Last Updated: February 10, 2021

By Andrew Duguay, Chief Economist

Data updated: July 15, 2020

The COVID-19 pandemic has created different stratified economic “winners” and “losers.” Restaurants forced to close in hard-hit pandemic areas may find themselves on the losing side of the coin. But on the other hand, grocery stores in those same locations where consumers are cooking more at home may find themselves in a better position.

Scenarios such as these are contributing mixed signals to an already uncertain situation fueled by changing consumer trends and a rocky job market. Factor in record-breaking stimulus and some positive news for the stock market makes for a difficult recovery to predict.

Comparing to the Great Recession

The uncertainty now can be contrasted to the Great Recession, which by historical standards and particularly compared to this recession, was slow-moving. There were points in 2007 and 2008, where nearly every indicator was negative for many months at a time, signaling ongoing continued weakness.

With the COVID-19 recession, there was an initial shock that sent every indicator into negative territory in late March and into April, followed by numerous mixed signals since. The economic ramifications are unknown due to the record pace of the stimulus enacted. Compared to historic government standards, the stimulus was very fast and aggressive. Consumers received enhanced unemployment benefits and stimulus checks, while businesses took advantage of the PPP programs.

These actions provide a sense of being able to survive the COVID-19 recession, as long as the stimulus doesn’t run out before the economic recovery picks up. But what we see from the economic data is the oscillation in those signals versus the clear direction that might have resulted in previous economic cycles.

Prevedere industry dashboards provide a better understanding of this. The dashboard is a report covering some key economic indicators that our economist team is watching month by month. Our team is looking for directional signals of recovery across industries.

Food and Beverage Economic Outlook

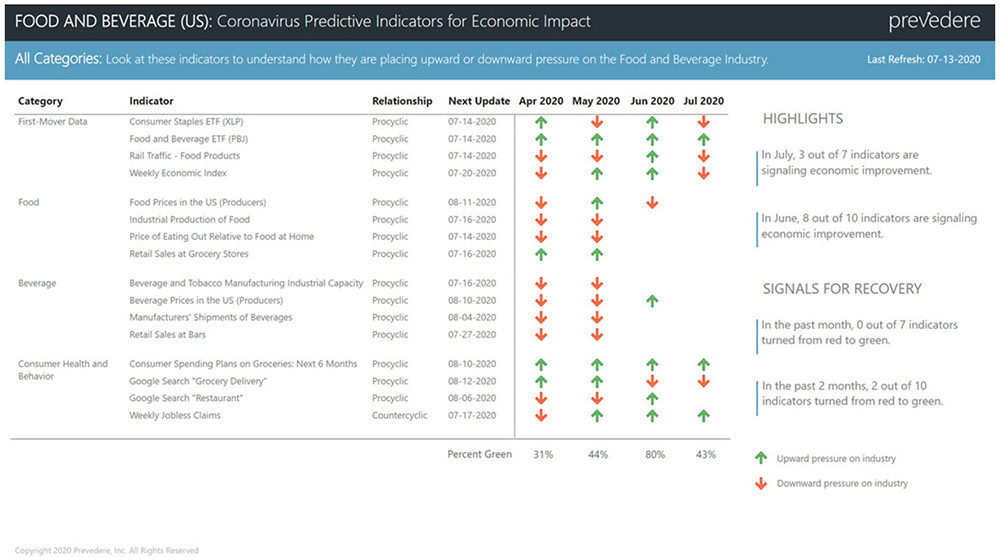

One example is the food and beverage space, which monitors demand for products sold into grocery stores, restaurants, and convenience stores.

Trying to predict demand in this phase of the crisis is challenging, given that some channels have disappeared, and other channels, such as grocery stores, have increased. The first wave of the pandemic was in April, with many closures across almost every state. There weren’t many positive trends, with a significantly low number of green arrows on the month-to-month change. Keep in mind that April indicators reveal March change, while May indicators show April changes.

Looking into June, optimism was burning high. Asia had a swift recovery, followed by Europe. While the U.S. got hit hard initially, the number of cases fell rapidly. Going into June, economic signals were positive, especially compared to a very poor April and May. Unfortunately, after the June rise, we entered July with some early signs indicating June was a good recovery month, but not good enough to return to pre-recession levels. That is concerning in several ways.

