Last Updated: February 10, 2021

Data updated: August 13, 2020

This report, “From Health Restrictions to Economic Restrictions,” is the third in a series presented by Prevedere and Nielsen on the changing consumer as a result of COVID-19. Insights provided by Andrew Duguay, Prevedere Chief Economist, and special guest Nicole Collida, Nielsen SVP & U.S. Brand Effectiveness Lead.

U.S. economic recovery will largely hinge on the health crisis management because the health crisis necessitated the financial crisis, and the two are intangibly tied. Recovery depends on whether consumers feel healthy or safe, and that has been challenging thus far, with so much uncertainty on people’s minds.

There has been much discussion on how to boost the economy when the first wave of COVID-19 hit consumers hard—now facing a second wave more significant than the first. Even though the number of new cases appears to be decreasing, it’s still more elevated than during the April/May peak.

Compared to earlier in the year, there is a more balanced approach, which is the theme for the second half of the year; companies adjusting to this new world, whereas early in the pandemic, strategies pointed to how to deal with this anomaly temporarily. It’s about adapting to a new reality with a consumer likely to be changed permanently in different ways. The length and depth of this crisis are going to be impactful.

There is a large hole to dig out of with U.S jobless claims in the U.S. still above 1 million new applications every week, and that is a staggeringly high number. (For context, the last recession, The Great Recession, never had claims higher than 700,000 in a given week.) Jobless claims are indicative of an economy that is very vulnerable and also very dependent on stimulus measures.

Stimulus measures taken by the federal government to date came with expiration dates, leaving the country in limbo with the temporary extension of some benefits at slightly reduced rates for unemployment payments. With Congress still battling out specifics on longer-term aid, consumer behavior hangs in the balance.

With the Executive Order, although those on unemployment will receive less, the good news is that it didn’t plummet from $600 to $0. The bad news is that leaving decisions such as to the last minute doesn’t boost consumer confidence and willingness to spend.

Does Stimulus Matter?

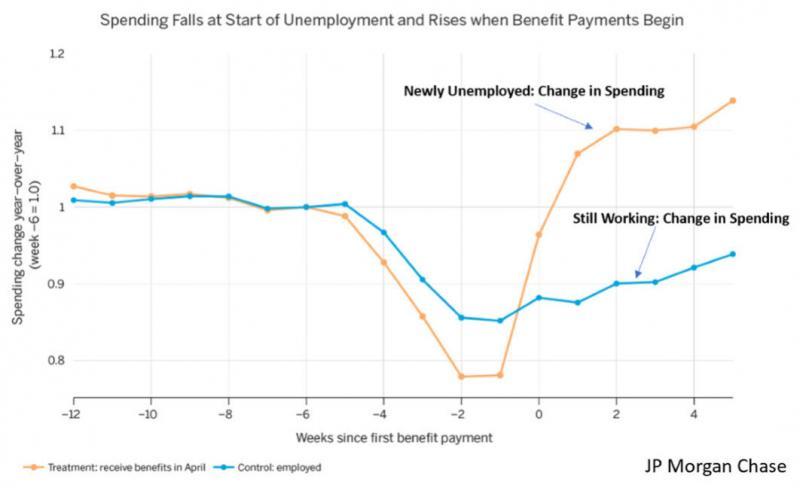

Given the current situation, enacting additional stimulus will have a significant impact on the U.S. economy. A recent study by JPMorgan Chase compared a group of people who have lost their jobs since COVID-19 and are collecting unemployment payments to another group with no employment status changes. They found that consumers with no changes in employment status on average were spending roughly 10% less than pre-crisis levels. This is natural during a recession because people move more conservatively.

Interestingly, the group who lost their job and had incomes replaced by supplemental unemployment payouts increased their spending by about 10%. The economic reality is that many retailers depend on extra unemployment payouts to go to unemployed people because they are spending it. This is true not only for consumer staples but also for other areas of the economy as well.

There have been shifts in spending habits, such as people spending less at restaurants and more in grocery stores. But there have also been shifts in the volumes that people are spending. And sometimes, changes are in very unorthodox or unassumed ways, such as this phenomenon over the last few months in which the aggressive stimulus turned into increased spending amongst many Americans.

