Last Updated: June 22, 2018

Traditional forecasting models were essentially built upon the age-old adage: history repeats itself. Let’s look at two of the most common:

- ARIMA – in this method, which stands for autoregressive integrated moving average, models are built on time series data sets – hence “autoregressive” – based on a previous state.

- Holt-Winters – this method, a version of Exponential Trend Smoothing (ETS), takes seasonality into account when forecasting.

While there are even more formulas and models used in today’s business forecasting methods, at their core, most are based on projecting recent past performance into the near future.

Yet in today’s fast-paced business environment, when executives need to more accurately forecast further out into the future so that they have time to implement critical business decisions, ARIMA and Holt-Winters may not be powerful enough. These traditional methods are never going to identify a major turning point, a sharp trajectory change or a random shift in momentum. Ultimately, the forecasts from these methods won’t be radically different than what they projected six months ago.

But we all know that’s not reality. The smooth trends and projections common in ARIMA, Holt-Winters and ETS aren’t a reality in today’s volatile business environment. Economic forces can quickly alter a business’ trajectory, yet the constant ebb and flow of the economy isn’t accounted for in traditional forecasting methods.

That’s why we’re looking at a new wave of forecasting models. ARIMA and ETS can be very accurate for short term predictions when the probability of major economic shifts is lower. But expecting things to remain the same is a fatal error in today’s business environment. New forecasting models, like Prevedere’s, outperform traditional processes in longer term forecasts because we take into account leading indicators that these traditional models were blind to. We know current trends aren’t necessarily going to continue, and look for external factors that are key predictors of shifts in momentum and the economy. Put simply, if you want to get a detailed view of distant objects, would you rather use binoculars or a telescope?

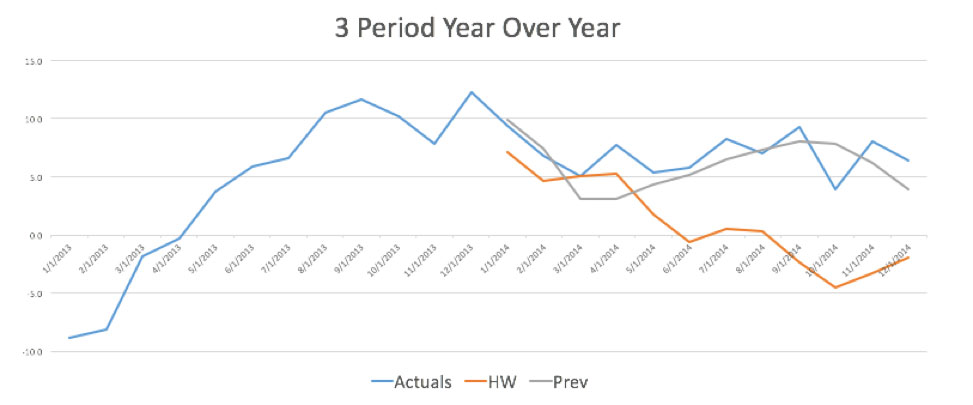

Let’s look at a real example:

The blue line represents actual sales for a Prevedere client. The orange line is the forecast for the company’s performance using Holt-Winters. You can see that under this historical model, the projection continued to shift downward – because that’s what it had done in the preceding months. Prevedere, on the other hand, was able to anticipate the shift in momentum in the economy, anticipating a much more positive year and more closely matching reality.

Think of it like this. Under traditional forecasting methods, the natural tendency is to revert to the mean, meaning that these methods will ultimately forecast an overall average performance. These methods will rarely predict a best, or worst, year ever. Not only that, they can’t explain the why behind forecasts – except for “that’s what happened in the past.” Prevedere, on the other hand, can forecast significant changes in performance and explain what external economic forces are driving that projection.

When selecting a forecasting method, ask yourself these four questions:

- Is it accurate in today’s volatile economy?

- Is it easily repeatable?

- Is it automated?

- Does it answer the “why” behind performance?

With traditional methods, the answer is “no” to each of these, but fortunately, forecasting is changing to better match today’s volatile economy. Are you ready for the shift?