Last Updated: February 10, 2021

By Danielle Marceau, Senior Economist

Data updated 9/16/2020

As COVID cases fluctuate, we are not likely to see consumers return to normal anytime soon. The economy is well below where it was at the end of last 2019, or even the first couple months of 2020. There is certainly a long road to recovery ahead, but that road varies depending on the sector.

Where the U.S. Economy Currently Stands

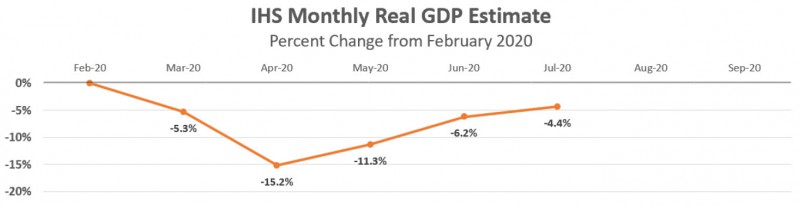

Gross Domestic Product (GDP) is the best measure of the overall economic output of any economy. However, the COVID-induced recession requires more timely data than a quarterly release. The monthly estimate produced by IHS Markit Insights on GDP helps add more granular frequencies. When looking at the IHS monthly estimate historically, it does a good job of mapping to formal GDP numbers, making it a strong indicator to track economic activity.

This chart shows, on a monthly basis, what the percentage change in GDP was. We are using February of this year as the baseline, the pre-pandemic level, as a threshold to return to in order to reach a full economic recovery. Activity fell 15.2% in April, and there has been some rebound. The most recent data point was July when activity was still over 4% below February 2020. The IHS monthly estimate is moving higher, which means the economy is moving through some recovery. But looking at June to July, the slope of that line flattened slightly, indicating that it is slowing down.

The consensus among most economic forecasters is that this recovery will look like a Nike swoosh. Data is starting to reinforce that, with a considerable contraction followed by a couple of months of a relatively robust recovery. We expect to see this continue to level off. Think about the drawn-out tail of the Nike swoosh. Here at Prevedere, we do not anticipate the economy fully recovering from all of the economic output lost in 2020, even by the end of 2021.

The Tale of Two Recoveries: Retail

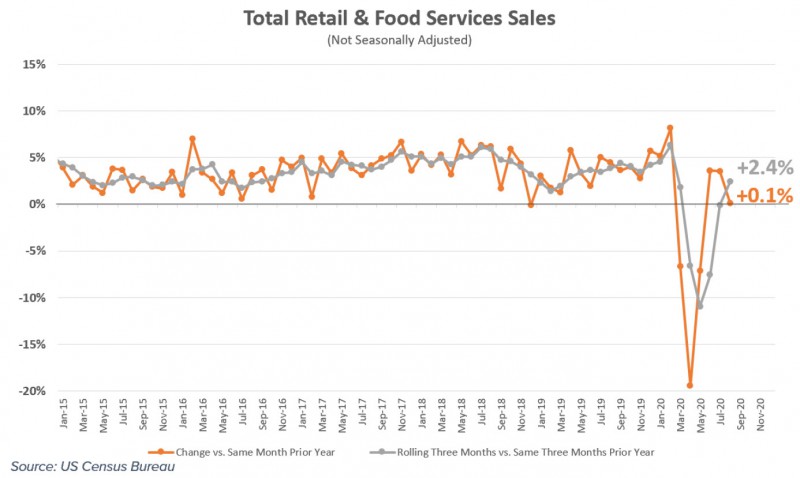

There was a quick snap back in overall sales when looking at total retail and food services sales in the United States. There were levels of spending above last year throughout the summer months, illustrating positive gains.

However, most of this spending was bolstered by the stimulus, the $1,200 individual cash payments, and the enhanced unemployment benefits. Because of the timing of the stimulus, most effects took place in the Spring. New data suggests a high probability of a double-dip recession in the retail industry as the government intervention wanes. Secondary softness is likely to take hold entering the final quarter of this year.

Retail consumer spending has been relatively optimistic, but consumer spending habits have shifted. Shoppers are spending on different things, in different places, and in different ways than they were pre-pandemic. There were many one-time expenses that people were investing in as they shifted towards the new normal of living, things like outdoor furniture or home improvements. Other items included furniture or desks, as many had to set up a home office to work from home.

