Last Updated: September 10, 2021

Part 2 – Who Benefits Most from Intelligent Forecasting?

Welcome to the second post in our series. In part 1 we introduced the concept and practice of Intelligent Forecasting, and posed a couple of What-If questions answered by predictive analytics.

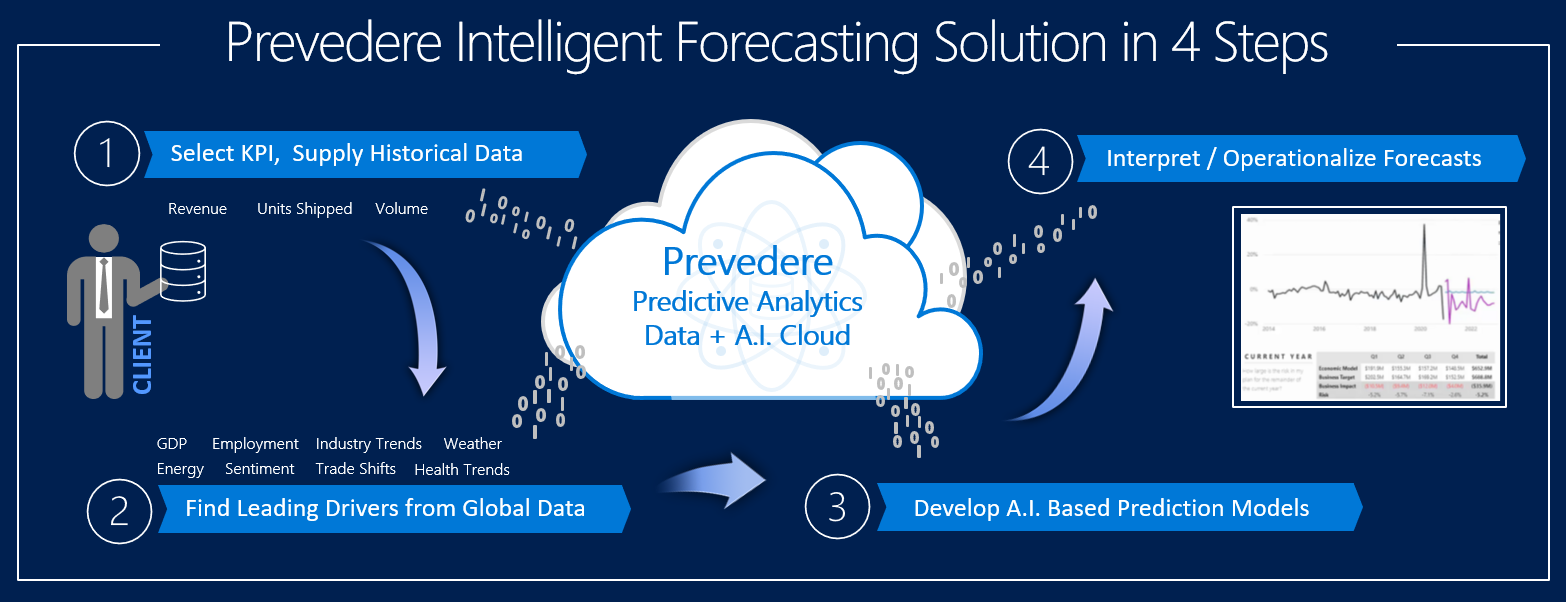

Before we get into the range of professionals and functions in organizations who ultimately benefit, let’s peel the onion one more layer and present the high level process of Intelligent Forecasting, so that you have an understanding of the steps involved in developing value from both forecasts and economic intelligence:

To explain the graphic and steps above with a little more context, here are the 4 steps that Prevedere executes with clients, once a forecasting goal, scope and targeted performance metric have been identified:

- We request 36-60 months of historical data related to the metric to be forecasted. This is often the revenue, volume, or units for either total business, country, division, segment, brand or other LOB.

- After ingesting this data into our Predictive Cloud, we perform several statistical operations against millions of external time series sources to identify the leading indicators that impact the client’s business metric. There may be 5, 10 15 or even 20 external drivers that closely correlate to the targeted KPI.

- The next step is extensive modeling and machine learning. Econometric modeling takes the signals from those leading external indicators to create and refine predictive models. The resulting output, called economic baseline forecasts, quantify the combined impact of the external drivers on your performance metric.

- Forecasting models can look 3, 6, 12 and 18 months out, and/or provide a 3-year CAGR projection. Clients are provided a complete understanding of what contributed to the forecast by our on-staff economists, plus an analysis of the economic conditions they will likely experience over the short, medium and longer terms.

Augmenting Existing Forecasting Methods

Planning for upcoming business cycles is challenging enough in ordinary times. These are not ordinary times. Traditional modes of planning are not adequate to address the highly unusual nature of COVID and an increasing number of external forces. Such an unprecedented level of uncertainty requires a more adaptable and agile approach. Planning has typically relied on internal company data and well-understood economic forces. This approach is no longer adequate, however, because of the depth and variety of unpredictable trends in the economy and specific industry sectors. This is why organizations look to Intelligent Forecasts to provide additional planning insight and economic foresight.

