Last Updated: February 10, 2021

By Andrew Duguay, Chief Economist

Data updated 8/25/2020

We knew August would be an exciting month; we talked about the summer of shock in the early spring. One of the main features we had our eyes on was how the unemployment benefits would be handled at the end of July. We understood that if the nation didn’t plan to at minimum wean the U.S. economy off of all the stimulus, we could be looking at some volatile market dynamics in the second half of the year. However, lawmakers have failed to reach agreement on extending the

$600 a week benefits, leaving millions of Americans in a quandary as America’s families are left dangling.

Many Americans who remain unemployed and have not found a job now find their income is trending rapidly lower. The U.S. President contributed a tie-over measure through emergency benefit payments by an executive order that would continue the unemployment benefits of $300 a week contribution, with the states contributing $100 a week.

Unfortunately, the roll out of the extension has been haphazard at best. As of August 25th, only two states have confirmed full payouts according to the extension. Several more states are confirmed to contribute beginning in September at some time. The translation; unless you live in those two states and you’re unemployed, you’ve likely seen a considerable reduction in your unemployment payouts. This is leaving American families in a difficult financial position as they wait for the supplemental benefits. Undoubtedly this will stall and alter the economy more broadly as U.S. households change spending in many ways, including spending not only on retail goods but also on their mortgages and rent.

Positive and Negative Indicators to Watch

There have been notable positive and negative surprises in terms of the leading U.S. economic signals that we are tracking. However, the asterisk was unprecedented stimulus levels. With the original stimulus expired and no concrete plan on the horizon, the U.S. is feeling a volatile unemployment effect above 10% and millions of jobs lost.

Looking at the coming weeks, we’re left with a very vulnerable nation right now, and this vulnerability certainly has reflected in the economic indicators in a couple of ways. The first ramification is that in August, consumer sentiment has degraded further by the preponderance of measures. When we see strong rebounds in retail sales, it is usually bolstered by strong rebounds in consumer sentiments. However, whether it’s Prosper Insights & Analytics’ measure of consumer sentiment or the U.S. Conference Board’s, we’ve seen in August is that consumer sentiment not only did not jump, but it’s gotten worse.

We expect the likelihood that negative pressure will begin showing itself in retail sales numbers. As new data comes out, it suggests that the forecasted retail sales rebound is not necessarily going to be as V-shaped as it looks now.

We see vulnerability on several levels, perhaps none more than in the housing market, where most Americans who have mortgage or rent payments to make operate on a month-to-month basis. If they lost their full income, could they sustain more than a month’s worth of expenses? According to several surveys, for most of them, the answer is no. Many of these extra unemployment payments were going towards paying the utilities, the rent, and the essential consumer goods, and will be sorely missed.