Fascinating dynamics such as these indicate recovery, as in return to pre-pandemic levels. Still, some major headwinds are for a secondary softness to hit this industry as overall economic recovery plays out.

The Tale of Two Recoveries: Industrial

According to the University of Chicago, 77% of employees who lost their job due to the pandemic expect to get it back. 42% of job losses, however, are likely to be permanent. What’s interesting is that it means about one out of every five people who lost their job will be surprised not to get it back.

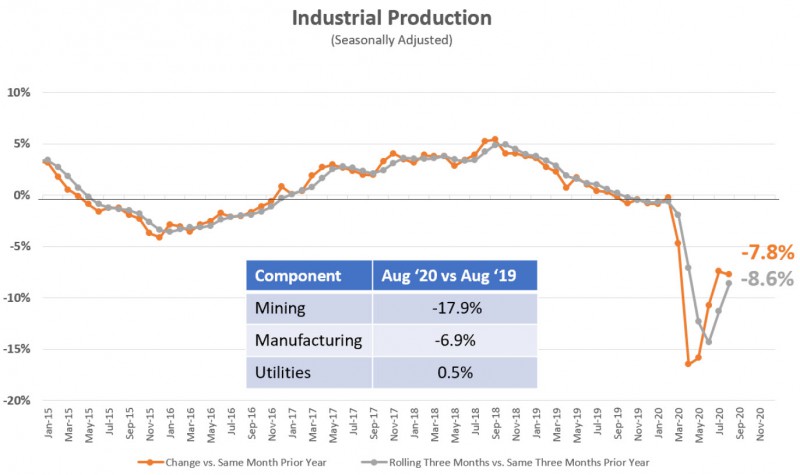

Industrial production is a broad gauge of how the industrial sectors of the USA economy are performing. It encompasses mining, manufacturing, and utilities. Data through August indicates that industrial production was down 7.8% versus last year. On a rolling three month average versus the same three months in the prior year, it’s down about 8.6%. It’s a big, slower-moving machine, so it is harder to turn back on. We expect that there will not be as quick a rebound to pre-pandemic levels as we saw with retail. Recovery will likely be longer and slower, with industrial production not returning to pre-pandemic levels until post-2021.

When looking at the economy’s different industrial production index sectors, mining is the biggest drag, down 17.9%. Manufacturing is down about 7% this year versus last year, and utilities are virtually flat.

Around $40 a barrel, low oil prices are putting downward pressure on mining activity in the United States. $40 is above the price needed for existing wells here in the United States to operate, which is between $30 and $38 a barrel. It’s well below where prices need to be to drive demand for new wells. As long as energy price hover there, any sort of really robust recovery in the mining side of things is unlikely. Manufacturing is starting to recover some as activity has increased month to month, but it is still well below last year. Manufacturer’s new orders are down 6.2% versus last year; there has been a mild bounce back, but the recovery rate is slowing.

Conclusion

Overall, retail is performing better than the industrial sectors within the U.S. economy, bolstered by stimulus and enhanced unemployment benefits. We expect headwinds to prevail during the final quarter of 2020 as the economic recession is realized by the U.S. consumer whenever they don’t have additional income from government intervention.

There will likely be a double-dip scenario within the retail industry, while the industrial sector continues its slow road to recovery. From an overall GDP economic output perspective, we do expect recovery to continue, but it will also continue to decelerate in the rate of recovery. The U.S. economy will likely not see a full-fledged economic recovery until at least 2022.

Navigate What’s Next with Economic Scenario Planning

The COVID-19 crisis has given rise to a world of economic uncertainty, with uneven effects across regions and industries. As we head into the 2021 planning cycle, every business wants to know How will the pandemic impact next year’s numbers?

Prevedere’s Economic Scenario Planning solution helps companies navigate these tumultuous times. The solution projects future business outcomes for three plausible macroeconomic scenarios under COVID-19. Companies can use these insights to sharpen 2021 forecasts and plans, improve shareholder guidance, and stay on top of the pandemic’s evolving impact.