The other thing to consider when planning the second half of the year and into 2021 is that economies don’t exit recessions the same way they enter. In this instance, geography and industry will dictate recovery. Micro-recessions and micro-recoveries and are going to be very pronounced in this economic cycle versus other traditional recessions. Traditionally, when the economy moves into recession, almost every industry also moves into recession. Usually, the share of wallet decreases collectively, and that’s the definition of recession rate contraction. In this instance, many industries are growing because they are increasing their wallet share, as is the case for many different geographies.

Recovery Varies Across Industries and States

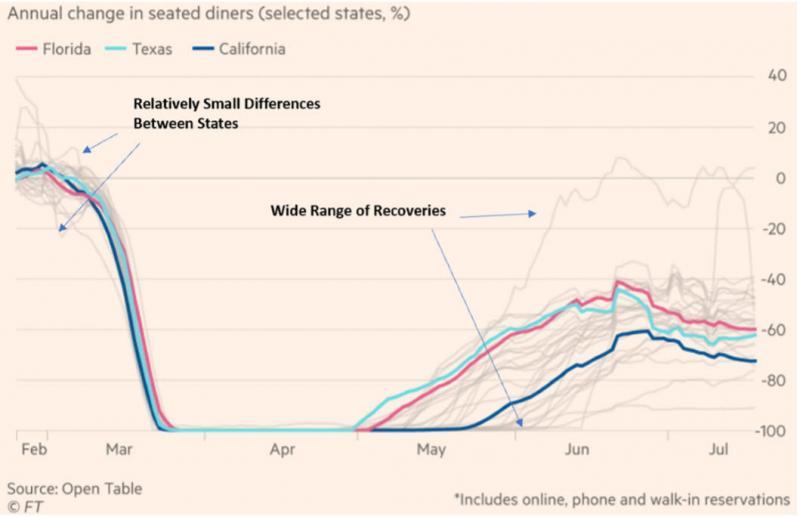

Across the country and before COVID, there was relatively balanced and stable growth in the restaurant sector. Then the pandemic induced a complete shutdown of everything, which lent itself to a very narrow range of differences between states. But looking at May, June, and July, it became about state policy (restaurants being open) and people’s comfort level (actually going out to eat).

Therefore there is a wide range of performance across different states. There have never been wider gaps in state performance than at any time in the last 50 years.

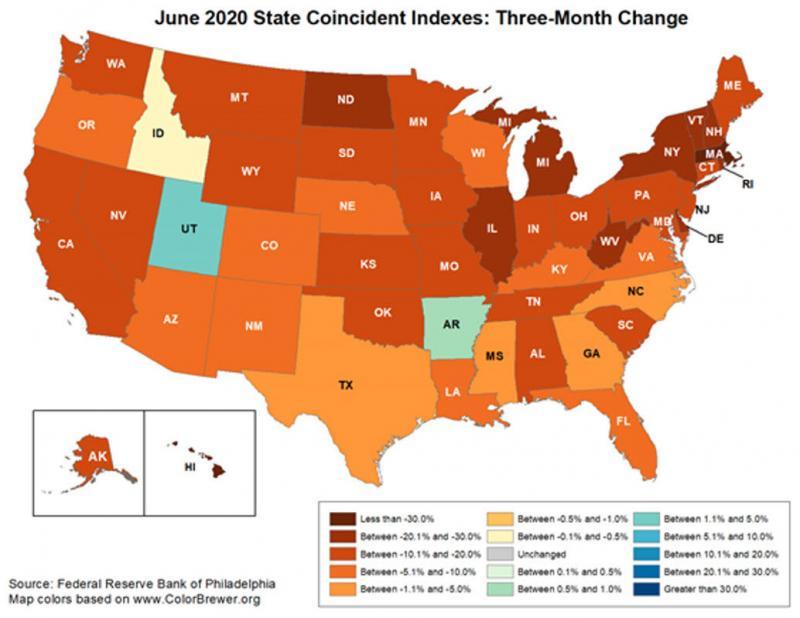

A good indicator to watch is the State Coincident Index, provided by the Philadelphia Federal Reserve. It reflects state-level GDPs and tracks wages, hours, and unemployment. It shows that changes happening on a state by state basis are vastly different. While most are contracting, the rate of contraction varies quite wildly.