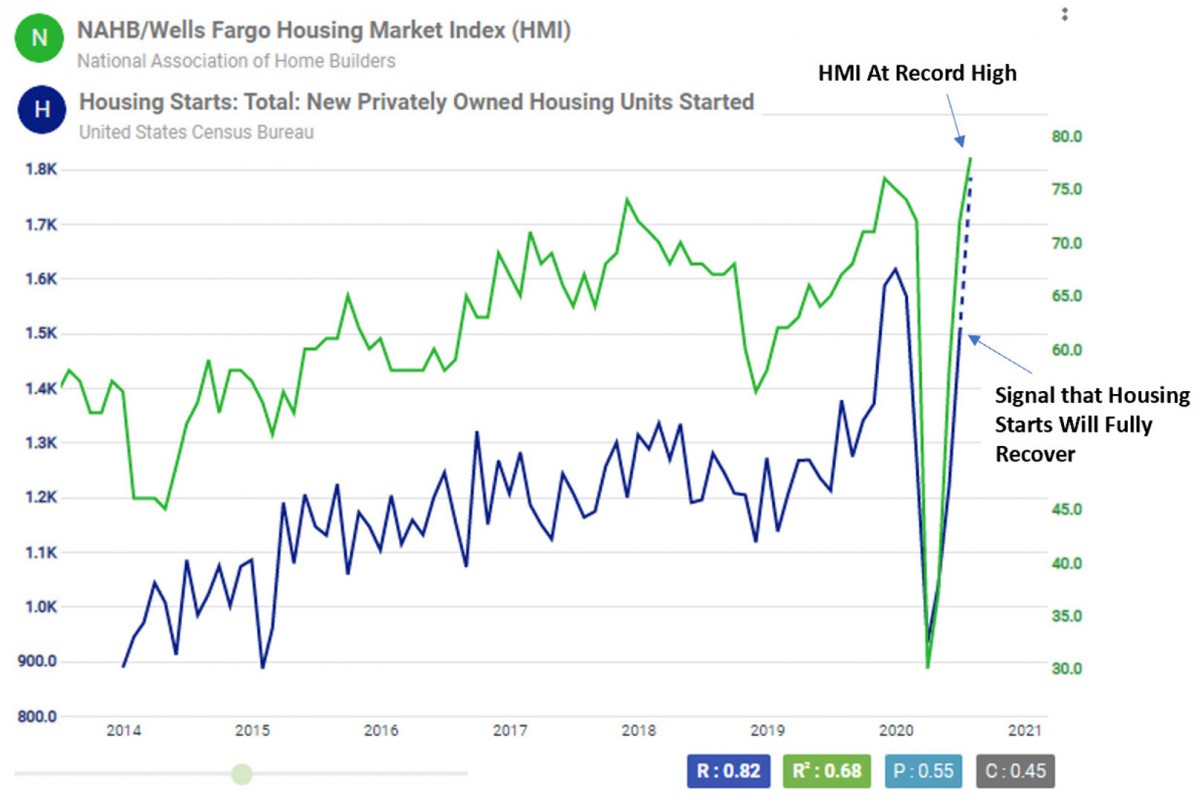

At the same time, what we observe in the housing market is a very positive dynamic. People are fleeing from cities to locate houses in the suburbs, and all this has translated into what we deem, empirically, a V-shaped recovery in housing. This could mean a second home in a rural area or moving out to the suburbs.

Record highs imply that housing starts would see a full recovery, and we’re going to get back to housing starts in tune with pre-recession levels due to the demand. Homebuilders have never been more confident or excited about the pent-up demand for new homes, as home sales are at multi-year highs.

This is also elevating home prices, which is usually excellent news for homeowners. By doing a quick real-time data look from our sources at Google, we see that people are searching for things like home improvement, suggesting remodeling expenditures, up 50% year over year. A search for home sales reveals that’s up 30% year over year. Solid numbers out of the housing market should excite home builders. However, we need to think about this combined with the fact that there’s another sub-segment of the U.S. struggling with lost jobs and struggling to make ends meet, particularly housing payments.

While there is an exciting housing boom, there is a risk for a housing bust down the road. The housing bust signals are ones that are probably going to play out slowly over time. Indicators suggest we could be seeing a very different scenario in about 12 months from now.

