Last Updated: February 10, 2021

This report, “New Consumer Behaviors Driving Change in Business Planning,” is the second in a series presented by Prevedere and Canapoch. Andrew Duguay, Prevedere Chief Economist, provides the latest economic-related insights. Special guest, Patrick Slattery, the Founder and Managing Director of Canopach, a CFO advisory firm in New York City, will present on best practices for C-Level planning through a crisis.

It’s a fragile uncertain time for businesses as the U.S. sees a steadily increasing number of COVID-19 cases while states are reopening. Economic recovery in the U.S. largely hinges on positive consumer sentiment and how fast we recover as a nation. Much will be determined by whether people feel secure to spend their money or if spending is stymied.

Consumer Confidence during Pandemic

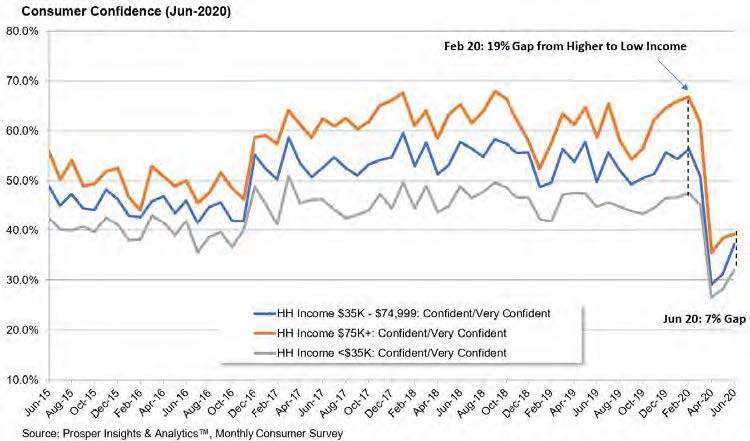

June data from Prosper Insights & Analytics indicates that confidence has rebounded slightly from May, but it’s still lower than we like to see for recovery. The chart below compares consumer confidence by income stratification:

More affluent income segments, with household incomes above $75K, historically experience higher confidence levels than lower-income groups. Interestingly, since the pandemic crisis started, the gaps have shrunk between higher wage earners’ confidence and the confidence of those who earn less money. Consumer confidence across the board has decreased overall. The sentiment gap has shrunk by two-thirds between the higher-income and the lower-income groups, from a 19 percentage point gap in February to a seven percentage point gap in June. It seems that regardless of income status, spending behaviors reflect how consumers feel about their health and safety.

This conclusion is supported by a recent study conducted by Opportunity Insights, a co-sponsored program from Harvard University and Brown University. Their white paper published June 17, 2020, studies the number one restriction on recent U.S. economic growth. They determined that it wasn’t necessarily government-mandated closures of stores. It wasn’t inadequate incomes, because we’ve stimulated and compensated for income quite well in the United States with the expanded unemployment benefits. It wasn’t a lack of business liquidity, given that the Federal government has poured several trillion dollars into the market to help back up the liquidity of the financial markets. They found that the fear of COVID-19 itself was suppressing consumer spending to become the primary barrier to economic activity.

Data from their research on real-time spending information backs up this consumer confidence metric. They found the most significant reductions in spending right now are from the high-income spending groups. While lower-income spending has declined by about four percent, higher-income spending has fallen 17%. Those who are more affluent are cutting their spending further, both in dollar terms and in percentage terms. It appears higher-income earners, who typically spend more on discretionary items, are reducing the amount of spending to a level they feel is more comfortable. Cost-cutting is happening across entertainment, travel, and restaurants. This indicates that it’s not necessarily the ability to spend right now driving the economy down; it’s the confidence in spending.

If consumers feel like they’re taking unnecessary risks by doing things such as going to the movie theater or dining out, then they’re going to spend less, and that’s going to suppress the economy. This suppression has effects on the job market as well. We see that in high-wealth areas, there have been more workers laid off, relative to lower-wealth regions, as determined by zip code across the United States. The result is an interesting dynamic where lower-wage earners feel more pain if they live in a high-wealth area.

In traditional recessions, you may see that affluent areas tend to spend during recessions, which leads to better economics than those concentrated around lower incomes. Currently, cutbacks come from high-income earners, and it’s driving the economy lower, impacting everyone.