The percentage of green arrows shows an 80% improvement in June, followed by a mixed bag as move through July. Because we’re only midway through July, data lags with some of the monthly data releases. As data comes out, we can fill in this dashboard to get a clear picture of what those economic signals are telling us. Currently, what we’re seeing is an excellent example of micro-recessions with weakness in July.

Automotive Economic Outlook

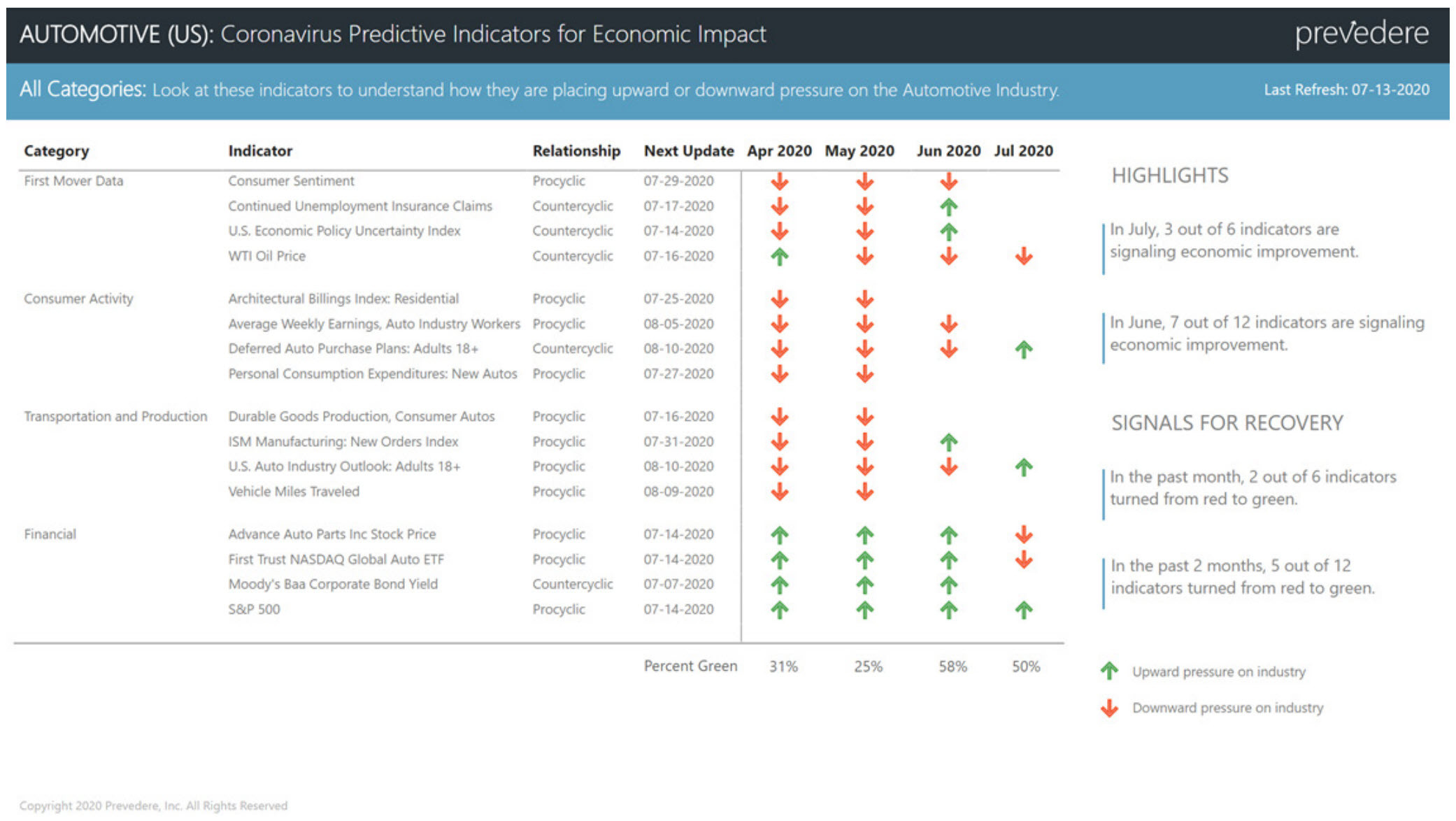

It’s not going to be a linear trend for recovery. This is true when we look at other industries such as automotive.