This has to do with different factors, one being the number of COVID cases and how the state responds to those COVID cases. Some states that have fewer closures and restrictions might have more coronavirus cases, but their economies might have been less restricted.

Housing costs and density are also other things to consider. For consumers who have lost their job and live in a high-cost area, the timeline is much shorter to a State crisis than in more rural areas that are more affordable. Other states that have a reliance on tourism, also face a very negative impact.

Other industries, such as oil and gas, have also been impacted. North Dakota, which is typically isolated in recessions, has been dramatically affected by its high exposure to the oil, shale, and gas industry.

Another aspect to consider in targeting different geographies is how healthy state government budgets are. That can vary wildly from state to state, depending on how conservative they were over the last ten years of economic growth.

Every state is feeling some financial crisis right now; most states have to balance their budgets, unlike our federal government. The unprecedented levels of crisis are having huge impacts on state government budgets.

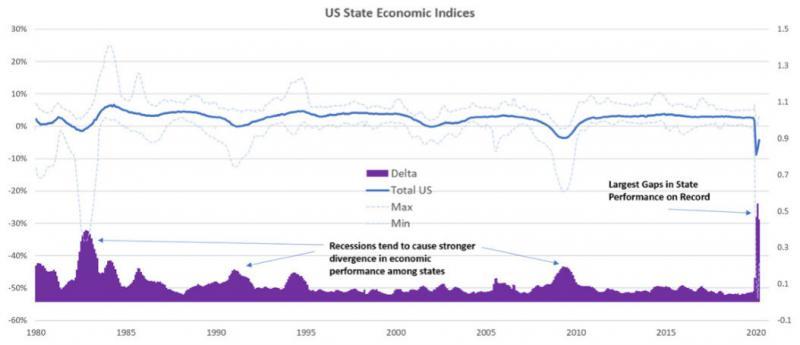

Another thing to factor in when considering which states are going to emerge from this quicker than other states is the various levels of performance on a state by state basis. A good example is looking at state economic indexes combined to get a total U.S. index.

Charted in the chart above is the maximum, or the best-performing state, in the light blue range and then below that is the worst performing state. Typically during recessions, you see the most significant divergence between state performance, the good and the bad.

Economic growth tends to make most states very similar to each other and their local economies, but recessions tend to highlight the differences. In looking at previous recessions, there have never been divergencies as strong as there is today. This means that local economics does matter in this crisis, which impacts how consumers act and behave.

Resulting consumer behaviors can be very different on a state by state or even city by city level, depending on some of the various factors.

Consumer Confidence Plummets

Initially, consumers responded to the pandemic with health restrictions in mind. Their behavior was intricately linked to their health and safety. Now, with the recessionary impacts coming to the forefront, it’s expected that consumer behavior will shift yet again.

