Last Updated: June 22, 2018

While retail sales have been lackluster so far this year, early signs are pointing to a merry holiday shopping season. This is welcome news to retailers who have seen minimal growth in consumer spending in recent months.

The Current State of the Retail Industry

Consumer spending has been decelerating, as evidenced by the mild 1.8% year-over-year increase in retail and food service sales in May – much slower than the 4.2% year-over-year growth rate registered in January. However, this slow-down was expected, as many of the leading drivers of retail sales have been pointing to deceleration since mid-2015. But will the current softness in the U.S. economy and recent weak jobs report lead to continued softness throughout the holiday shopping season? Not likely.

Prevedere’s Retail Leading Indicator Provides Optimistic Holiday Outlook

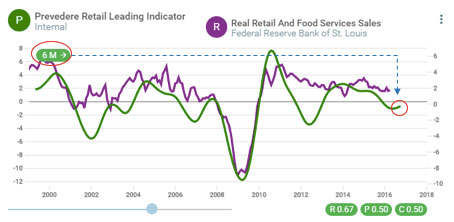

Our Prevedere Retail Leading Indicator is a proprietary 6-month leading indicator of the retail industry, signaling future growth, contraction and major shifts in momentum by analyzing various factors such as consumer attitudes, credit affordability, construction activity, retailer stock prices and other demand factors. This leading indicator (represented by the green line below) reached a low in the first quarter of 2016. Since it leads Real Retail and Food Services Sales (the purple line) by six months, we’re expecting that the rate of growth for retail sales will begin to accelerate just prior to the holiday shopping season.

But What about the Weak Jobs Numbers?

While many may fear that the weak jobs numbers in May are indicative of future weakness in the economy, and therefore retail sales, that’s simply not the case. Unlike the factors referenced above, employment is a lagging indicator. The weak jobs report for May was in reaction to the softness that we have been seeing in the economy and the deceleration in the retail industry. It is not indicative of future activity – instead leading indicators are required to gauge how the economy will perform going forward.

More Support for Happy Holidays

The Prevedere Retail Leading Indicator is not the only leading driver suggesting that the retail industry is likely to accelerate in the latter half of the year. On a year-over-year basis, the Architectural Billings Index (a 5-month leading indicator to Real Retail Sales) is also seeing momentum shift in the right direction, as are Consumer Sentiment and the ISM Non-Manufacturing New Orders Index (6-9 month leading indicators of retail sales).

Certainly, there are key factors that can throw this momentum off track. Specifically, a weakening dollar, rapid rise in interest rates, large swings in commodity prices or major stock market corrections can incite fear and uncertainty and weaken consumers’ propensity to spend. However, such rapid changes are unlikely. We expect that the U.S. economy will remain in general growth territory through the remainder of this year. The retail industry will be a primary beneficiary of this growth trend, with acceleration picking up just in time for the holiday shopping season. To stay up to date on these trends, follow me on Twitter @D_Marceau1, search hashtag #PVOutlook, and sign up for our leading indicator reports here.