Negative Factors

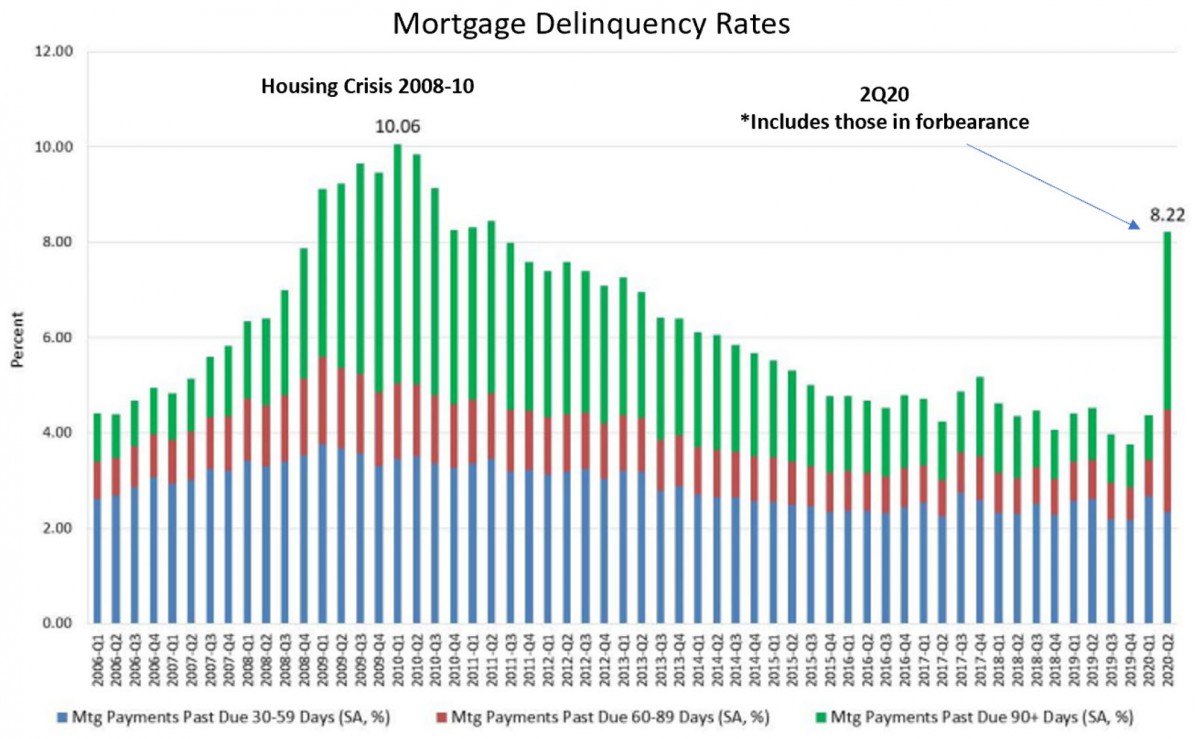

The first negative factor is government programs that allow mortgage owners to delay their payments due to COVID. This action permitted homeowners to put their mortgages into forbearance voluntarily. This doesn’t mean payments are forgiven. However, it does give homeowners peace of mind knowing that their home won’t foreclose, and they have some time until they have to continue payments. Many have taken advantage of the government’s offer.

Mortgage delinquency rates have increased, and they’re up to over 8% right now, which, historically, compares to housing crisis type levels. However, there is another asterisk because we know that a lot of this is voluntary. The situation has unique characteristics that differ from the last housing crash.

The last housing crisis was slow. Home prices peaked around 2006 and 2007. Foreclosures didn’t enter the market until 2009, ‘10, or even ‘11, as foreclosing on a home takes a long time. The government can intervene and stall a lot of those actions. The market is likely going to be tight right now and probably for the next couple of quarters.

While there is currently demand, 2021 could look at lot different. Right now, lumber prices are at near-record highs. Housing prices are appreciating at about three times the rate of inflation. But the cost to build a new house is also elevated.

Next year could bring more foreclosures, which are going into the process now due to many Americans’ recessionary conditions. Plus, there will be an elevated inventory of expensive homes built today to meet current demand. This has all the indications of a very cyclical market over the next several years, with the boom and bust cycle.

80% of renters and 90% of homeowners can only afford to make payments one month without any income. There are a lot of very vulnerable people with rent and mortgage obligations. The National Multifamily Housing Council (NMHC)’s Rent Payment Tracker found that 90% of renters pay some contribution towards their rent as of this week in August. This is lower than last year, when 92.1% of renters spent some portion of their rent. However, it’s still in the 90’s, so most people are paying their rent, but the numbers are weaker than they were last year.

At the same time, there are many people at risk of losing their homes. The housing market is likely moving through a boom cycle that will probably be followed by a bust cycle about 12 months from now.

It’s important to not fit the last recession into this recession; every recession has different causes and effects. In talking about the housing market, we shouldn’t get caught saying the market is going into another housing crisis like 2008.

If another level of stimulus passes that helps people continue to pay their mortgages, there may not be as much concern about a potential crisis. There are many more factors to monitor as they play out on the housing side and what happens next with unemployment benefits.

For now, the overall message for the economy is that there were positive numbers in July, particularly in the retail spent sector. However, many early signals out of August suggest that there will be a rocky road ahead and not to expect a V-shaped recovery throughout most industries.

Many traditional consumer recessionary behaviors, such as confidence and spending levels, will come to light. The initial aggressive stimulus delayed many of those actions. But now the U.S. is settling into the reality that aggressive stimulus can’t last forever.

Economic Scenario Planning in a COVID-19 World

Planning and forecasting based on historical performance is no longer valid in today’s economic climate. As you look ahead beyond the immediate crisis and consider your business plans, having visibility to external economic factors and considering how your company will fare in the “new normal” economy is paramount. This is what we call Intelligent Forecasting.

Prevedere helps companies answer, “what’s next?”, using global data and AI technology. Whether it is a black swan event like the COVID-19 pandemic, less severe shocks like falling oil prices, or the regular contraction-expansion business cycles, Prevedere provides executives with insights on global forces impacting their business.

Click here for more information on Prevedere’s ‘What If’ Scenario Planning Offering >>

***

About Andrew Duguay

Mr. Duguay is a Chief Economist for Prevedere, a predictive analytics company that helps provides business leaders a realtime insight into their company’s future performance. Prior to his role at Prevedere, Andrew was a Senior Economist at ITR Economics. Andrew’s commentary and expertise have been featured in NPR, Reuters, and other publications. Andrew has an MBA and a degree in Economics. He has received a Certificate in Professional Forecasting from the Institute for Business Forecasting and Certificates in Economic Measurement, Applied Econometrics, and Time-Series Analysis and Forecasting from the National Association for Business Economics.