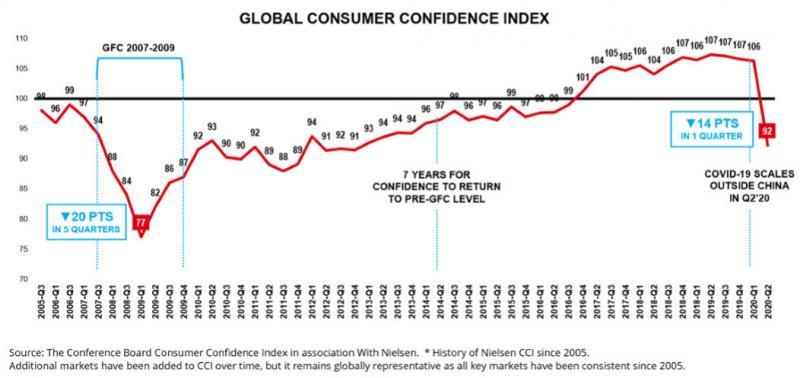

Over the second quarter of 2020, we saw the sharpest plunge in the Consumer Confidence Index (CCI) in 15 years. The U.S. plunged by 14 points in total consumer confidence for Q2 2020. When you look back to 2008 and 2009, the CCI dropped by 20 points, but over five quarters. It fell to a low of 77, and that took seven years for the U.S. to recover. There was a slow decline in 2009, taking seven years of recovery. The U.S. just experienced the most significant single drop in history over the past quarter. So it’s difficult to tell what the potential timeline for improvement will be and how long this sharp decline will take to gain back.

Decline in the CCI is underpinned most notably this quarter by job concerns. North America benefited from a higher CCI overall to start, but it dropped by 19 points over the last quarter. The percent of survey respondents who consider the job market favorable was the biggest driver of that. North America experienced the most extensive single decline in job prospect favorability, more so than anyone else in the globe, making it the single most significant global reduction.

Health Concerns, Restricted Living Forced Initial Behavior Shifts

Early in the pandemic, key trends emerge related to health such as pantry loading on staples, a surge in DIY beauty, and stockpiling items like hand sanitizers, or at-home cold remedies.

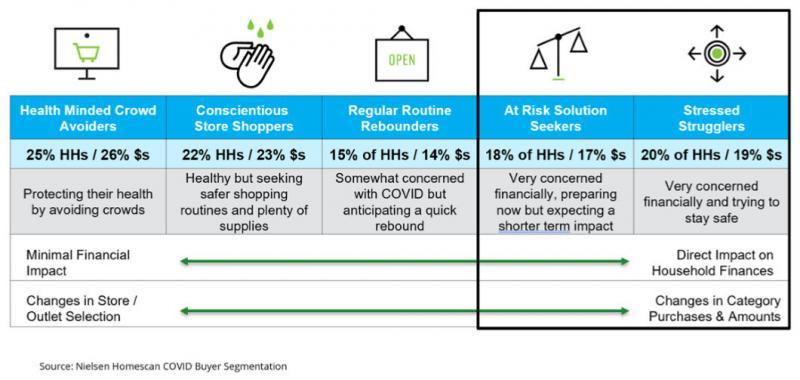

These stimulus acts are either coming to an end, or uncertain, and under temporary extensions. Further job losses are looming, and businesses have to think about how to staff for their sustainability. Although one-fourth of households impacted with financial loss, the scale of impact varies. Nielsen analyzed households and segmented each based on economic impact.

The analysis identified a range of households, including those impacted in an insulated fashion, to those exposed to financial risk as a result of the pandemic. The left side of the graph represents those that have a less economic impact. Health-minded crowd avoiders, or conscientious store shoppers, makes up almost half of the households. They are still operating with health concerns at the forefront. They are changing the way they interact with different stores or the method they select outlets. They are seeking safer routes to a lot of the same behaviors that they’ve previously had.

Those on the right side of this chart are those “at-risk” solution seekers or are stressed strugglers beginning to emerge as a very prominent group of households in the U.S.

These are the households that were most impacted by financial struggle or financial loss and had to shift their behavior most dramatically. As recessionary impacts start to reveal themselves, families are likely to experience continued shifts in action as they are already the most at-risk. They are behaving very differently. They can’t afford the pantry load for their households. So while health is still a concern, they’re often making more trips, albeit smaller, to channels to fulfill their household needs without breaking the budget.

These are the households that stimulus dollars are going to matter most. It is essential to talk a little bit about how stimulus did affect spending. 30% of the households that Nielsen surveyed said that they at least partially funded household goods with stimulus checks.

In looking at these consumers, it’s clear how much the stimulus matters. With these impacted households beginning to spend less, businesses have to prepare for a continued shift in purchasing. As the pandemic spread throughout the U.S., consumers cut their spending in many categories.

