Last Updated: February 10, 2021

By Danielle Marceau, Senior Economist

Data updated 10/14/2020

This report details the lasting impact that COVID-19 has already had on small businesses and potentially will have in the future. Many past economic updates have focused on the consumer, the labor market, and their ability to spend. However, this report will take a more in-depth look at what drives the significant shifts in the lackluster labor market. In particular, this update focuses on some of the small business trends that are developing due to the pandemic.

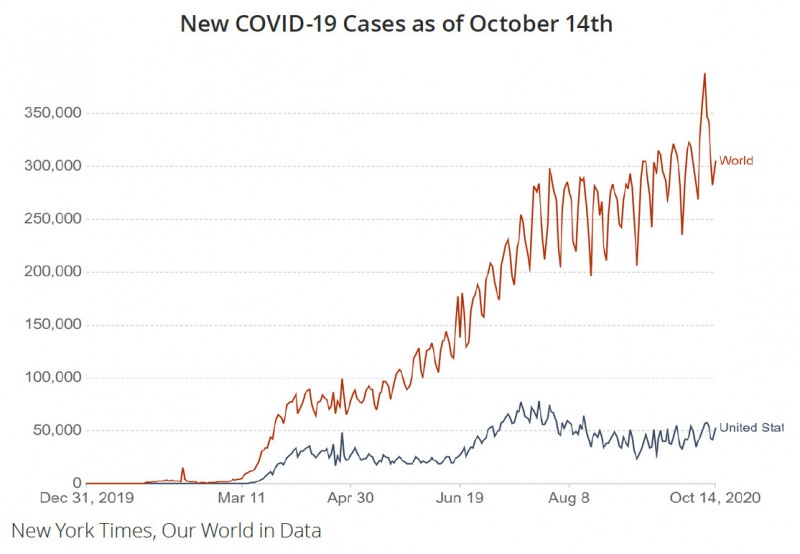

In the context of the pandemic, we have once again started to see a general increase in the number of new cases globally. Cases of COVID-19 were stalling out late this summer, but we have seen a rise in the number of new cases again in recent weeks. Specifically, there is truly a third wave currently underway in the United States, and new cases are on the rise in the majority of the states. This third wave is adding significant headwinds for economic growth as we head into 2021. The longer that this pandemic continues, and the longer it takes for us to reign in the number of new cases and open up the economy again, it’s likely that the recession will be that much deeper and take that much longer to recover.

Permanent Business Closures Continue to Increase

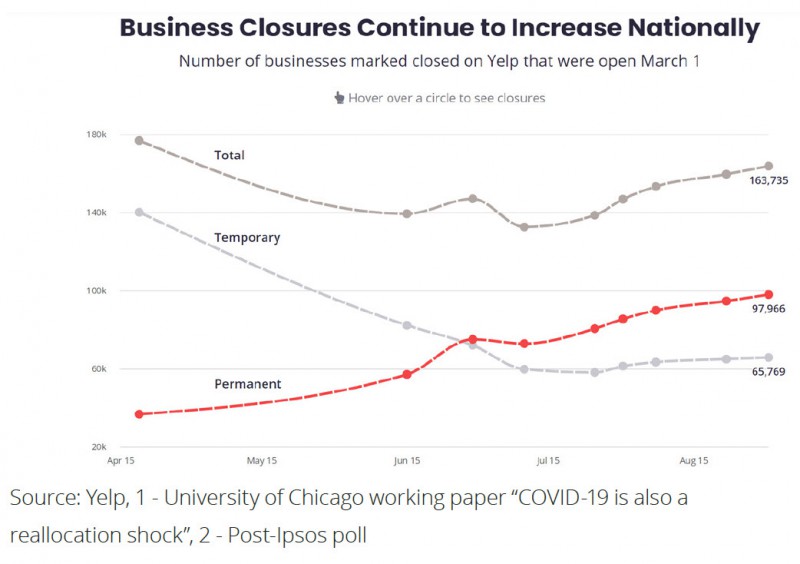

Shifting the focus to some of the specific effects of COVID-19 on small businesses, data from the Yelp Economic Impact Report had some interesting findings on business closures.

Third-quarter data shows that total business closures have started to increase again. In the chart above, the top line is of all businesses on Yelp marked as closed versus the number of open businesses on March 1st of this year. According to Yelp, we were beginning to see a decline in the number of closed companies, but starting around July, the number of closures began to eek up again.

The bigger and more concerning implication here is that there are more permanent business closures since the beginning of the pandemic than there are temporary business closures, as indicated by the red line and the gray line in the chart above. Those lines converged in July, and currently, of the 163,000 businesses that were closed at the end of the third quarter compared to March 1st of this year, almost 98,000 of them are permanently closed.

