Last Updated: November 10, 2023

It is necessary to consider a variety of factors to plan for a range of potential outcomes in the coming months.

Key Takeaways:

- The Fed is aggressively pursuing 2-2.5% inflation and will continue their policy of aggressive tightening to achieve their inflation mandate

- While some supply-side indicators show inflation is cooling, other demand-side indicators—primarily heightened consumer spending—suggest inflation could remain elevated through 2023

- While consumer spending is generally considered a positive factor in economic growth, high demand could precipitate strong action from the Fed, increasing the risk of recession in 2023

As we approach year-end, several economic indicators are top of mind: inflation, labor market activity, Fed policy, and recession outlook. Much of these indicators show signs of moderation, while others flash red warning signs. On the whole, it seems there are nearly as many positive signals as negative ones.

While these disjointed signals have become normal in the post pandemic economy, they create a challenging and uncertain environment. As such, it is necessary to consider a variety of factors to plan for a range of potential outcomes in the coming months.

The Fed’s inflation targets: practical optimism or wishful thinking?

Inflation is top of mind for economists, business leaders and consumers alike. Fed officials know this and have demonstrated that they are fully committed to bringing long-term inflation back down to a target 2-2.5% per year.

As such, the Fed has embarked on one of the most aggressive tightening policies that we’ve seen in decades. Just this month, they raised the short-term borrowing rate by 75 basis points—the fourth consecutive time this year. All indications are that they will continue down this path as long as necessary to rein in consumer prices.

Having been criticized early on for characterizing inflation as transitory, the Fed is particularly keen to demonstrate their resolve. Over the course of this year, they have shown that they are willing to accept declining economic activity to achieve their pricing mandate. Evidence of underlying economic strength, particularly in labor market activity, supports the belief that their current path of quantitative tightening will successfully slow inflationary pressures—while avoiding a significant downturn.

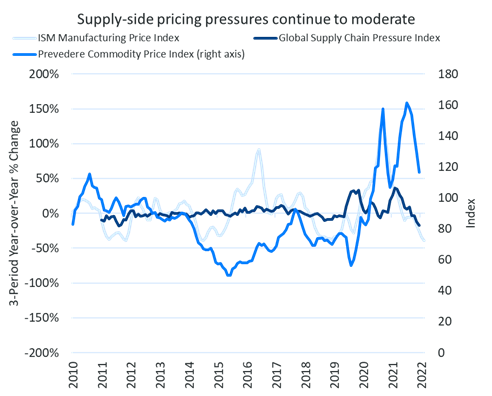

Granted, their optimism is not entirely unfounded. Supply-side pricing pressures indicate that peak inflation may be in the rearview mirror:

- Input costs are moderating

- Mobility continues to improve

- Backlogs of new orders are clearing

But this does not mean that the inflation fight is over. Early analyses mistook severe supply-side constraints as demand destruction. To understand the full picture, it is important to examine both transitory factors and structural, demand-side drivers of price growth.

Tight labor markets insulate consumers from inflationary impact

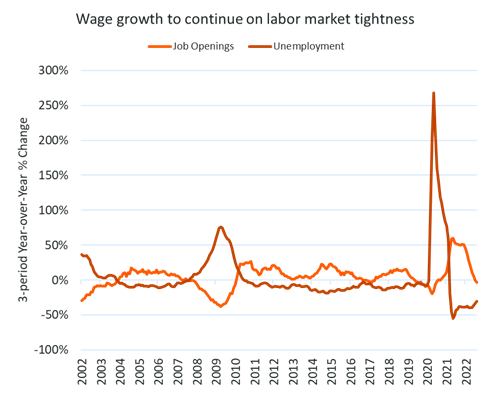

Several demand-side factors are driving inflation, not the least of which is heightened consumer spending precipitated by an historically tight labor market.

There are currently twice as many available jobs as there are unemployment persons looking for work. While last month’s employment report revealed some cracks emerging, it will likely be some time before we see a meaningful shift in labor market activity.