A second forecast based on economic forces provides either an economic benchmark or in some cases an actual replacement for internal forecasts, which their have their own inherent limitations. This forecast can provide guard rails, where a variance between the internal and economic forecasts can be calculated and clearly identify which months, or territories, or categories are beyond acceptable prediction thresholds. Compared to traditional modeling, the economic forecast can be rapidly generated, tweaked and recreated in minutes, providing real agility to strategic planners.

Five Roles Who Benefit from Intelligent Forecasting

Intelligent Forecasting is a breakthrough that increases the accuracy, efficiency, and timeliness of planning and forecasting. Its impact is being felt across the enterprise, from the senior executive team to FP&A and the Office of the CFO, to operations. Here are five roles and organizational functions that derive real benefit.

- CEOs and Executive Management

The CEO and the executive team work in concert to ensure a company’s strategies and operations align with their established plans and policies. Having access to an economic barometer that can be tuned to geographies, business segments and timelines is an invaluable tool for steering the organization through calm and stormy waters.

CEO, COOs, CROs and CMOs who can best prepare their businesses effectively for a more digital and macro data driven future will give their companies the best chance for a brighter future. Also, the exec team is often provided insight from a head of strategy (or innovation, or emerging trends), who would be able to leverage the strategic outputs from Intelligent Forecasting in order to identify and mitigate internal and external threats to business, such as globalization trends, technology disruption and new regulations.

- Office of the CFO

The CFO has primary responsibility for the planning, implementation, managing and running of all the finance activities of a company, including business planning, budgeting, forecasting and negotiations. CFOs have found that having an Intelligent Forecast as a guardrail to their business has improved forecast accuracy and their ability to better guide resources. According to Harvard Business Review, external factors can influence up to 85% of business performance for larger companies. Intelligent Forecasting provides that economic baseline as a gauge of where external factors are driving their business. It is imperative for finance leaders to think more holistically and strategically about the long-term picture and prepare for a post-COVID-19 world.

- FP&A

FP&A involves evaluating all aspects of a company’s operational setup. Core functions are forecasting, planning, budgeting and reporting. FP&A analysts consider business and economic trends, assess past performance, and try to predict potential problems and obstacles.

Intelligent Forecasting is a natural and logical fit for this critical business function. By leveraging predictive modeling and scenario planning based on economic drivers, FP&A can identify, anticipate and manage risk in a timely manner. FP&A can be supported with the latest data-driven forecasting solution that doesn’t need Excel any step of the way.

- Functional Teams: Category, Brand and Product Managers

Whether in retail, CPG or manufacturing industries, these teams are responsible for the go-to-market strategy and supply chain execution for one or more products or categories. Forecasting demand, production needs and inventory levels are essential to the profitability of their organizations. Materials management, capacity planning and logistics all benefit from a demand outlook based on economic drivers. Fast and accurate Intelligent Forecasts can add millions of dollars to the bottom line, improving margins and reducing net working capital. Spinning out multiple predictive economic models as quickly and easily as possible is a primary goal for Intelligent Forecasters, so that functional teams can adjust strategies and plans for their specific geographies and industries.

- Data Analysts and Scientists

It may be possible for internal teams of data analysts and data scientists to develop Intelligent Forecasting solutions, but they would face two key challenges. The first is to identify, access, prepare and correlate the hundreds of potential external data sources that are used to kick start the economic prediction model. Teams could spend months wrangling this external data only to find no statistical relevance to the business problem they were tasked to solve. Intelligent Forecasting solutions providers such as Prevedere typically offer an external data repository, with thousands, sometimes millions of external sources that are primed for modeling.

The second challenge is the time it would take to build and test the predictive models, applying specific machine learning algorithms used to improve forecast accuracy. Intelligent Forecasting leverages multiple advanced algorithms throughout its modeling process. It moves beyond univariate ARIMA and trend smoothing, incorporating econometric methods. The insights generated from the Intelligent Forecasting process can integrated into other systems and analytics provided by the client organization. Both the forecasts and the external economic data are available for additional processing and modeling as needed by internal analysts and scientists.

Conclusion and Further Reading

All the roles and functions mentioned above have the ability to positively change their future, to be more profitable, productive, risk averse and competitive. It all seems so glaringly obvious, but if someone could tell you with a high degree of confidence what your economic conditions were going to be over the next 18 months, what your sales will be, and if there are any unexpected market changes ahead, would that be of interest?

We hope that this series will continue be of interest and value to you. Below is a list of the posts, and also 2 recommended pieces of content that offer more insight into this topic.

- Part 1 – Introduction and Overview

- Part 2 – Who Benefits Most from Intelligent Forecasting (this post)

- Part 3 – Which Industries Leverage Intelligent Forecasting

- Part 4 – Data Scientist View of Intelligent Forecasting

- Finale – Conclusions, The Future, How to Get Started

Content Recommendations

- eBook on Intelligent Forecasting

Econometric modeling is a game-changer when systematically embedded in forecasting processes and made available as an always-on tool for strategic decision making. This eBook explains the practice in depth. LINK - Webinar: A New Era in Financial Planning for the CFO

This webinar speaks to the evolving role of CFOs, and how they can champion technology and data to improve methods their business units leverage to plan, budget, and forecast. LINK

Thanks for your time today.