These are some of the significant impacts of COVID-19 on businesses rippling their way through the labor market. Previous economic updates talked about the labor market and the structural shifts happening. The most recent report showed that temporary layoffs and permanent layoffs are converging, and there is no longer a higher number of temporary layoffs. Many of those temporary layoffs have now converted to permanent, and a good portion of this is because of this trend of businesses that have permanently shut their doors, causing some jobs to be permanently lost.

Specifically, this data suggests that the COVID-19 pandemic is shifting from a major short-term economic shock to a more widespread event with lasting economic impact. Ultimately, it will result in a long recovery ahead that is likely to be very slow as we continue to see these significant structural shifts.

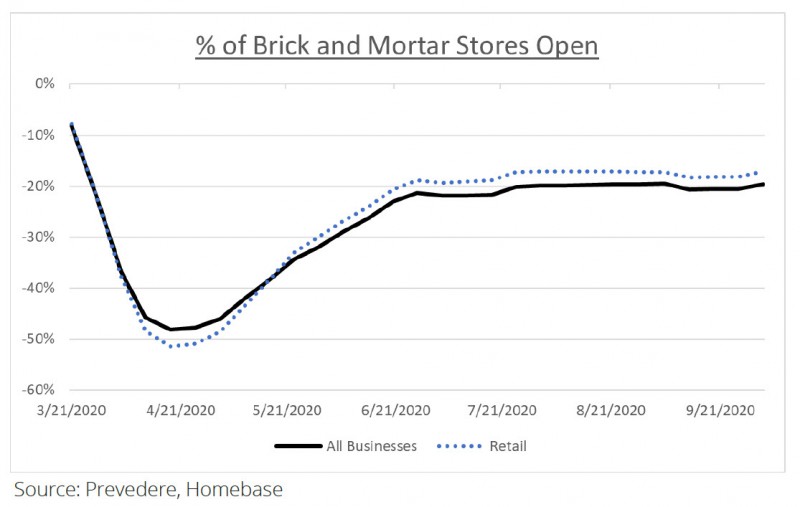

Brick & Mortar Stores Close

Focusing on retail stores, specifically, those businesses with a brick and mortar front, provides a second source to confirm the data coming from the Yelp Economic Impact Report. The chart above shows an index of brick and mortar stores open with respect to a pre-COVID baseline. The percent of brick and mortar stores currently open is negative, indicating a lower percentage of stores open now than before COVID-19. The dotted blue line is specific to retail stores, whereas the solid black line includes all businesses with a brick and mortar front. As the chart indicates, there was a robust increase in May, June, and early summer as the economy started to open up again.

Over the last quarter, however, all businesses’ black line has stalled out and is hovering around the 20% mark. There could be some brick and mortar stores that are staying closed until the virus subsides, but they would have to be strong financially to weather this for this long. This could be a potential indication that the 20% mark might be the number of permanent store closures directly related to COVID-19. Initial analysis suggests that this 20% drop in the number of businesses open compared to before the pandemic could be more signs of that permanent shock that we will continue to see long term.

Six months into the pandemic, this 20% decrease in open businesses indicates that many jobs will not be there anymore or at least will not be there until this pandemic subsides. The third wave happening right now tells us that COVID-19 is not likely to subside any time soon.

From two different data sources, these two charts confirm that the temporary loss of jobs that we had expected at the beginning of the pandemic to be brief is shifting into permanent job losses.