Looking across different indicators in the automotive space, grouped into categories, initially, the stock market and financial signals were favorable, unanimously hitting bottom in March or April and then showing some positive signs. Now those same signals are starting to weaken again. It’s an exciting trend that may be due to an over anticipated recovery that is now beginning to cool off.

Fundamentals from the consumer view, such as big-ticket purchase plans, auto spending intentions, or purchase deferrals have been negative with perhaps the start of some signals of optimism.

Overall, it’s close to 50-50 across the board when you group these economic signals. One of the lessons here is not to rely on one indicator because it could provide a singular, pessimistic view. Conversely, a different single indicator might indicate recovery when conditions are still weak. To get a balance, look across a critical set of indicators.

Recovery is going to be weak, and it’s going to vary. It’s likely going to oscillate through the coming months. Recently, there was talk of V-shaped or U-shaped recovery, but now it may be more like a W-shaped, up and down like a seesaw, as we go through these micro-recessions and micro-recoveries.

Steel Economic Outlook

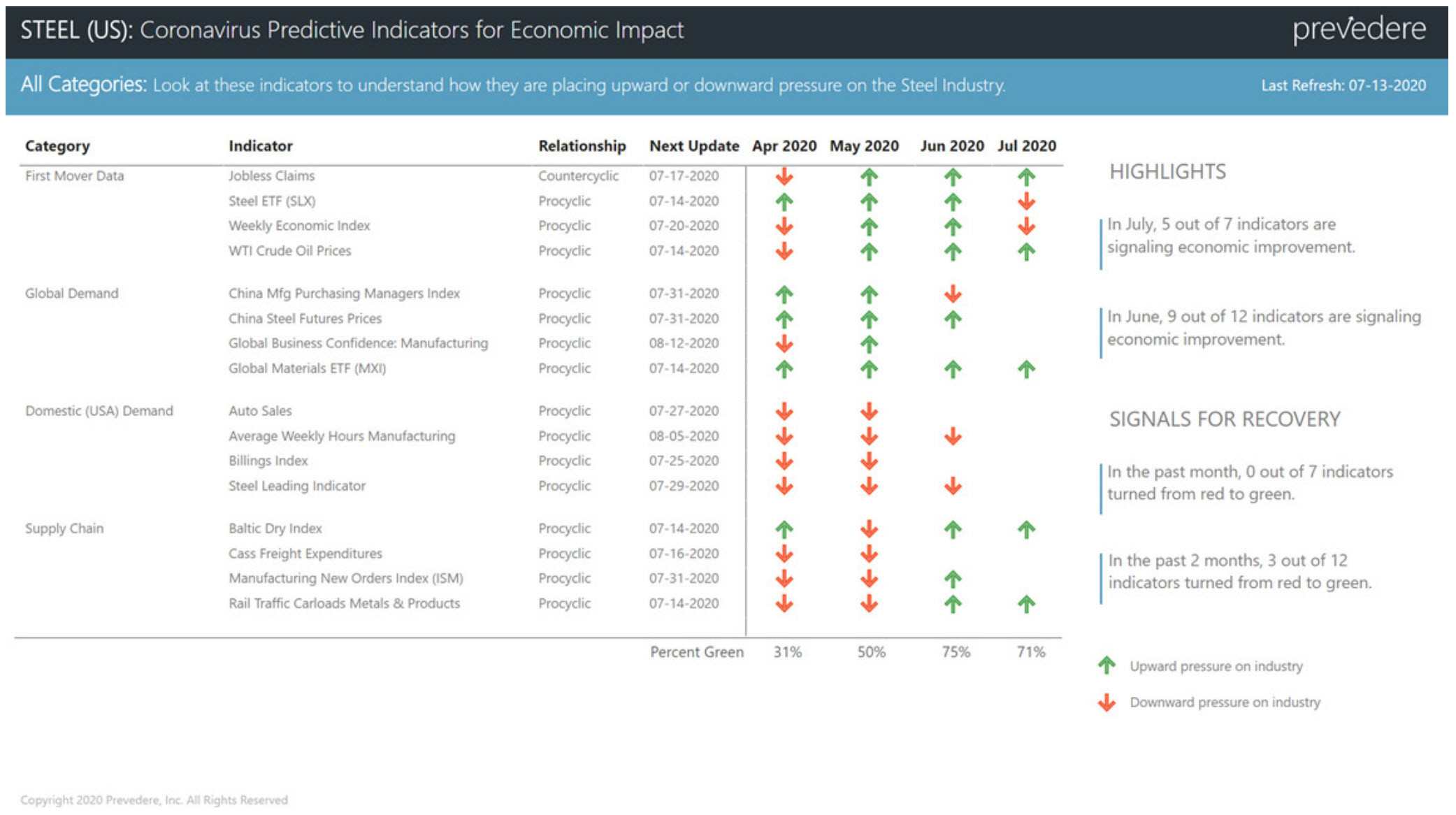

The steel industry is another example where we see sectors, such as domestic demand, with poor indicators. However, global indicators from China show some positivity in steel. Together, they present a mixed bag for the steel industry. You want a more uniform recovery across the different sectors of steel.