New COVID Cases Impact Consumer Spending

The nation reopening has had only a modest impact on economic activity. Attention needs to focus on the number of cases, making data somewhat difficult to observe:

Along the East Coast and in the Northeast, cases have been declining. However, cases are increasing in several other states, including California, Florida, and Texas. Despite efforts to reopen businesses, these states will likely have more consumers that are not going to feel safe going out, and as a result, spending less.

To get back to previous spending levels, consumers will likely need to see cases begin to subside and possibly some real progress with a vaccine. There have been recent headlines that jobs and retail sales have bounced back somewhat from April numbers, but there is still a long journey ahead. There will most likely be continued economic disruption throughout the summer months and into the second half of the year.

Business Strategy in the COVID-19 Recession

It’s helpful to look at the COVID health crisis in the context of a profession that deals with crises regularly—the cybersecurity profession. Specifically, there’s the NIST framework, which has five functions, which break down into three steps: organizing what you know and running your business to avoid a problem.

There are two steps specifically that cyber professionals refer to as ‘right of bang,’ which occur after the crisis has occurred: respond and recover.

The immediate response to the crisis means dealing with the direct effects of the crisis and mitigating any of the immediate damage. Beyond the response phase, there’s the recovery. But first, let’s consider respond.

Responding to Crisis

Think of a house catching on fire as a kind of crisis you’d apply this model to. During ‘response,’ companies are fighting the fire. They are getting people out of the house and pouring water on it. In the case of the COVID crisis, it was dealing with work from home.

Many businesses had already established either telecommuting or remote work. But they didn’t have the bandwidth, hardware, and software to accommodate their workforce on the required scale. Adding to the complexity, depending on the business sector, reconfiguration of physical environments was necessary. Responding to supply chain disruptions was also no easy feat to relieve.

In the initial response, there may be ripple effects or flare-ups. The crisis drives businesses, and they still respond to it, dealing with new areas of increased tech activity. While responding, the existing planning and measurement tend to remain in place, and the existing tools and practices are employed. Companies look at their insurance and contingency plans. If they’ve advanced to the level of maturity that they have playbooks for dealing with these things, they are running their playbooks. But they can’t continue doing that forever.

Recovery Phase of Crisis

Eventually, we reach recovery as the most immediate danger is relieved. Currently, this manifests as we see businesses start to think about reopening and the many potential changes required to do so. In looking towards response in the current environment, we need to consider planning both pre- and post-pandemic. If we consider planning as a combination of looking at growth and profitability across the business as usual or the organic business presented, plus strategic initiatives.

If companies can’t meet their targets through organic means, they will typically look at M&A activity or other investments. That simple model usually holds year after year. There are correlations and estimation models to support it. Businesses and stakeholders in the investment community that set expectations generally feel comfortable in coming up with targets and means of closing any gaps to targets. However, many areas are changing concerning the measures as we look at in the response phase.

5 Evolving Areas of Measurement in the Response Phase to COVID-19

1. Amplification of Existing Trends

During the COVID-19 pandemic, almost the entire workforce needed to work from home. That introduced considerable disruption in the business environment. In addition to working from home, many people dealt with homeschooling children, space restrictions, and other competing distractions.

Innovation: Employees working from home had a definite impact on innovation. Business transformations are an ongoing pursuit for decades. Innovation is typically run in large phases in what is often referred to as a waterfall approach, where a business case is made using a structured process that might run 18 months or more. Working from home has necessitated and amplified the need for innovation faster. As the need to transform business has increased, it increases pressures on newly acclimating remote workforce organizations.

Job Changes: Then there are impacts of social distancing restrictions to consider. With the same amount of space, we have to accommodate the distance between people. This can translate into job-sharing where some employees work part-time from home, part-time in the office. This may also include alternating shifts with their counterpart, maybe working two or three day work week on-site in the office and the remainder at home.

Resource Disparity: The other trend that’s being amplified is this disparity in economic prosperity in the workforce. Those with roommates, or those living in a seven hundred square foot studio apartment, now work from home where their environment is significantly more constrained than those with more space and more resources available. Additionally, there are issues with bandwidth and network access. In rural areas, some people are still connecting by DSL. All these things had been happening at one level, but with COVID-19, they’ve been amplified.

