Last Updated: November 6, 2024

Have you been in this situation? You run a promotion that has been a success for three years running, but this time, it flops. Why? What happened? What changed? Sales teams, C-Suite executives, the marketing department – everyone is frustrated.

The “answers” usually involve a lot of guesswork and even blame. Companies are left to make assumptions as to why performance goals were not met when, in fact, situations like these can be avoided. By building better and more accurate forecasts, companies can better predict consumer demand, improve strategic decision making and eliminate the blame game.

Often, changes in consumer behaviors have nothing to do with a company’s internal efforts. Instead, they are impacted by external economic factors such as gas prices, hourly wages or growth in e-commerce. This is one of the largest challenges for CPG and retail companies working to improve their forecasts – learning what is driving their customers’ intent and likelihood to purchase and finding accurate, real-time data on these factors. Amit Philip, Vice President of Insights and Analytics at The Hershey Company, a Prevedere client, sums it up well, “Our task with growth year-over-year is looking at what we did last year and making sure we can lap previous years’ activities. For us, ‘a retail trip’ is like gold. We try to track retail trips and what can impact them – looking at factors like weather, because if it’s snowing we want to know how that will directly impact us.”

It’s no secret that business performance fluctuates as economic environment changes. For example, The Hershey Company cites government regulation (the SNAP program) as one primary external factor that impacted sales significantly. However, companies often don’t realize just how large this impact is. Others are aware of the impact but not sure exactly what external factors are effecting their business directly. In fact, some of our retail and CPG clients have noted that as much as 90% of performance is affected by external factors yet still relied on internal metrics for building their forecasts prior to applying Prevedere.

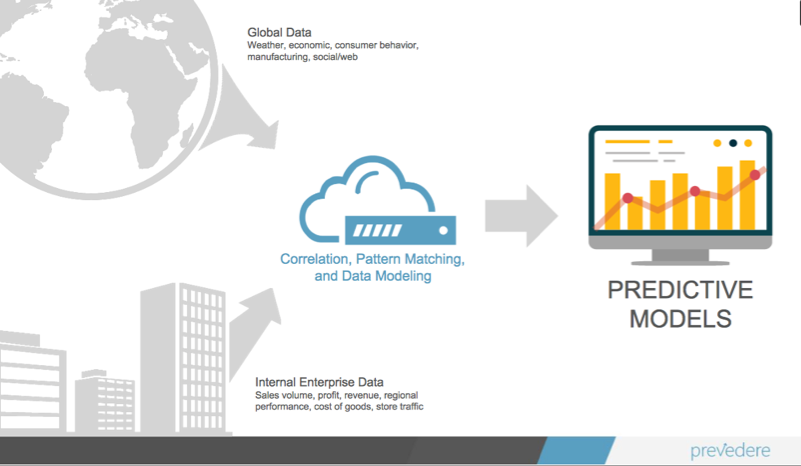

As a predictive analytics company, we follow track changing economic conditions over time to understand the relative impact of certain factors on others. Our economists look at how some factors lead, or lag, behind others – and quantify the duration of these lead-lag relationships. With this abundance of predictive insight, we’re able to help companies understand what they can expect in the coming months or quarters and provide a specific timeline for these expectations. Since our retail and CPG clients largely use these forecasts to predict consumer demand, I’ve listed five key tips on how to improve sales forecasts:

- Start simple. Begin with a single metric or a small number of metrics – preferably easily accessible data. Since the goal of forecasts is to make better decisions, companies need to first take a close look at just a few factors that are highly relevant to business objectives, then use analysis to answer specific questions.

- Stay relevant. Avoid data overload by keeping your focus on correlations and factors that are clearly impacting the retail and consumer goods industries. Reputable data sources can easily provide more data than you need, and you will likely find correlations in that data, but you must hone in on data that makes sense and provides actionable insight, not just insight for insight’s sake. Retail industry factors that illustrate the health and outlook of the industry include: consumer sentiment, architectural billings, credit availability, employment, wages, etc. These are the factors that most affect consumers’ likelihood to buy and therefore are a good place to start your analysis.

- Analyze leading indicators. The best insights come from data that helps to project the future – in which a change today is an indicator of sales down the line. For example, a factor like hourly earnings is an indicator of retail sales; when earnings decrease, sales will soon decline as well. It’s not enough to follow concurrent, highly correlated actions – instead, follow indicators that are true leads into future activity.

- Don’t forget granular factors. Looking at national sales, or overall sales from a product perspective is a good place to start but limits your insights as you start to drill down into the different dimensions of your business. Regional trends and the drivers for each brand and SKU are important to build actionable performance forecasts.

- Apply forecasts to business decisions. Forecasting isn’t valuable until it is applied to real business decisions. From marketing, manufacturing, staffing and more, accurate forecasts will help better prepare companies for the best and worst situations. They are also imperative to helping companies identify opportunities to scale-up in markets or product lines that are poised for growth in the coming months.

To learn how one company enacted these tips to improve performance, view our webinar replay with Retail Information Systems News and The Hershey Company here.