As Finances Tighten, Category Spending Will Likely Shift Again

Consumers cut spending in categories like alcohol, cosmetics, produce, other nonalcoholic beverages, early in the pandemic spending, and dramatic drops in volume early on. But as the government introduced stimulus dollars to the market, these categories rebounded, some more than others. For example, alcohol surged at roughly 30% or more growth year-over-year, in some weeks as stimulus flooded the market.

That said, stimulus dollars lead to declines in other areas, including staples like prepared foods, dairy, and pasta. As stimulus dollars flooded the market, those categories tended to tail off in terms of volume. So what does this mean for now? With stimulus running dry and job loss looming, the groups that initially benefited from early pandemic behavior will have notable tailwinds.

Categories, like frozen pizza, will see tailwinds as the U.S. moves from a health-minded impact into an economic or recessionary-minded impact. Categories that benefited from stimulus dollars flooding the market are those that are now likely to face headwinds. Consumers are making tough choices about how they spend the limited dollars they have for their households. Channel preference is also expected to shift as consumers make these difficult decisions. There were significant increases early in the pandemic in grocery for one-stop shopping and in e-commerce for ease of shopping and regarding health and safety concerns.

Channel Preference Also Likely to Shift

It’s essential to understand channel shifting in today’s world as consumers prioritize economics rather than just health. There will likely be continued declines in areas like drugstores and new declines in areas like the club channel. safer routes to a lot of the same behaviors that they’ve previously had.

Drugstores will likely still be a result of health and wellness concerns and fewer small trips. Consumers making fewer trips will drive a drop in warehouse clubs. They will probably be impacted by less stock up trips and less disposable income for many of these households.

The value channel was flat previously, and an economic shift will bring many share gains to that channel, as consumers focus on price and look to the value channel to meet most of those needs.

Grocery and e-commerce channels will continue to maintain their strength. While the basket makeup may change in these channels, they’ll remain strong as consumers have shifted their habits, and that new normal concerning those channel preferences is here to stay. Consumers are prepping for a recession.

Attitudes Align to Great Recession Tactics to Save Money

In July, Nielsen surveyed consumers and asked them about the impact that COVID had on their lives and their financial outcomes. They also asked them to name the top five actions they would take if this economic situation continues to worsen. Many behaviors arose that were similar to those that emerged during the Great Recession in 2008 and 2009. They look similar such as consumers will be cooking at home. Despite less money, consumers also state that they plan to pantry loads and look for bulk buying.

Lower prices will continue to be essential for consumers. And that means providing price reductions and promotions will be increasingly important as well, to drive traffic and help consumers make decisions about the brands that they’re purchasing, both retailers and manufacturers are going to have to think about promotional strategy.

Looking Forward

Consumers are going to prioritize in-home spending. They are not only going to cut back on out of home discretionary spending because of health and safety concerns but also on discretionary dollars, simply because there isn’t as much to go around as financial pressures continue to emerge.

Consumers are going to be more risk-averse. They’re going to be looking for those assurances that they’re making the right decisions. They want to be able to match their needs to the value they can derive from the money they spend as they make these difficult choices.

It’s never been more critical for brands and retailers to understand what drives consumer purchase behavior. What are the decisions consumers are making before they even get to their online or physical shelf? And how any product or service will deliver value and quality, and give consumers peace of mind through efficacy.

It’s clear that with limited dollars, there will be little space for second chances as brands and retailers engage with consumers. It is vital to understand consumers and to segment them based on their behavior.

But at the end of the day, segmentation is only as useful as the activation strategy that you put behind it. Ensuring that the approach aligns with consumer groups is going to be critical to long-term success.

Complimentary COVID-19 Economic Outlook Weekly

In the wake of the COVID-19 pandemic, it is now more important than ever to have access to trusted data and expert economic analysis to help guide strategic decision making and business planning. To meet this need, Prevedere is unveiling its Economic Outlook Weekly report, with a complimentary package focused on COVID-19.

There is no charge for access to leading indicators as they matter updated weekly.

Complimentary COVID-19 Economic Outlook Weekly includes:

• Macro view of COVID-19 global economic impact

• Key leading indicators to watch

• Regular economist presentations offered as information becomes available

• Weekly updates sent to your inbox