2. Short Product Life Cycles

On the other hand, there has been a significantly shortened product life cycle in several areas. Some products related to the response grow phenomenally. One example is Zoom video, whose market cap equals the combined market cap of both Ford and GM. Significant changes to the supply chain and the tools being used, especially concerning international supply chains and multiple outsourcing levels, are seeing a greater focus on resiliency over efficiency.

The transform business models discussed are now changing demands, and the work from home, work from anywhere challenges are going to differentiate innovators. Those who can adapt to the shorter product life cycles will take market share, driving new performance measures.

3. Seismic changes to business models

As we look at the next area, there are seismic changes to business models happening virtually overnight. For example, the travel industry is vastly different than it was even 90 days ago.

Businesses have also realized value by migrating within and across sectors. The Zoom example being an extreme case of that. Risk tolerance has also changed. Consumer appetites change based on their expectation of future risk, and that’s impacting business models, and underlying economic trends are shifting as well. The stimulus payments and a number of the world’s responses are driving what will, over the longer term, increase inflation and other macroeconomic trends that businesses will have to deal with.

4. Stakeholder capitalism

There’s been an amplification and reinforcing a trend toward stakeholder capitalism. It’s certainly not comprehensive across all businesses, but it is growing. And that means the social contract terms are changing between business and the community, driving new measures and expectations.

5. ∑n syndrome

The last area is the Sigma syndrome. We’re seeing significant changes to performance measures, and that ties back to supply chain resiliency versus efficiency. The pendulum had swung very hard in the last decade toward efficiency, which had created complex layers of supply chains, which had hindered resiliency. And now, in dealing with crises, companies are paying the price for that and need to come up with new ways of measuring performance.

All five of these areas have a significant impact on performance measurement, and what they imply is that businesses need to transform and much more quickly than we were accustomed to.

In Summary

In response to the crisis and cost-cutting measures, many companies have shut down new IT projects and throttled back existing IT investments, when they should be doing the opposite now.

As part of the response phase, cutting those costs was the right move. But the recovery phase is a time of transforming business models and developing estimations models and the underlying business case in ROI for new investments. That’s key to rebuilding businesses to accommodate the changes in consumer spending, the changes in behavior, and to better prepare for any future crisis.

All aspects of planning and forecasting need to become integrated, a disciplined mantra even, into the transformation framework. As you look ahead beyond the immediate crisis and consider your business plans, having visibility to external economic factors and thinking how your company will fare in the “new normal” economy is paramount.

Modern executives have faced their fair share of challenges throughout the last weeks. Risk is inherent in any business; organizations that succeed are ones that manage their vulnerability deftly. This is how to insulate and ensure resiliency when the inevitable fortunes of change strike. COVID-19 and any black swan event are unavoidable. Executive leadership needs to be thinking of contingencies to anticipate how best to react to rapidly changing conditions. Organizations with the right technology, training, and methods are better able to adapt to change quickly and with certainty.

Complimentary Economic Leading Indicator Access

As the U.S. transitions into the recovery phase of the COVID-19-induced recession, it is more important than ever to have access to timely, reliable data and expert economic analysis to help guide forecast decision making and re-planning. To meet this need, Prevedere has created a complimentary Economic Outlook Weekly report.

The report provides executives with leading indicators to watch that offer an unbiased view of the evolving economic landscape. The Economic Outlook Weekly report is emailed weekly and includes a range of demand and supply-side factors to cover the full spectrum of economic activity. Each indicator is displayed graphically and updated automatically as new information is released. There is no charge to receive this service. Sign up for your complimentary access here.

Complimentary Economic Outlook Weekly Services Include:

• Macro view of key recession economic indicators

• Regular economist reports offered as information becomes available

• Weekly updates to your inbox

***

ABOUT

Andrew Duguay, Prevedere Chief Economist

Andrew is Chief Economist for Prevedere, a predictive analytics company that helps provides business leaders a real-time insight into their company’s future performance. Prior to his role at Prevedere, Andrew was a Senior Economist at ITR Economics. Andrew’s commentary and expertise have been featured in NPR, Reuters, and other publications.

Patrick Slattery, Founder & Managing Director Canopach

Patrick is an established leader in finance transformation and the use of performance metrics and best practices to improve effectiveness and efficiency. An expert in functional business process design, requirements development, technology selection, detailed design and implementation, as well as continuous improvement and performance management and their implications on business strategy and execution.