Last Updated: June 22, 2018

Forecasting and predicting consumer demand is a critical process for any business, but perhaps none more so than those in consumer packaged goods. Inventory, production, storage, shipping, marketing – every facet of CPG and retail companies’ operations is affected by accurate forecasting. Identifying consumers’ preferences and their likelihood to purchase enables these companies to make better decisions regarding product lines, entering new markets and their supply chains, ensure that shelves are stocked, and minimize the risk of inventory shortages or overages.

Fact-based predictive insights are crucial for CPG and retail companies to build accurate forecasts. Insights that stem beyond historical, internal data to include external economic data, such as weather patterns, consumer spending power and employment, recent sales metrics of complementary goods and more, give these companies greater power in creating accurate sales and demand forecasts. In fact, research shows that companies willing to bring in external data are better able to produce “significant business results,” says Doug Laney, vice president & distinguished analyst of data and analytics strategy of Gartner.

Companies often discuss external risk factors in their annual reports, hypothesizing on how the economy, consumers, raw material prices, and other external factors impacted their businesses. However, many of these same companies do not have the technologies and processes in place to actually measure the impact of these factors and use them in building forecasts. To truly determine cause and effect, the key is to marry these external risk factors with historical, internal data, which not only allows companies to address the “why” behind previous performance but also to make better predictions on forward-looking demand. In fact, with our clients in the CPG and retail space, we’ve found that as much as 90% of a company’s performance can be affected by external factors.

Better Predicting Consumer Demand

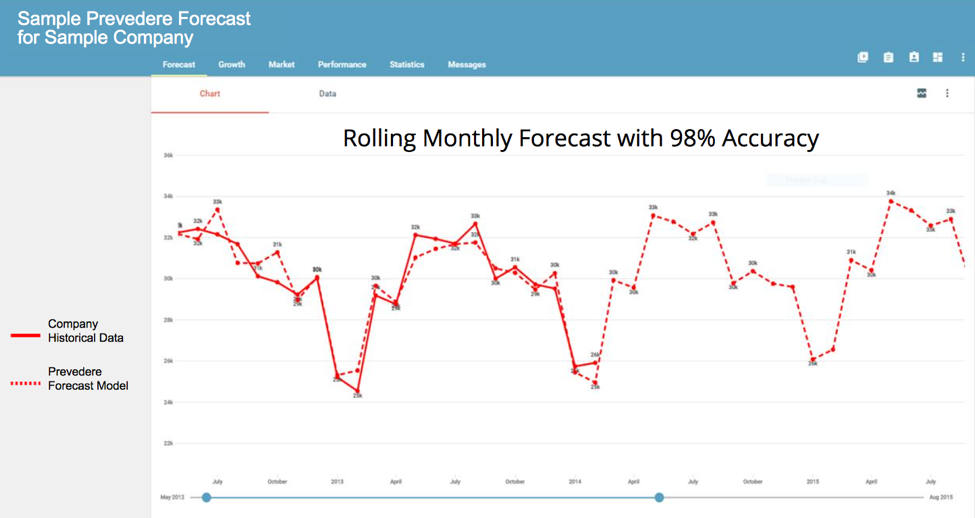

Accurate forecasting begins with understanding how external data directly impacts the cost of goods, demand and ultimately, business performance. At Prevedere, we’re able to provide immediate answers to these tough questions better than ever before. – at both the product line and market area levels. To give some perspective, let’s look at a couple of real examples:

Beverage Brand: One of our clients, a global alcohol brand, needed to predict upcoming sales at the SKU level to make smarter planning decisions for manufacturing its key product line. In the past, the company relied on its historical data alone to decide the products and quantity to manufacture and deliver to its distributors. Using this method, the company tended to overproduce as a safety net, wanting to avoid the risk of shortages and consumers being forced to purchase a competing product at all costs. When the company turned to Prevedere, it began building its own demand models on a weekly basis. As a result, executives could make better staffing and purchasing decisions for raw materials that were needed to produce their beverages.

Bottom line? The company saved $9 million per year by simply avoiding over-production with accurate demand forecasts.

Electronics Company: Another Prevedere client, an electronics company, wanted to gain a competitive advantage and increase its market share by releasing the latest and greatest mobile device. Historically, the company had largely relied on guesswork predicting consumer demand and expensive market research in planning new product releases, and that approach didn’t always pay off. The company had previously released a new product that had not met sales predictions, and it could not afford the same mistake again. To avoid the risk of releasing a product that would fail to meet demand, which would ultimately lead to millions of dollars down the drain in R&D, manufacturing and marketing, the company turned to Prevedere. With our help, the electronic manufacturer’s marketing department was able to incorporate factors like consumer sentiment, retail sales and projections, as well as housing starts and employment rates, to identify markets and demographics that would be most appealing for its new mobile device.

Bottom line? The electronics company was able to not only distinguish profitable markets for its new mobile device but also identify the least profitable markets to exit.

Convenience Store: Executives at a convenience store chain knew they needed to reduce inventory costs and improve the bottom line, but they didn’t have the sophisticated tools or internal knowledge to make the accurate forecasts necessary to meet these objectives. The company turned to us, where we began by looking at the chain’s major product categories: dairy, alcohol, candy, snacks, and tobacco. We examined each category on a national level to determine what was driving the demand for these products. From there, we dove into a more granular level, taking in economic factors for certain markets such as employment and cost of living to build predictive models. With this information, the grocery chain was able to build predictive models for each of its market areas, which procurement used to stock shelves with the goods consumers were ready and able to purchase.

Bottom line? Forecast accuracy helped the grocery chain avoid losing millions of dollars related to inventory overages on products like milk, candy, beverages and more.

These are just a few of the ways accurate Predicting Consumer Demand improves bottom-line results. To learn more about improving forecasts in the CPG industry, view our webinar replay with Consumer Goods Technology here.

Prevedere has been acquired by enterprise planning leader Board.

Prevedere has been acquired by enterprise planning leader Board.