U.S. Economic Outlook

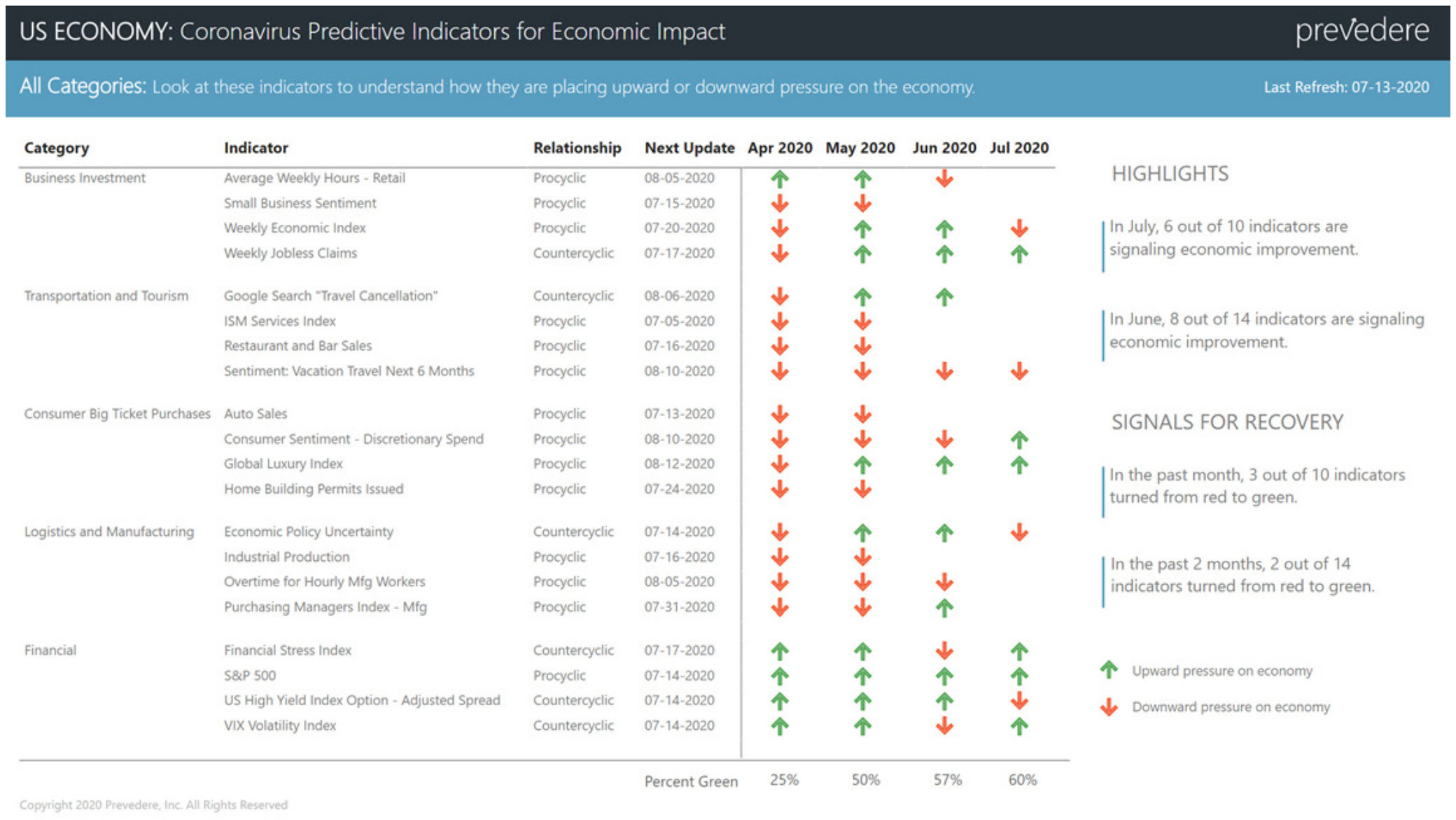

Our U.S. dashboard covers the total U.S. economy and has a variety of up to 20 indicators that we’re monitoring. It includes the Weekly Economic Index, which is a reliable weekly proxy for GDP that relies on real data. There are no estimates, forecasts, or expectations, but actual data such as electricity consumption, transportation shipments, and transactions like retail transactions, to gauge what GDP is going to do.

After a couple of months of recovery, July is looking weaker, which is concerning because we’re still nowhere near pre-recession levels. When it comes to the summer months, phrases like “the summer of shock” come to mind as expiring unemployment benefits will cease at the end of the month.

Things may change because there’s movement in Congress to consider expiring benefits and the number of people still on temporary unemployment. Americans are getting their jobs back, and news jobs are being created, but not at the pace to fill all positions that were lost.

Before considering the expiration of those unemployment benefits, the trends are already signaling a mixed bag using the economic indicators that we’re following. This summer will experience micro-recessions, micro-recoveries, and winners and losers. This is already clear based on the need to continue to social distance. It generates a mix of new business opportunities in some areas and weaknesses in other areas that were strong before the recession. However, some sectors are

going to get left behind.

Optimism and uncertainty don’t mix in the long run. In many ways, the stock market is a measure of confidence because it’s an expectation of future earnings, showing some optimism. But at the same time, there’s volatility in the day-to-day markets and uncertainty reflected in consumer sentiment surveys.

