Last Updated: January 12, 2021

Improved business forecasting using economic intelligence and external data analytics has closed the planning accuracy gap, yet many organizations have not made the transition. It is no secret that many companies today are off on their forecasts. Read any recent news article on the topic, and you’ll likely find that most Fortune 500 executives who missed the mark blamed external factors, such as the stronger dollar, a drop in oil prices, or changes in the housing market.

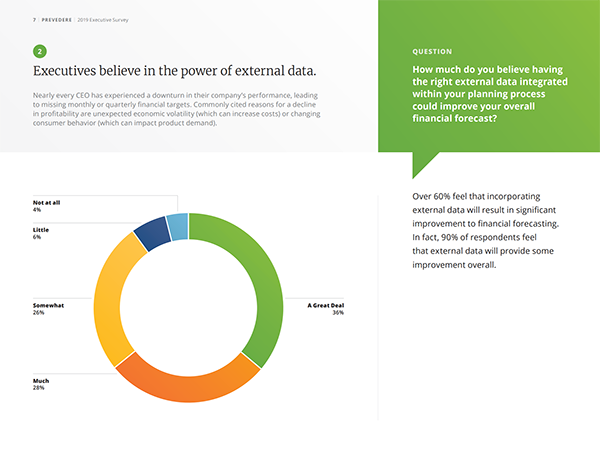

While companies may understand that a correlation exists between the strength of the dollar and their quarterly sales reports, the truth is that when they initially create sales projections, there is usually no proven internal process to determine precisely which factors may or may not impact upcoming performance. This is despite the fact that over 60% of executive leadership feel that incorporating external data will result in significant improvement to financial forecasting. Add to this, that 90% of respondents from the “Why Creating a Data-Driven Organization is Challenging the C-Suite” report, feel that external data will provide some improvement overall. So we have to ask ourselves why the gap in using external data analytics.

Business Forecasting Using Economic Intelligence and External Data Analytics

The typical application of historically-based business forecasting assumptions are mainly based on guesswork when applied to the future. In fact, only 12% of executives feel highly confident in their forecasting processes, according to another recent survey. In the Prevedere commissioned survey conducted by Gatepoint Research, 100 executives, directors and managers in businesses with revenue greater than $250 million (65% work in Fortune 1000 companies with revenues over $1.5 billion) were asked about their business forecasting processes. We found that most businesses are largely playing a guessing game regarding external factors when it comes to demand forecasting. Typically, the business forecasting process simply included examining last year’s or last quarter’s data to “guess” the next quarterly forecast.

Top three survey executive conclusions:

- Executives know their forecasts are inaccurate but don’t realize that the problem lies in the process.

Nearly half of the survey respondents cited they had missed their business targets due to inadequate or inaccurate forecasting, yet 62% thought their forecasting capabilities were better than average. Repeatdly businesses are reporting that their forecasts are off, but most executives blame external factors rather the forecasting process itself. Improving business performance forecasting using external data analytics tools has proven to close the planning accuracy gap, yet organizations are still not pivoting with the technology.

- Executives have difficulty pinpointing key business drivers.

Executives realize that external factors significantly impact business performance. In fact, two-thirds of respondents admitted that external factors have adversely affected the accuracy of their business forecasts. However, despite 77% of respondents depending upon analysts and data scientists, these same respondents still struggle to understand key indicators that impact their businesses. 44% admitted that they either could not or were unsure of how to determine the key drivers of their companies’ performance.

- Accurate, timely business forecasting is a significant challenge for businesses.

Timing is critical when it comes to predicting business performance. Merely reporting the past doesn’t help executives plan for the future. Nearly 60% of executives in our survey said that accurate, timely forecasts constitute a significant challenge, suggesting that they don’t have the systems and processes in place to gather and leverage real-time economic intelligence in their forecasting processes.

C-Suite, External Data, and Emerging Technology are Key to Success

In the “2019 Executive Survey” report findings amongst C-Level and senior executives, we were able to gauge the challenges faced regarding data and analytics specifically. Compiled findings were illuminating and provide an inside view on popular reservations leadership hold when deliberating on data and emerging technology. According to the report, the top obstacle for efficient and accurate planning, according to the respondents, is not having the right software to collect and synthesize the data (46%). However, even if they have the right data, the second biggest obstacle (42%) is turning that data into actionable insights. Many respondents also noted that accessing internal data is still a major challenge (37%).

