guess. This is meant to track something similar to the most recent Republican proposal. This represents little-to-no new cash payments, but rather an extension of enhanced unemployment benefits to some degree. This would help power consumers through 2021, at least at an elevated level.

The red line is a pessimistic scenario in which there is another round of cash payments and a much higher level of enhanced unemployment benefits, but the economy itself is severely weakened and the recession gets more severe. It would result in something more similar to what we saw during the first half of 2020, but this scenario seems less likely at this point.

Conclusion

What happens regarding the stimulus will be the most impactful thing to come out of the election and the new government in early 2021. It was certainly a major impact to the business community, and especially consumers, throughout 2020 and we think it will strongly impact the shape and trajectory of the economic recovery over the next two years.

Beyond the stimulus, the federal minimum wage, or maybe regional or local minimum wages, is an interesting policy to track. However, we are uncertain how much or how quickly Federal action will be at this point concerning any new business-disrupting minimum wage laws.

While Consumer Confidence around elections is also interesting to follow immediately after an election, companies need to be very careful using it to project sales because it does swing and there’s not much evidence that it changes consumer behavior as strongly as it moves after an election. We also know that consumer sentiment is being overridden by a pandemic during this election cycle, likely leading to a different overall relationship between sentiment and spending than in past election cycles.

Navigate What’s Next with Economic Scenario Planning

The COVID-19 crisis has given rise to a world of economic uncertainty, with uneven effects across regions and industries. As we head into the 2021 planning cycle, every business wants to know how the pandemic will impact next year’s numbers.

Prevedere’s Economic Scenario Planning solution helps companies navigate these tumultuous times. The solution projects future business outcomes for three plausible macroeconomic scenarios under COVID-19. Companies can use these insights to sharpen 2021 forecasts and plans, improve shareholder guidance, and stay on top of the pandemic’s evolving impact.