There will be some businesses that overshoot and overinvest and end up having to pull back months later. And then there’s going to be other industries that were left behind, which might see a quicker recovery.

Either way, U.S. economic recovery will be bumpy and likely come in waves.

Complimentary Economic Leading Indicator Access

As the U.S. transitions into the recovery phase of the COVID-19-induced recession, it is more important than ever to have access to timely, reliable data and expert economic analysis to help guide forecast decision making and re-planning. To meet this need, Prevedere has created a complimentary Economic Outlook Weekly report.

The report provides executives with leading indicators to watch that offer an unbiased view of the evolving economic landscape. The Economic Outlook Weekly report is emailed weekly and includes a range of demand and supply-side factors to cover the full spectrum of economic activity. Each indicator is displayed graphically and updated automatically as new information is released. There is no charge to receive this service. Sign up for your complimentary access here.

Complimentary Economic Outlook Weekly Services Include:

• Macro view of key recession economic indicators

• Regular economist reports offered as information becomes available

• Weekly updates to your inbox

About Andrew Duguay

Mr. Duguay is a Chief Economist for Prevedere, a predictive analytics company that helps provides business leaders a real-time insight into their company’s future performance. Prior to his role at Prevedere, Andrew was a Senior Economist at ITR Economics. Andrew’s commentary and expertise have been featured in NPR, Reuters, and other publications. Andrew has an MBA and a degree in Economics. He has received a Certificate in Professional Forecasting from the Institute for Business Forecasting and Certificates in Economic Measurement, Applied Econometrics, and Time-Series Analysis and Forecasting from the National Association for Business Economics.