What’s clear, is that executive leadership believe their organizations are lacking in having the right combination of data and software to accurately and efficiently convert data into insights. Read the full report >>

One of the more common themes or rather quandary, from leadership, often involves explaining how external factors, such as global economic volatility or changing consumer behavior, can potentially impact their business performance. Essentially data outside a company’s four walls continue to pose a major unknown threat. We now understand that external factors can influence up to 85% of a company’s performance. We also know that companies miss their projected forecast by 13% on average, and according to the Institute of business forecasting, companies lose up to $300M per year in profit for every 1% error in forecasting. In order to close the gap and create a data-driven culture, leadership’s high-level planning should be to bring together the right data and the right software.

What’s next in business performance forecasting

Without question, businesses are struggling to create the right processes that will help them build more meaningful forecasts. In a co-presentation Prevedere had with Dr. Barry P. Keating is a professor of economics and business analytics in the Department of Finance at the University of Notre Dame, Dr. Keating spoke about the evolution in external data analytics and business forecasting science.

“While most companies know their current forecasts continue to be inaccurate,” said Dr. Barry P. Keating is a professor of economics and business analytics in the Department of Finance at the University of Notre Dame, “they don’t realize that their processes need work, and if they do, they just don’t know where to begin.”

“It is helpful to know that the strength of the U.S. dollar impacts your sales, but knowing exactly how and when it will affect all levels of your business – production, logistics, demand and even labor – gives executives a 360° outlook that drives better decisions. With business performance forecasting solutions like Prevedere, executives can take the guesswork out of forecasting and gain the kind of actionable economic intelligence that produces results.”

The Impact of External Data Analytics Tools and AI Science

According to Dr. Keating, many enterprise companies are using outdated data analytics tools and science for forecasting methods. Dr. Keating, as a veteran in the space long before ‘Big Data’, was a frequent phrase, he can see why large companies with an abundance of accessible information are still missing the mark.

“Thirty years ago, the problem companies had was that very little data was available. Companies often didn’t keep track of sales, price changes or promotions for at least not two or three years in the past. Most of the models we used were time-series models that have been around for 50, maybe 100 years, such as moving averages, exponential smoothing or ARIMA,” said Dr. Keating.

The reason time series models have been used for so long, he explained, is because they handle trends, seasonality, and cyclicality very well. However, those models are blind to changes in the economy.

“The federal reserve bank of St. Louis did a study four years ago and found that anytime there is a downturn in the economy, the forecast errors of the Fortune 500 quadruple! The reason is – they are using time-series models. They don’t have that ability to see ahead regarding the economic changes,” Dr. Keating added.

Common external and alternative data science forecasting challenges, like failing to consider the factors outside of your own four walls and not knowing what data to keep and dismiss, or how to interpret it, that’s where Prevedere changes the game. “Prevedere is a unicorn regarding data science.” Watch Dr. Keating talk about the latest in External Data Analytics Tools and Forecasting Science.

The Business Forecasting Path Forward

It may well be that the most significant barrier to entry right now is how to transform a business into a truly data-driven organization.

According to a NewVantage Partners’ 2019 Big Data and AI Executive Survey, a majority (69%) of executives from major global corporations readily admit that they have yet to create a data-driven organization. Further, executives that identify their firms as being data-driven has dropped from 37% in 2017 to 31% in 2019. So, why is the evolving role of data and analytics posing problems for executive teams? The key is transitioning data and analytics initiatives to address the real needs of executives for strategic, forward-looking insights. Based on findings, leaderships reservations on the importance of data is less the issue than decoding the myriad of emerging technology and perhaps how that technology fits within their organizations to efficiently convert data into insights.

When asked in terms of data what hinders executives’ business planning process, nearly half of executives (45.5%) say having the right software to collect and synthesize data. Just over 42% (42.1%) say converting data into insights is a hindrance, followed by gathering internal data (36.8%) and gathering external data (36.4%). Read the full report here >>

Most business leaders realize that data and analytics improve business operations and the bottom line. From improving planning processes to enhancing customer relationships and mitigating risk, there is an increased desire to operationalize insights gleaned from data. However, tapping into its true potential comes with challenges. In order to move towards a data-driven culture, leadership’s high-level plan should be to bring together the right economic intelligence, right data, and the right software. Companies should be leveraging technology solutions that not only automatically collect, cleans, and organizes data, but also identifies external factors that will impact demand for their products.

***

Companies should be leveraging technology solutions that not only auto collect, clean, and organize data, but also identifies external factors that will impact demand for their unique products, solutions, and market needs. Over 40% of executives said that having a third-party partner to assist them with external data and analytics would be extremely/very important to their planning needs. Read the full 2019 Executive Survey Report >>

Prevedere has been acquired by enterprise planning leader Board.

Prevedere has been acquired by enterprise planning leader Board.