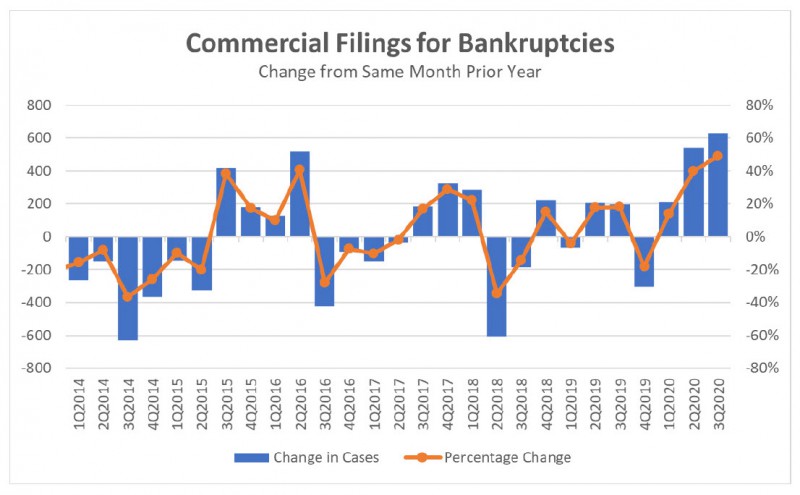

Commercial Bankruptcies on the Rise

Some of the data of commercial filings for bankruptcies is also supporting these impacts from COVID-19. The number of commercial businesses filing for bankruptcy was up 48.9% in the third quarter of 2020 versus the third quarter of 2019. Most of these are small businesses that do not have much access to capital. In September, the number of bankruptcies accelerated and was up about 78.7% compared to last year. With the Paycheck Protection Program running out for many businesses in September, we expect to see a little more in these bankruptcies. This third data point is again suggesting a permanent loss in jobs.

For many retailers, this has started to accelerate a trend that was already underway because of shifting consumer preferences around retail. These charts show the data more on the business side concerning the labor market and permanent job losses, but it is also essential to think about what this means for other businesses. There is a whole side of the economy that is not directly related to consumer spending and consumer demand. If there’s a lower number of small businesses, we can expect B2B companies that depend upon other corporations’ demand to take a hit. These effects of COVID-19 are going to hit both sides of businesses and the labor market as well.

These are the key reasons why we see this recession continuing to be long and drawn out. By the end of 2021, we still do not expect the economy to be fully recovered from the COVID-19 pandemic.

Entrepreneurial Spirit Alive and Well

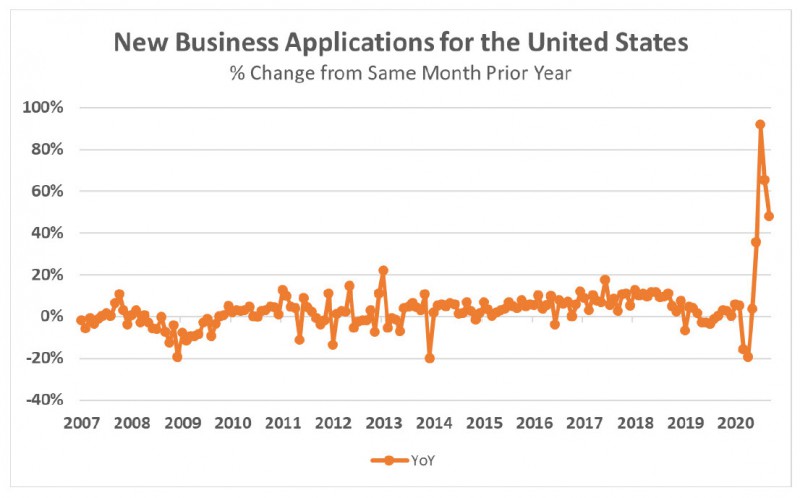

On a more positive note, while there are job losses from corporations and businesses, the American consumer is out there, and the entrepreneurial spirit is alive and well. Interestingly, new business applications in the United States have skyrocketed, which is unprecedented. Even coming out of the past recession, there was no same spike year over year in the number of new business applications. American workers are looking for other ways to earn a living rather than just their traditional jobs.

This something to keep a pulse on moving forward. How does this have the potential to disrupt economic recovery? How will this be different from past economic recoveries as consumers are out there creating their own jobs by creating their own businesses, innovating, and providing products and services that were not really in demand pre-pandemic?

Without stay-at-home orders or other regulations, there was not the same level of demand for the same type of products. It will be a shift in the market for businesses and about understanding what types of companies are in demand and how Americans are striving to meet those business needs.

Conclusion

The data clearly says that this health pandemic’s negative impact is not a quick shock with an immediate rebound. From an economic perspective, these impacts are going to last at least through 2021. We are facing some headwinds with a long road to recovery. Businesses are closing their doors. Many of them are shutting down at an accelerating pace, especially as the initial stimulus and government support start to subside.

The COVID-19 impact on small businesses will impact our potential for economic growth during the next four to six quarters.

Navigate What’s Next with Economic Scenario Planning

The COVID-19 crisis has given rise to a world of economic uncertainty, with uneven effects across regions and industries. As we head into the 2021 planning cycle, every business wants to know How will the pandemic impact next year’s numbers?

Prevedere’s Economic Scenario Planning solution helps companies navigate these tumultuous times. The solution projects future business outcomes for three plausible macroeconomic scenarios under COVID-19. Companies can use these insights to sharpen 2021 forecasts and plans, improve shareholder guidance, and stay on top of the pandemic’s evolving impact.