Higher than average wage growth resulting from exceptionally tight labor market conditions allowed wages to keep pace with inflation for much of the post-pandemic period, largely insulating consumers from price shocks and keeping demand strong. This presents a significant risk in today’s high-inflation environment.

Yet global demand headwinds may remove some of that insulation: tighter financial conditions, high energy costs, lingering COVID lockdowns in China, and the continued war in Ukraine. These, combined with dwindling savings and little room for further government support, paint a bleak picture for the U.S. consumer in 2023.

Household spending: Dislocated or disconnected?

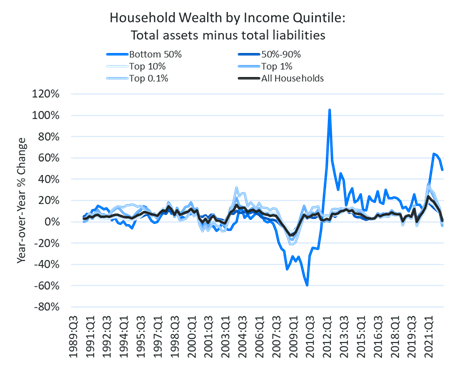

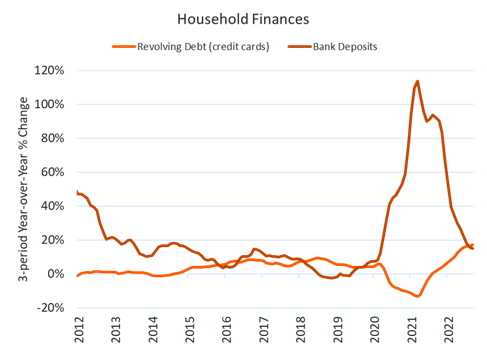

Household finances also present some risk. Pandemic-related programs like targeted debt relief, expanded benefits, and direct fiscal stimulus replenished household balance sheets. With wage growth, these programs allowed consumption to remain resilient.

As these programs start to wind down, the result will be a negative wealth shock from a massive drawdown in equity markets, eating into accumulated household wealth. As the Fed continues to raise interest rates, credit will become more expensive. Thus, we expect that consumers will pull back on discretionary spending, particularly in categories requiring credit or finance. Specifically, housing, automotive, and big-ticket durable goods will take a hit in 2023.

While credit card spending is on the rise, which signals considerable risk of future financial distress, demand among many consumers is still remarkably strong as they currently have some of the strongest balance sheets on record.

Consumer spending: delight or despair for the Fed?

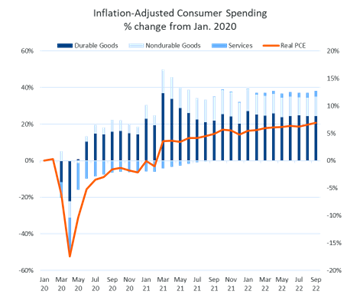

Despite these challenges, the most recent spending data indicates that inflation-adjusted consumer spending remains well above pre-pandemic levels, and in many categories, is still growing.

It is strange to describe strong consumption as an economic risk, since consumer spending has long been the engine of economic growth in the U.S. But in this case, overheated demand could very well be the catalyst for the next economic downturn.

Inflation has become entrenched in key consumer price categories like food, shelter, cars, healthcare, and transportation. Since consumers have fought hard against inflation, the Fed’s job has become much more complicated. It has all but assured a hard landing.

The question then arises: will inflation and demand ease fast enough for the Fed to take its foot off the gas? As of now, Prevedere does not see this as a likely outcome.

In fact, this combination of factors will likely lead the Fed to tighten financial conditions dramatically over the next three months, with multiple rate hikes still to come. We expect interest rates will go above 5% in the first half of 2023, pushing up the cost of credit for auto loans, mortgage rates, and credit cards.

While no Fed chair wants to cut short an ongoing expansion, current inflationary conditions all but ensure the end is near. This post-pandemic expansion will be one of the shortest in modern history.

For More Information

Suggested actions:

Is your strategy considering the macroeconomic factors that impact your business?