Last Updated: October 1, 2024

Businesses are transforming their analytics, planning and forecasting strategies by integrating external factors. Macroeconomic indicators, such as GDP growth, inflation, interest rates, along with industry-specific trends, customer sentiment, provide valuable insights that enhance decision-making, improve forecast accuracy, and will as an early warning system – constantly watching and alerting the business as the external environment changes.

However, identifying and integrating the most relevant, impactful and leading external data into your analytics and planning processes can be challenging.

At Prevedere, we make it simple and cost-effective for businesses to access and leverage external economic data. Our AI-powered analytics and econometric models improve forecasting precision and inform smarter decisions. Learn more about our Platform here.

Michelle Green, Prevedere’s Chief Economist, outlines the best practices for incorporating external economic indicators into analytics and planning as a foundation for businesses to build resilience and agility in response to changing economic conditions.

Michelle Green, Prevedere’s Chief Economist, outlines the best practices for incorporating external economic indicators into analytics and planning as a foundation for businesses to build resilience and agility in response to changing economic conditions.

The Importance of External Data as Business Drivers

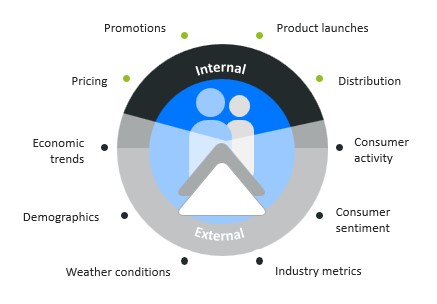

External data – macroeconomic indicators (GDP, inflation rates, and unemployment levels), industry trends, consumer activity and sentiment, demographic, weather and other indicators – capture the powerful forces influencing your business from outside your walls.

Incorporating these indicators into business analytics and planning processes gives you a broader understanding of how external factors shape demand, costs, and overall performance. Armed with this critical information, you’ll make better, more informed decisions that improve business outcomes in both stable and uncertain times.

These external indicators explain past and current performance, and serve as leading drivers for future outcomes. Integrating internal and external data is a critical analytics and planning capability.

Identifying Relevant External Indicators

When planning, it is essential to focus on external indicators that are proven to impact your business. You should:

- Focus on relevant drivers: Identify the macroeconomic and external factors most strongly correlated with your business performance. Historical analysis can reveal these connections.

- Leverage credible sources: Use data from government agencies (e.g., the Bureau of Economic Analysis, Federal Reserve), financial institutions, and industry reports. Many data sources are public and available at zero cost (although it may be challenging to automate integration). Where needed, you should invest in proven data sources to augment and complement public sources for a complete picture of your external environment.

- Benchmark data from industry reports: Benchmarking against industry and market-specific trends helps assess how broader economic conditions influence your performance.

- Embrace and harness multiple approaches: Use external indicators to validate forecasts at a business level and test them against market and industry-level forecasts to validate growth and market-share objectives.

External Data Collection and Management

Accurate, up-to-date data is the foundation of effective forecasting. Businesses must:

- Ensure data accuracy and timeliness: Use reliable, regularly updated external data sources (like Prevedere’s Global Intelligence Cloud), which should issue alerts based on thresholds and directional change.

- Integrate internal and external data: Start with identifying, dashboarding and monitoring the most relevant external indicators, then develop reports than consolidate and blend them with internal key performance indicators.

- Implement data management tools: Utilize tools that collect, centralize and facilitate the consistent and efficient management of large external datasets – expanding easily with new external data related to your next use cases.

Advanced Analytical Models and Forecasting

Modern econometric techniques and AI quantify the relationship between economic factors and business performance. Tools will provide skills (e.g. Generative AI) and capacity (e.g. Predictive AI) to augment your data and analytics team’s capabilities.

By applying these methods, businesses can build more accurate forecasts – standalone external data-driven models, and as inputs to internal forecasts. Best practices include:

- Leveraging Econometric modeling: Use regression analysis, time-series models, and scenario-based forecasting to understand the impact of economic drivers.

- Scenario planning: Develop optimistic, baseline, and pessimistic scenarios to account for a range of economic possibilities.

- Machine learning: Employ machine learning algorithms to detect emerging patterns and improve forecast accuracy over time, continuously refining models with new data inputs.

- Use specialized platforms: Specialist platforms (like Prevedere!) bring your expertise and knowledge, AI and machine learning together to harness external data, add an economist perspective and enhance overall analytical and planning power.

When developing your external data-driven models and forecasts inevitably the initial phase includes learnings, refinement and optimization. Allow for an “observation period” to confirm appropriate model health and forecast accuracy. Build a consensus-forecast process that incorporates the external indicators and insights as an additional perspective.

Incorporating Economic Insights into Forecasting

Once ready, external indicators should be incorporated into analytics, reporting and forecasting – for guidance, acting as guardrails and influencing analysis and decisions related to performance.

Integrating and combining insights from external data into your forecasting process ensures that your business remains aligned with the broader economic landscape. Key steps include:

- Cross-functional collaboration: Engage departments from finance, marketing, and operations to ensure all perspectives are considered when interpreting economic data – ensuring a well-rounded interpretation of external factors.

- Regular updates: Continuously adjust forecasts based on your actual performance, and the the latest external environment developments and indicator updates – including refreshing your early warning system dashboards and alerts.

Monitoring, Evaluation and Continuous Improvement

Evaluating the accuracy of your standalone external data-driven models and consensus forecasts against actual outcomes is critical. Businesses should:

- Monitor your external indicators and models: Monitor actual performance against forecast expectations, and adjust external indicator monitoring and alerting processes, and your models accordingly.

- Establish feedback loops: Regular reviews of external business drivers and their effects will ensure analysis and forecasts are relevant.

- Optimize: Explore, test and find the optimum balance – such as breaking summary models into lower levels by brand, category, and regions.

- Adapt to changing conditions: As economic drivers and business conditions evolve – processes, analysis and models must be updated to reflect new realities. Using a specialized platform allows for cost effective exploration and testing of new theses.

Risk Management

Economic volatility poses risks to forecasts. Businesses must:

- Incorporate External Indicators into analysis and planning: Understand, monitor and plan for the impact of the external environment. Develop your early warning system.

- Develop contingency plans: Prepare for different economic scenarios and integrate risk mitigation strategies into the forecasting process.

- Maintain organizational agility: Ensure the organization is prepared to adapt to rapid changes in the economic environment.

Tools, Technology and Training

Implementing the right tools and training to your team is crucial for success. Key recommendations include:

- Advanced external data management and forecasting platforms: Utilize platforms like Prevedere’s, which support the efficient centralization and integration of external data into your analytics, reporting and forecasts.

- Integration and automation: Ensure data sources, relevant external data, insights, models and forecasts are seamlessly integrated into existing processes. As processes are updated, integration allows for automation and easy maintenance.

- Data visualization: Clear communication of economic insights to stakeholders is essential. Use dashboards and visual reports to convey complex data simply – with the insights clear and actionable.

- Ongoing training: Regularly educate teams on using external data and econometric modeling to maximize the effectiveness of your analytics and planning efforts.

Conclusion

Incorporating external economic data to deliver insights and planning drivers is an essential best practice – and no longer optional.

Building an analytics and planning process that combines a business’s internal plans, strategy and tactics alongside and integrated with the external environment reality offers businesses a significant competitive advantage. By adopting best practices for working with external data you will enhance forecast accuracy, improve decision-making, and increase resilience to economic fluctuations.

At Prevedere, we help businesses harness the power of economic data and AI-driven analytics. Contact us and we’d be delighted to discuss how our Platform can support your business’s needs.